Street Calls of the Week

The last two weeks were very busy in terms of the macro calendar. We had many important numbers and events, mostly from the major central banks and bankers. This week, will be a little bit more quiet so maybe we will be able to focus on the technical side of trading. If so, we do have a nice occasion on the USD/JPY, one of the main instrument on the market

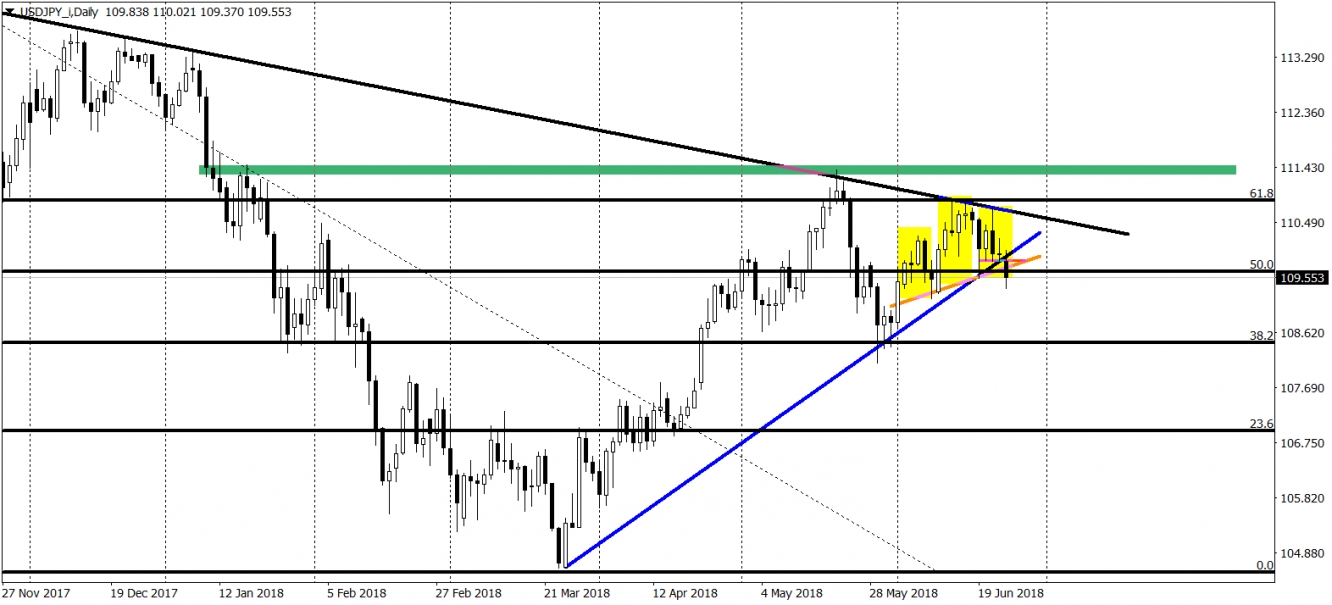

The pair bounced from the long-term down trendline (black), which confirms us the bearish sentiment. The price tried to break this level since the 13th of June and all tries were unsuccessful. If the price does not want to go up, it will probably go down. In this case, the bearish sentiment is additionally strengthened by the head and shoulders pattern (yellow) that emerged on the H4/D1 chart. Today's candle fights to break the neckline (orange), success can trigger us a sell signal. What is more, USD/JPY broke the mid-term up trendline (blue). All that is very bearish.

The target for the sellers is on the 38,2 % Fibonacci so the trade has a good risk to reward ratio. Negative sentiment will be denied when the USD/JPY will come back above the neckline, which for now is less likely to happen.