The Japanese Yen (JPY) could strengthen as trade related uncertainty has created risk aversion in global markets. The uncertainty is caused by the Trump administration sending mixed signals regarding foreign investment in American companies. First the US Treasury Secretary Steven Mnuchin stated that a “Statement will be out not specific to China, but to all countries that are trying to steal our technology”. Then later on Monday, Peter Novarro tried to downplay the remarks in an interview on CNBC saying that the market is overreacting. With little in the way of economic or political developments in Japan, the JPY is trading in relation to risk appetite. During risk off, the JPY tends to strengthen given its safe haven characteristics.

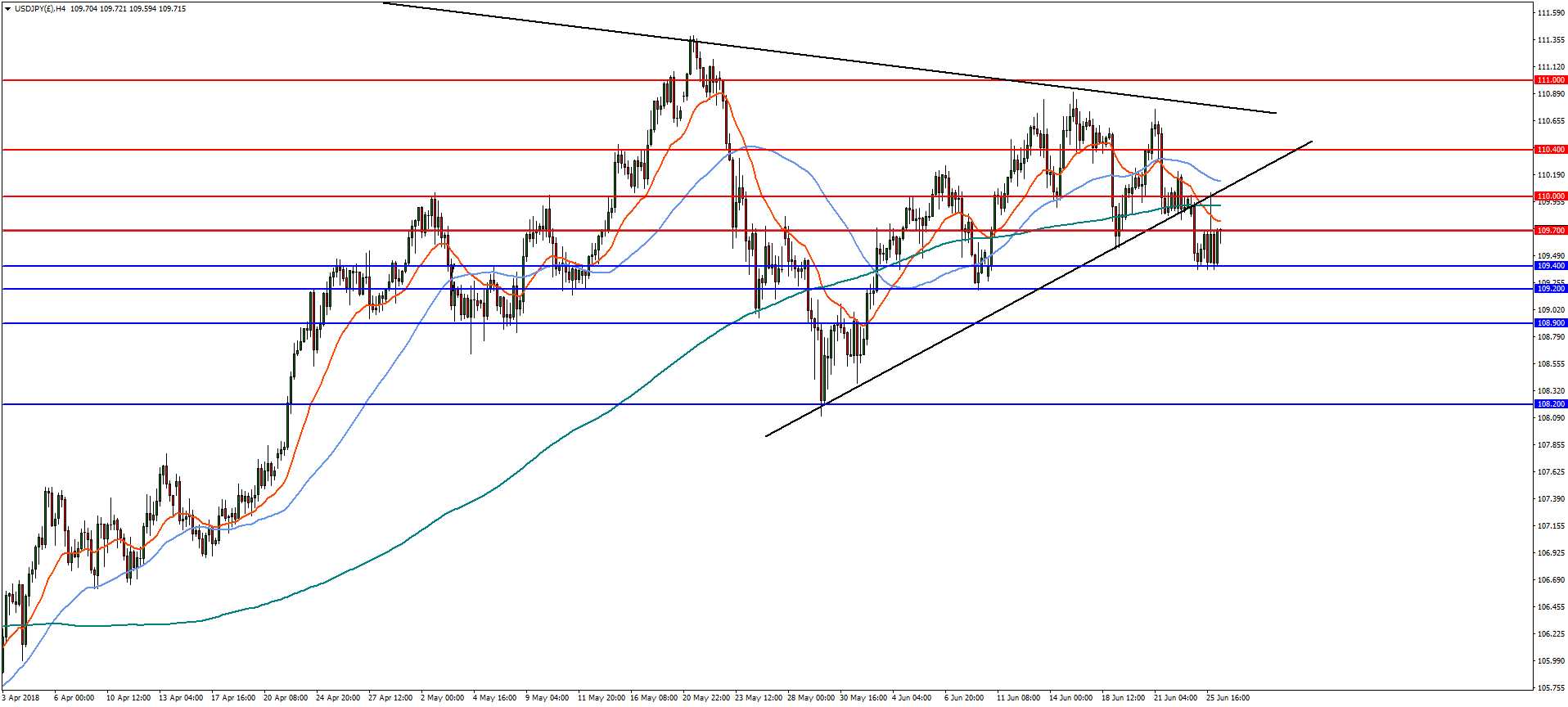

USD/JPY

On the 4-hourly chart USD/JPY failed to break the December 2017 resistance trend line and appears to be moving lower after breaking below the support trend line at 110.00. The pair needs to break near term support at 109.40 to continue to the downside with further support near the 61.8% retracement at 109.20 and then 108.90. However, a reversal above 109.70 will find horizontal and trend line resistance at 110.00.

