Key Points:

- Dollar depreciates sharply against the CHF.

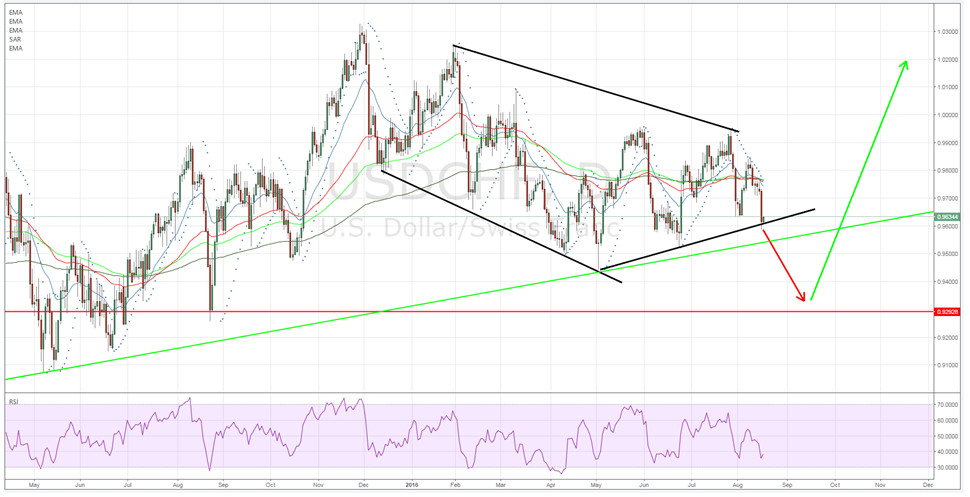

- Downside breakdown likely.

- Watch for a breach of the medium term trend line.

The last few days have been relatively unkind to the US dollar as the currency has felt the impact of a sharply negative sentiment swing following the release of the disappointing Non-Farm Productivity data. Subsequently, the USD/CHF has been under pressure and the pair has declined towards the bottom of the pricing channel in a move that is likely to continue in the short term.

In fact, price has just breached a short term rising trend line and a concerted close below this line could signal a deeper decline on the way. Currently, the USD/CHF has also broken sharply below the 100 Day moving average which is a relatively bearish signal and largely sets up the pair for an additional bearish leg. In addition, the RSI Oscillator also confirms the pair’s current direction but is now reaching close to oversold levels. This may indicate that we could see some price action moderation before another pullback.

However, any subsequent move below the daily low of 0.9585 is likely to see further selling and put support at 0.9440 in focus. Any move below this critical point could see the currency pair in real trouble as there is very little in the way of strong reversal points until the critical 0.9300 handle. Subsequently, any downside move could indicate a sharply negative new phase for the pair.

Fundamentally, the US dollar weakness is likely to remain for the remainder of the week with only the US Philly Fed Manufacturing Index and Unemployment Claims waiting for release. At this point, the market has largely become unimpressed with the stronger labour market statistics and so it is likely that they will have little effect in reversing the current sentiment drive. Subsequently, it is likely that the pair’s near term technical trend will remain in the short run.

Ultimately, the USD/CHF is facing further pain on the horizon given the real risk of a downside breakdown and potential challenge to support at 0.9440. Subsequently, keep a close watch on the medium term ascending trend line at 0.9542 as a breach of this is a strongly bearish indicator.