- Leading indicators have been declining for over a year. US capacity utilisation has been falling since December. Commodities and inflation expectations have been falling since May. The net asset class behaviour and macro data are strongly telling us external conditions are too tight and need to be adjusted to avoid more gloomy outcomes.

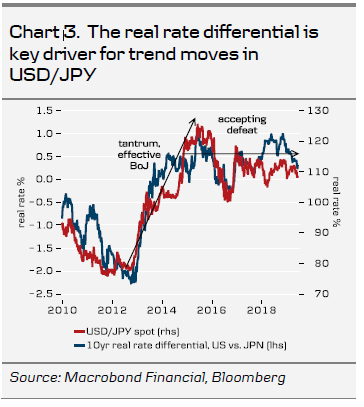

- The most likely response is solidly placed with a change in Fed policy, but trade war resolution and (Chinese) fiscal easing are non-central options. The required adjustment of US real yields could easily take USD/JPY to 105, or lower, over 3M (NYSE:MMM).

- This becomes the second time the Fed has failed in keeping real yields above zero and is a direct result of Chinese deleveraging, a continued too tight policy stance, a negative shock from the ongoing trade war and fading US fiscal impulse.

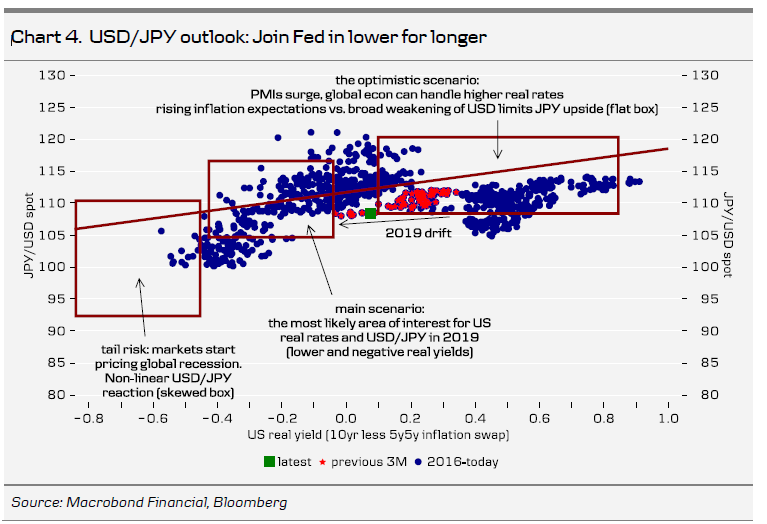

- An adjustment in the coming month(s) of 20-50bp in US real yields could easily take USD/JPY to(wards) 105. Upside risk in USD/JPY seems limited (110, say), as global reflation would limit the relative delta in inflation-adjusted yields. BoJ is heavily sidelined and cheap talk is not enough to avoid a lower USD/JPY.

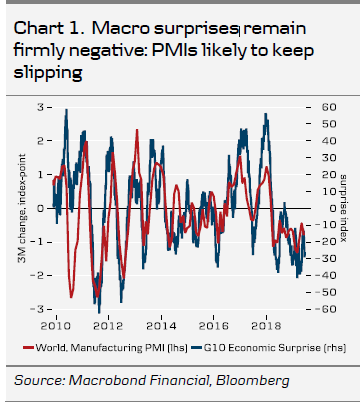

A very direct consequence of downside to global demand, continued weak stimulus from China and a Fed behind the curve is to accept the Fed will need to take real yields back below zero. USD/JPY is a fairly clean way of expressing such a view, but other central banks at the ZLB and with low credibility stand to face appreciation. If we do not get a trade deal and magically see better PMIs (Chart 1 – that appears unlikely), 105 becomes our base case.

