If you tuned into our FACE show yesterday, June 26th, you would have caught the discussion between Blake and me talking about USD/JPY. As you know the pair is trading higher, breaking above 160.22 this week, which was the previous 2024 high.

We are seeing bull market in progress, with the possibility of slightly more upside in the near-term. However, Japan has expressed concerns about the current weakness of the Japanese Yen, which could lead to potential intervention threats, keeping this pair volatile during summer. There is a risk that Japan would take action, which would likely cause a sharp reversal in the pair, especially if they receive support from other countries.

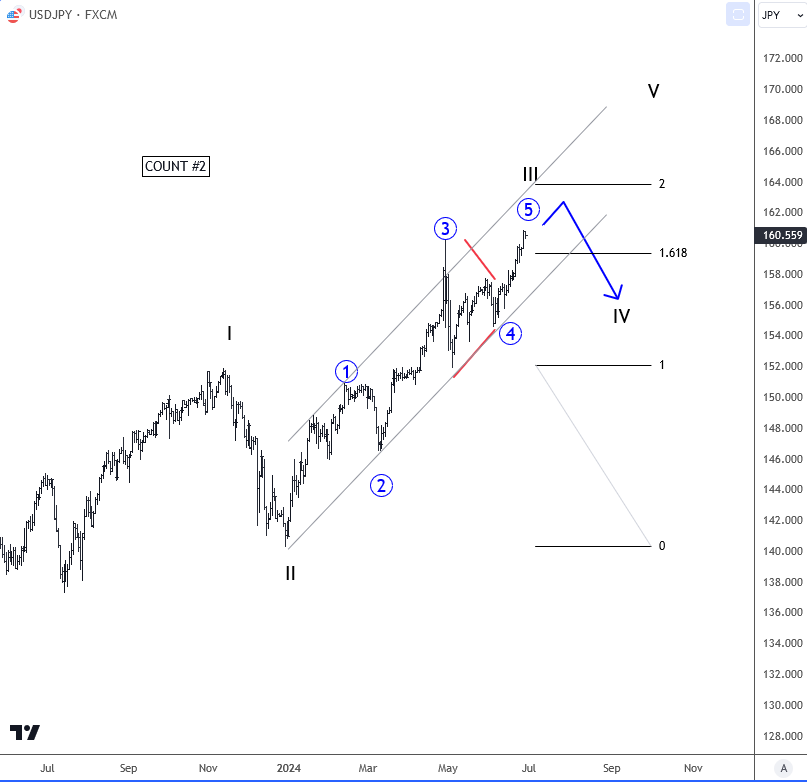

From an Elliott Wave perspective, we see USD/JPY forming a potential wedge pattern on the daily chart. In Elliott Wave terms, this wedge can represent an ending diagonal, known as a strong reversal pattern. The fifth wave is already in its late stages, but in the short term, there can still be some extension towards 162, maybe even 164, to the upper trend line resistance. However, this pattern is worth monitoring for potential reversals still this year.

While no one knows for sure what can trigger a turning point, maybe it could be intervention by Japan. But normally, such actions have only a temporary impact. For a major reversal in the pair, we would need not only intervention but also a weak dollar with lower US yields on dovish FED, while BoJ should be looking for higher rates.