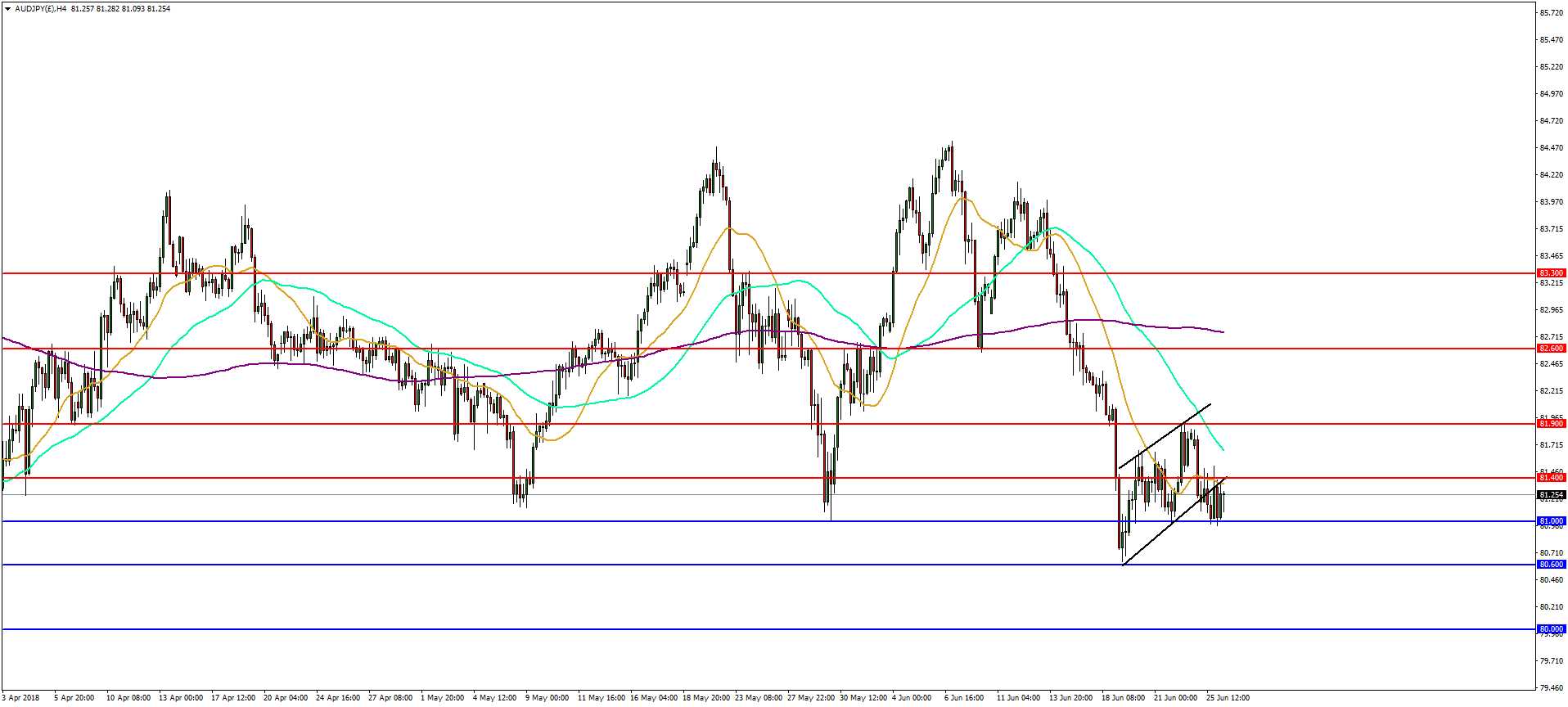

AUD/JPY

In the 4-hourly timeframe, the AUD/JPY appears to have broken a bear flag with a measured target at 78.50. A break of 81.00 is needed to open the way to declines to last week’s low at 80.60 before continuing towards the psychologically important 80.00. A reversal and break of 81.40 would negate the outlook with any upside move finding resistance at 81.90.

For more in-depth analysis and market forecasts visit our FxPro Blog.