USD/JPY has posted slight gains in the Thursday session. In North American trade, USD/JPY is trading at 112.64, up 0.10% on the day. On the release front, Japanese indicators were positive. Flash Manufacturing PMI improved to 54.2, and Revised Industrial Production rebounded with a gain of 0.5%, matching the forecast. Later in the day, Japan releases the Tankan Manufacturing and Non-Manufacturing Indices, with both indicators expected to improve to 24 points. In the US, retail sales reports were strong, as Core Retail Sales and Retail Sales both beat their estimates, coming in at 1.0% and 0.6%, respectively. There was more positive news as unemployment claims fell to 225 thousand, well below the forecast of 237 thousand.

There were no surprises from the Federal Reserve, which raised rates on Wednesday, bringing the benchmark rate to a range between 1.25% and 1.50%. This marked the third rate hike in 2017, testimony to the strong performance of the US economy. The Fed statement was optimistic about the economy, noting that the labor market “remained strong”. It also lowered its unemployment forecast in 2018 from 4.1% to 3.9%, and revised growth for 2018 from 2.1% to 2.5%.

Despite this rosy prognosis, the dollar was broadly down after the announcement. Why? One reason is the sore point in the economy – inflation. The Fed has not changed its September forecast for rate hikes next year, with the Fed dot plot indicating that three rate hikes are projected for 2018. This disappointed some investors who would like to see four increases next year. As well, the rate statement said that the Fed did not expect the tax reform legislation to have any long-term effect on the economy, contradicting White House claims that the legislation would trigger substantial growth in the economy.

When the Bank of Japan implemented its radical stimulus plan, one of the primary goals was to eliminate deflation and push prices higher. Years later, however, the BoJ’s inflation target of 2 percent remains elusive. However, the program has led to a sharp depreciation in the yen. This has led to sharp denunciations from the US and other countries, and criticism that the Bank was manipulating the yen was especially sharp when the dollar rose to around 120 yen. A weak yen has been a boon for exports and helped revive the manufacturing sector. A chief economist at the NLI Research Institute went as far as saying that the low yen has been a major accomplishment for the BoJ. According to this view, the BoJ is reluctant to signal the possibility of a taper of stimulus, since that could trigger a sharp rise in the yen. Clearly, the BoJ is closely following yen fluctuations, and currency movement will continue to be an important factor for the BoJ.

USD/JPY Fundamentals

Wednesday (December 13)

- 19:30 Japanese Flash Manufacturing PMI. Actual 54.2

- 23:32 Japanese Revised Industrial Production. Estimate 0.5%. Actual 0.5%

Thursday (December 14)

- 8:30 US Core Retail Sales. Estimate 0.6%. Actual 1.0%

- 8:30 US Retail Sales. Estimate 0.3%. Actual 0.8%

- 8:30 US Import Prices. Estimate 0.7%. Actual 0.7%

- 8:30 US Unemployment Claims. Estimate 237K. Actual 225K

- 9:45 US Flash Manufacturing PMI. Estimate 54.0. Actual 55.0

- 9:45 US Flash Services PMI. Estimate 54.8. Actual 52.4

- 10:00 US Business Inventories. Estimate -0.1%. Actual -0.1%

- 10:30 US Natural Gas Storage. Estimate -55B

- 18:50 Japanese Tankan Manufacturing Index. Estimate 24

- 18:50 Japanese Tankan Non-Manufacturing Index. Estimate 24

Friday (December 15)

- 8:30 US Empire State Manufacturing Index. Estimate 18.8

*All release times are GMT

*Key events are in bold

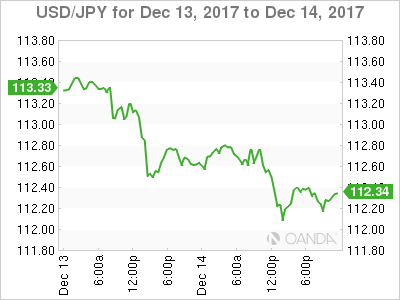

USD/JPY for Thursday, December 14, 2017

USD/JPY December 14 at 11:00 EDT

Open: 112.54 High: 112.88 Low: 112.54 Close: 112.64

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 110.10 | 111.53 | 112.57 | 113.55 | 114.59 | 115.50 |

USD/JPY ticked lower in the Asian session. The pair edged higher in the European session but has inched lower in North American trade

- 112.57 is fluid. Currently, it is a weak support level

- 113.55 is the next resistance line

Current range: 112.57 to 113.55

Further levels in both directions:

- Below: 112.57, 111.53, 110.10

- Above: 113.55, 114.59, 115.50 and 116.54

OANDA’s Open Positions Ratios

USD/JPY ratio is showing movement towards short positions. Currently, short positions are at 51%, indicative of a lack of trader bias as to what direction USD/JPY will take next.