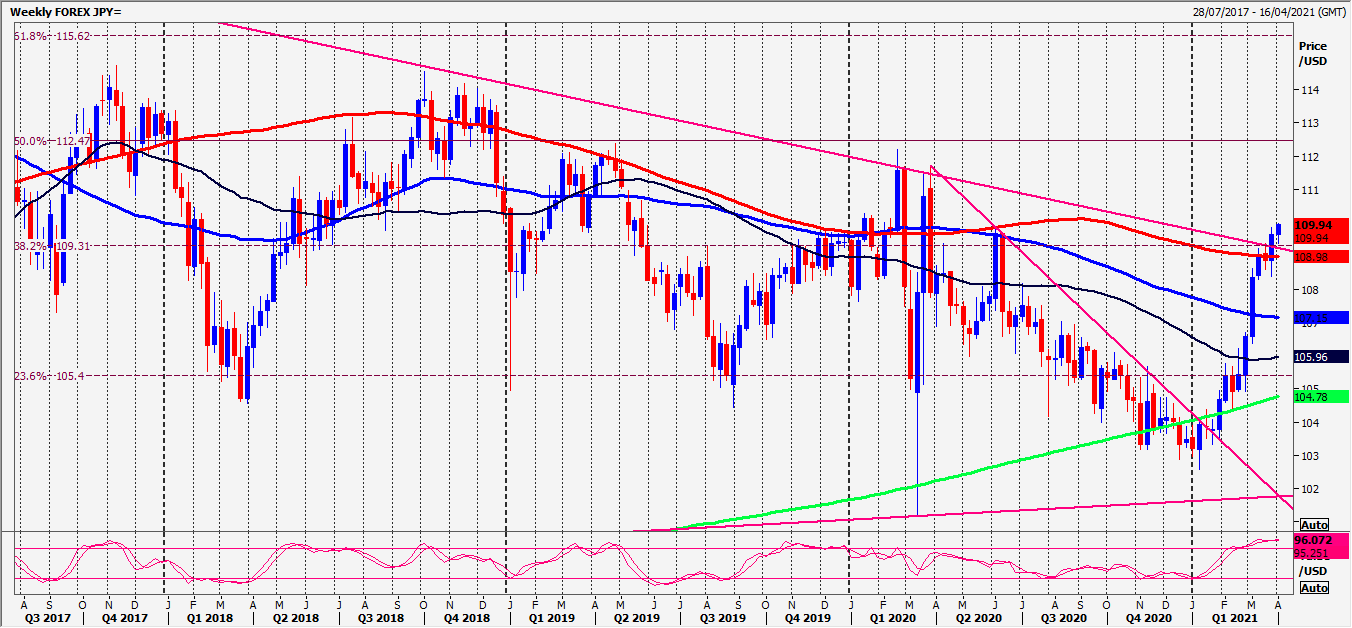

USD/JPY still holding strong resistance at 108.95/109.05 for a negative outlook.

EUR/JPY remains in a tight 2 week sideways trend with an unexpected recovery from 129.96. Last week’s inside week reinforces this sideways trend – we wait a breakout.

CAD/JPY also stuck in a sideways trend last week, holding a range of just 55 to 70 pips over the last 4 days with a bounce from strong support at 8660/40.

Today’s Analysis

USD/JPY holding strong resistance at 108.95/109.05 (again on Friday) targets 108.50/40, perhaps as far as 108.10/05. Strong support at 107.85/75.

Strong resistance at 108.95/05 but there is also the head and shoulders neckline at 109.25/35. Shorts need stops above 109.45.

EUR/JPY first support at 130.10/00. A break below 129.80 tests 3 month ascending trend line support at 129.60/50. Longs need stops below 129.30.

Holding first support at 130.10/00 targets 130.30 before a test of important resistance at the March high at 130.55/65. A break above 130.75 tests important 15 month trend line resistance at 130.30/40.

CAD/JPY bottomed exactly at strong support at 8660/50 to test first resistance at 8690/8700 where a high for the day was expected. Shorts need stops above 8720 today. A break higher targets 8760, perhaps as far as 8790/8800 before a retest of the high at 8820/30.

Strong support at 8660/50. A break below 8640 targets 8605/00 then 8580/70.

Disclaimer: No representation or warranty is made as to the accuracy or completeness of this information and opinions expressed may be subject to change without notice. Estimates and projections set forth herein are based on assumptions that may not be correct or otherwise realised. All reports and information are designed for information purposes only and neither the information contained herein nor any opinion expressed is deemed to constitute an offer or invitation to make an offer, to buy or sell any security or any option, futures or other related derivatives.