USD/CHF – Appreciation of the dollar pushes the price towards resistance

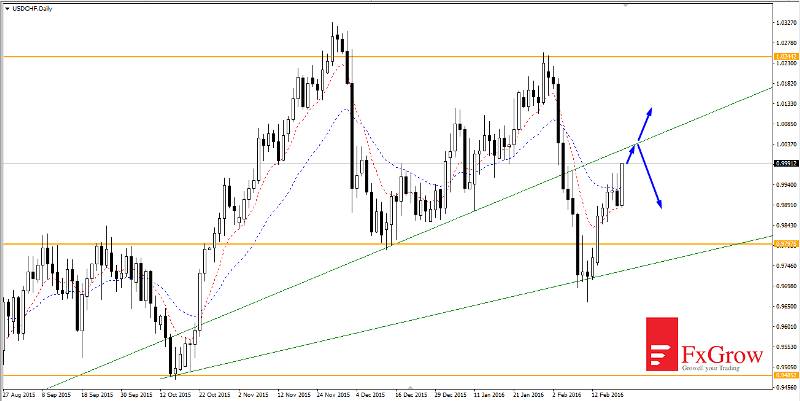

The currency pair USD/CHF been declining since the beginning of February. A dynamic drop led to a break of the trend line conducted since the one-day landslide associated with the release of the EUR/CHF exchange rate, as well as support around the 0.9797 level.

Price now rebounded from the low which was formed in the second week of February, near the 0.9700 level. Strong growth, interrupted only by one downward day, is continued, and the gaining pushes dollar price to the resistance, which now provides previously broken trend line. If the bullish movement is to be continued, bulls should effectively break resistance and then may re-test this year’s highs. However, if the bears take control, it is likely to return back to support at 0.9797.

Disclaimer: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.