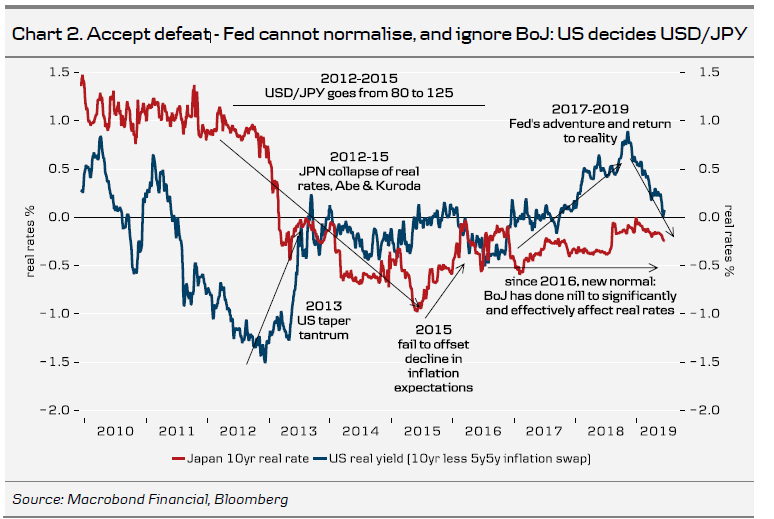

1. The USD/JPY is driven by a narrowing real-rate differential

Once upon a time, we did see USD/JPY on trend for higher levels. But that’s long gone these days (Chart 3). What did work, however, was the combination of Abe & Kuroda back in 2012-15, when they managed to depress Japanese real yields by over 200bp (Chart 2). But since 2015-16, the BoJ has not been willing to compress real rates further. Today, USD/JPY is driven by US real rates and we believe the BoJ will not be coming back to the table.

2. China is the reason but Fed is the fix: Real yields going below zero

We view the rocketing off in US real yields in the past years is the outlier, rather than the new normal. Chinese deleveraging is a significantly underappreciated and disinflationary force and central banks have not offset it. Rather, inflation and growth have run in mini cycles since China started to lower its growth target, but the trend is of major global headwinds. The US (and global) economy was running hot in the past few years but is now cooling.

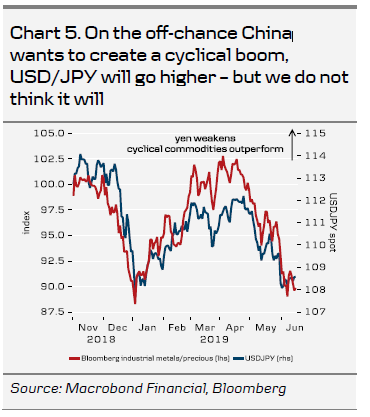

We believe monetary policy will be the adjustment factor. An adjustment could come via traditional Chinese easing (Chart 5), but it remains our base case that it will do only the absolute necessary and that is not enough to give a year-long impulse to demand.

Chart 4 shows the cross plot of USD/JPY and US 10yr real rates for the period since 2016, where the BoJ has been inactive as a driver. To equilibrate global macro, real yields are shifting lower and the US still has some adjustment to do. We believe USD/JPY can easily go to 105 with this in itself, as reflected in the middle box of the chart. The tail risk is a scenario where global growth slowdown accelerates and a new negative demand shock creates the need for much, much stronger Fed reaction. It is likely only in this tail-risk recession scenario that USD/JPY will go below 100. There is an off-chance of a Japanspecific deflationary shock to take the cross lower, but we have a low probability of such.

3. Conclusion: Risk picture favours much, much lower USD/JPY

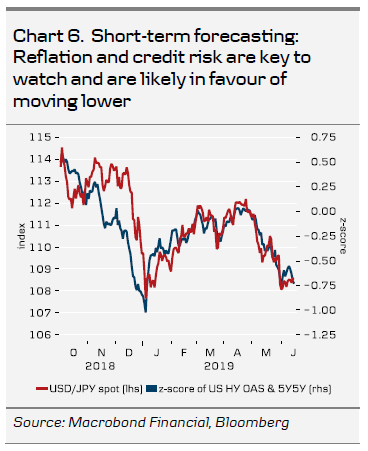

Global sentiment is a key driver in the cross (Chart 6) as risk-off, commodities, inflation expectations and falling US rates run together to take USD/JPY lower via real rates. Our 3M forecast is 107. At the moment, global macro continues to weaken and central banks have only just started to address the issue, which creates significant downside risk to this view.

An adjustment in the coming month(s) of US real yields could easily take USD/JPY to(wards) 105 while upside risk in USD/JPY seems limited (110, say). This becomes the second time the Fed has failed in keeping real yields above zero and is a direct result of too tight external conditions for global demand. An adjustment of macro tailwinds is needed: It could come from an external source but we think it will be the Fed. By extension, we see a substantial risk that USD/JPY will end up trading lower than the current 3M forecast.