USD/JPY sellers remain in control as traders become skeptical that Japan officials follow through on intervention threats. The yen has steadily weakened this quarter on US economic resilience and as the BOJ vowed to keep rates low for now along with a weak signal for a chance of future hike.

Dollar Technicals

The dollar index could be flashing an oversold signal and that could lead to further bets against the yen and not necessarily with European currencies that might see much more tightening.

Potential Triggers

- On Wednesday, starting around 930am est, BOJ Governor Ueda will speak on an ECB forum panel with BOE Gov Bailey, ECB President Lagarde, and Fed Chair Powell. Yen watchers are awaiting any sign that BOJ is getting ready to tweak its control of the yield curve.

- Quarter-end could also spark a reversal for the steadily weakening yen (132 to 144).

- Traders will also pay close attention to Friday’s US PCE data as softer inflation data could cement the market’s expectation that the Fed will be done after one more hike.

Key Levels

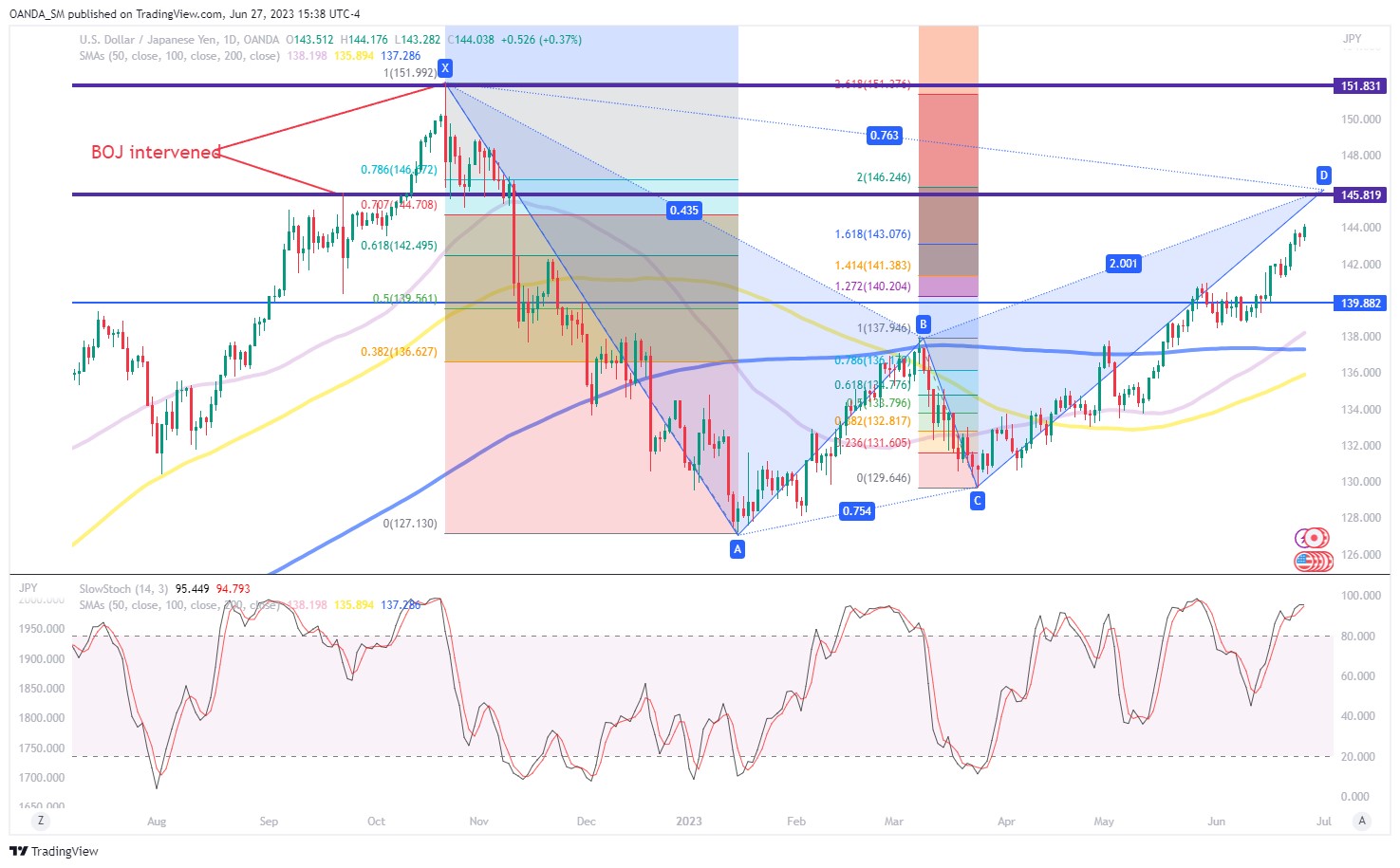

Intraday moves have supported a steadily weakening yen, but it may have a neutral bias until we hear from BOJ Gov Ueda on Wednesday morning. Upside resistance may come from 144.70, which is the 70.7% Fibonacci retracement of the October high to January low move. If a daily close occurs above the 145 level, further bullish momentum could target 146.11. To the downside, 143.10 provides initial support. Any hawkish fireworks from Ueda could support the case for a test of the 142.50 region.

If Ueda stays the course, the yen could continue to weaken. Japan intervened last fall when the yen weakened towards 145 and after prices breached 150. Sustained weakness won’t be tolerated and expectations for action will grow if yen weakens beyond 145. Everyone has their eye on the 150 level, so it will be interesting to see if that makes that barrier to hard to reach.