- USD/CHF found support at the ascending trendline for the third time, hinting at a potential reversal and further upside.

- Safe haven flows and policy divergence between the Fed and SNB are influencing the Swiss Franc’s value.

- A break above 0.90680 on the H4 chart could signal a bullish reversal.

Most Read: Gold Price Analysis: Bullish Bias Amid Tariff Uncertainty and FOMC

USD/CHF fell yesterday as the CHF benefitted from safe-haven demand. The US dollar had been attracting haven demand in 2024, but yesterday saw traditional haven’s benefit, namely the Swiss Franc and Japanese Yen. The move failed to last however, with buyers immediately pushing the pair back above the psychological 0.9000 handle.

The US Dollar Index gapped up overnight on tariff chatter which helped USD/CHF maintain momentum above the 0.9000 handle. The DXY however, has found it hard to push above the 108.00 handle and this could leave USD/CHF vulnerable to further downside.

US Dollar Index (DXY) Daily Chart, January 28, 2025

Source: TradingView

Swiss Exporters Hope for Further CHF Weakness

The Swiss export industry has been hoping for a weaker Swiss Franc and will hope that the trendline bounce will lead to further upside. The downside, however, is that as tariff chatter ramps up and comes to fruition the Swiss Franc may strengthen due to safe-haven flows. The question will be whether the SNB will intervene.

Policy Divergence May Also Hurt the Swiss Franc

Market participants have also seen concerns raised about policy divergence between the US Federal Reserve and the Swiss National Bank (SNB). There has been chatter that the Fed may announce a pause in today’s FOMC meeting of its rate-cutting cycle. On the other hand, the SNB may continue to cut rates as inflation has been lagging of late. The SNB may use further rate cuts to stir up demand and push inflation into the SNB range of 0%-2%.

This factor could weigh on the Swiss Franc in the months ahead. However, I believe that expecting the Fed to announce a pause is premature. I think the Fed will keep rates steady but leave the door open for further rate cuts in the second half of the year.

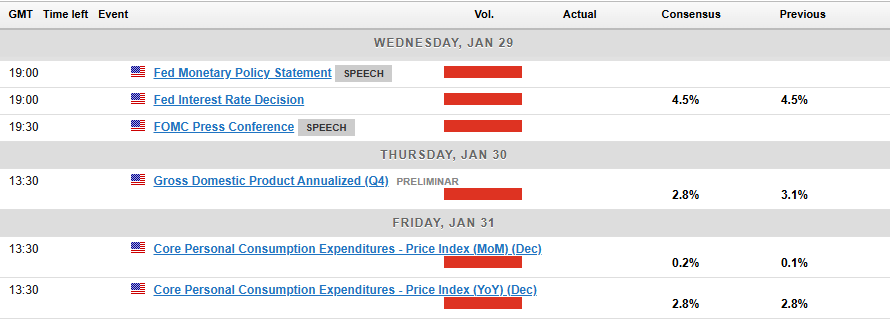

After today's FOMC meeting, we still have US GDP data on Thursday and then the Feds preferred inflation gauge, the PCE data on Friday.

Technical Analysis

This is a follow-up analysis of my prior report “USD/CHF Technical Outlook: Bulls in Charge as Potential Double Top Pattern Forms” published on 13 January 2025. Click here for a recap.

From a technical standpoint, USD/CHF topped out on Monday January 13 before beginning its move lower.

Since then USD/CHF has made its way lower before yesterday’s brief spike below the psychological 0.9000 handle saw the pair complete its third touch of the ascending trendline. A third touch of the trendline usually hints at another leg to the upside and potentially fresh highs.

USD/CHF Daily Chart, January 9, 2025

Source: TradingView

Dropping down to a four-hour chart and the trend remains bearish as USD/CHF failed to take out the swing high from Monday at 0.90680.

There is also a descending trendline on the H4 timeframe which may come into play.

First, however, a four-hour candle close above 0.90680 will be the first sign that bulls are back in charge. A trendline break after that will only reinforce this belief and could lead to a swift move back toward recent highs above resistance at 0.9157.

A break lower for USD/CHF will require a candle close below the 0.9000 psychological level on the daily timeframe. We did have one yesterday on the H4 chart as you can see below, but that was followed by a swift recovery and bounce back above.

USD/CHF Four-Hour Chart, January 28, 2025

Source: TradingView

Support

- 0.9040

- 0.9000

- 0.8980

Resistance

- 0.9068

- 0.9087

- 0.9157