Earlier today, the greenback declined to the lowest level against the Swiss USD/CHF since mid-September 2017, which resulted in a small drop under the long-term support line. Is this a sign of bigger a move to the downside or just a trap?

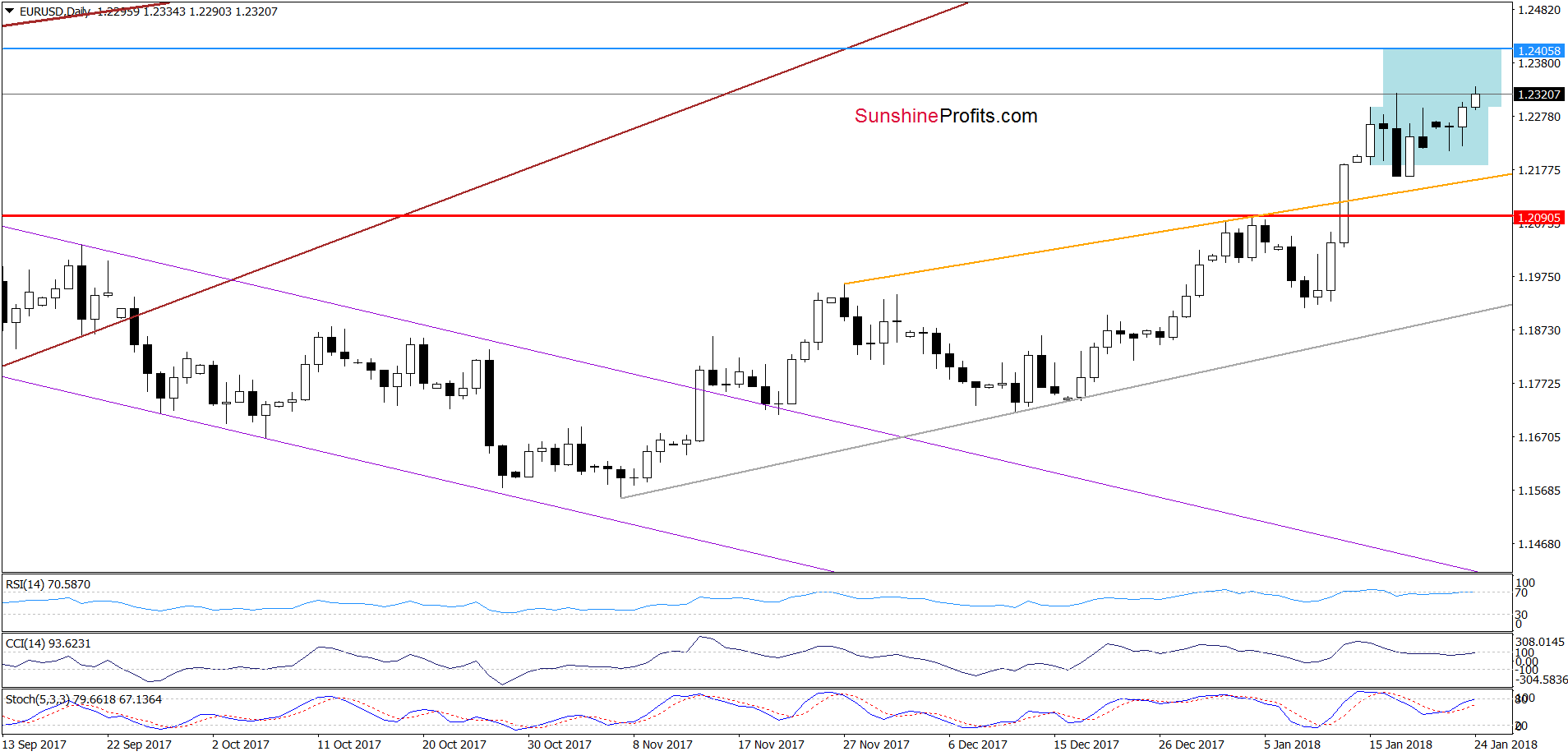

EUR/USD

The first thing that catches the eye on the daily chart is a tiny breakout above the upper border of the blue consolidation and a fresh 2018 high. Although the size of the move is not impressive at the moment of writing these words, please note that the Stochastic Oscillator generated a buy signal, which suggests further improvement and a climb to at least 1.2405, where the size of the upswing will correspond to the height of the blue consolidation.

What could happen if currency bulls manage to push the exchange rate above this area? We think that the best answer to this question is the quote from our Thursday alert:

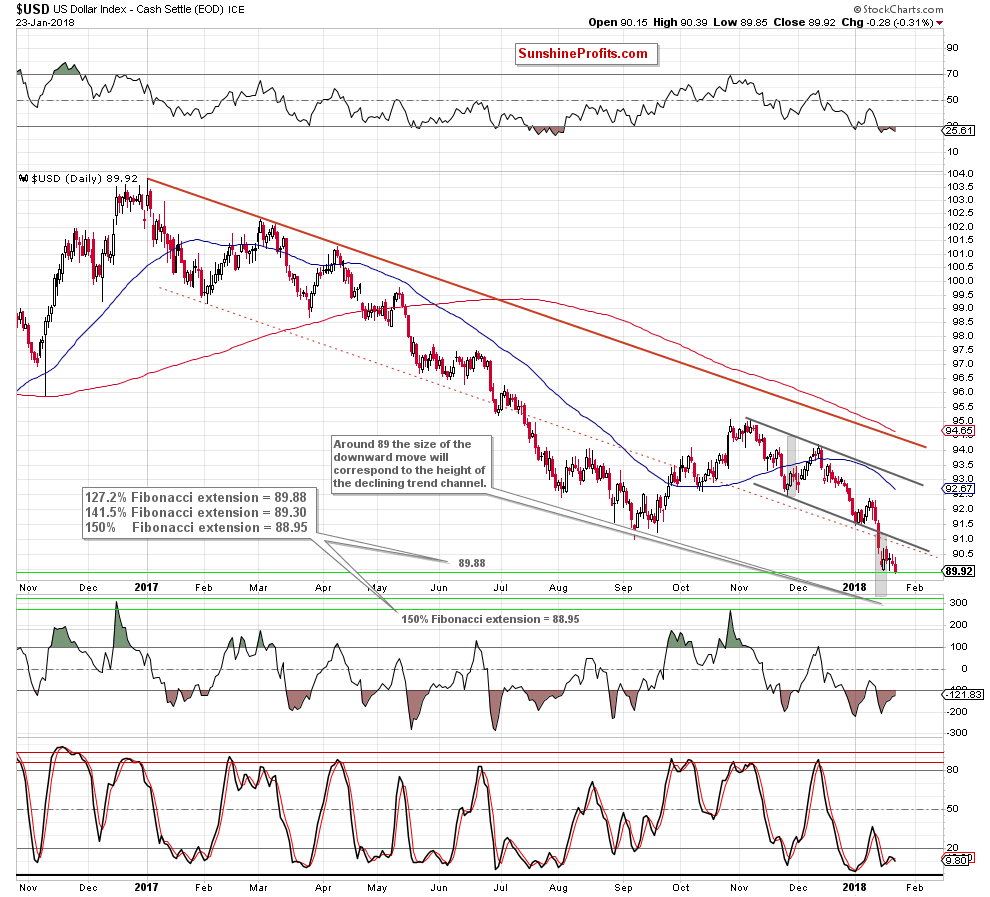

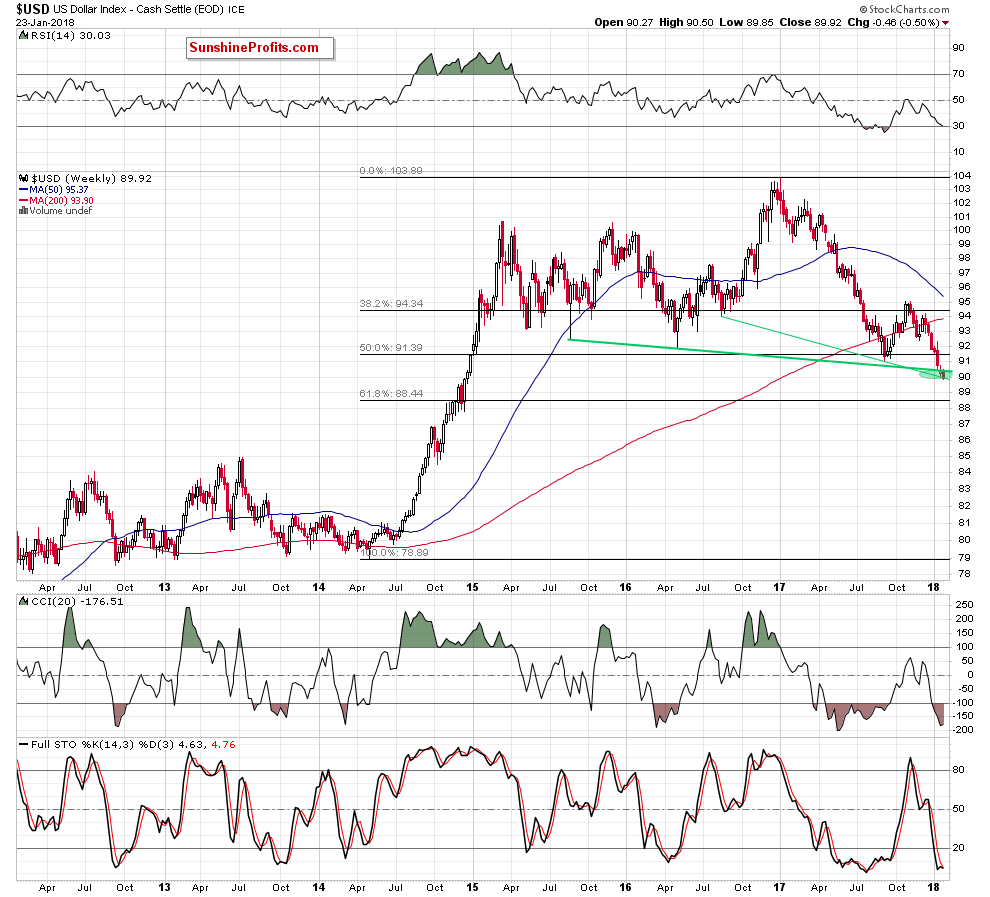

(…) we see that potential bulls’ failure could trigger one more downward move and a drop to around 89, where the size of the downward move will correspond to the height of the declining trend channel.

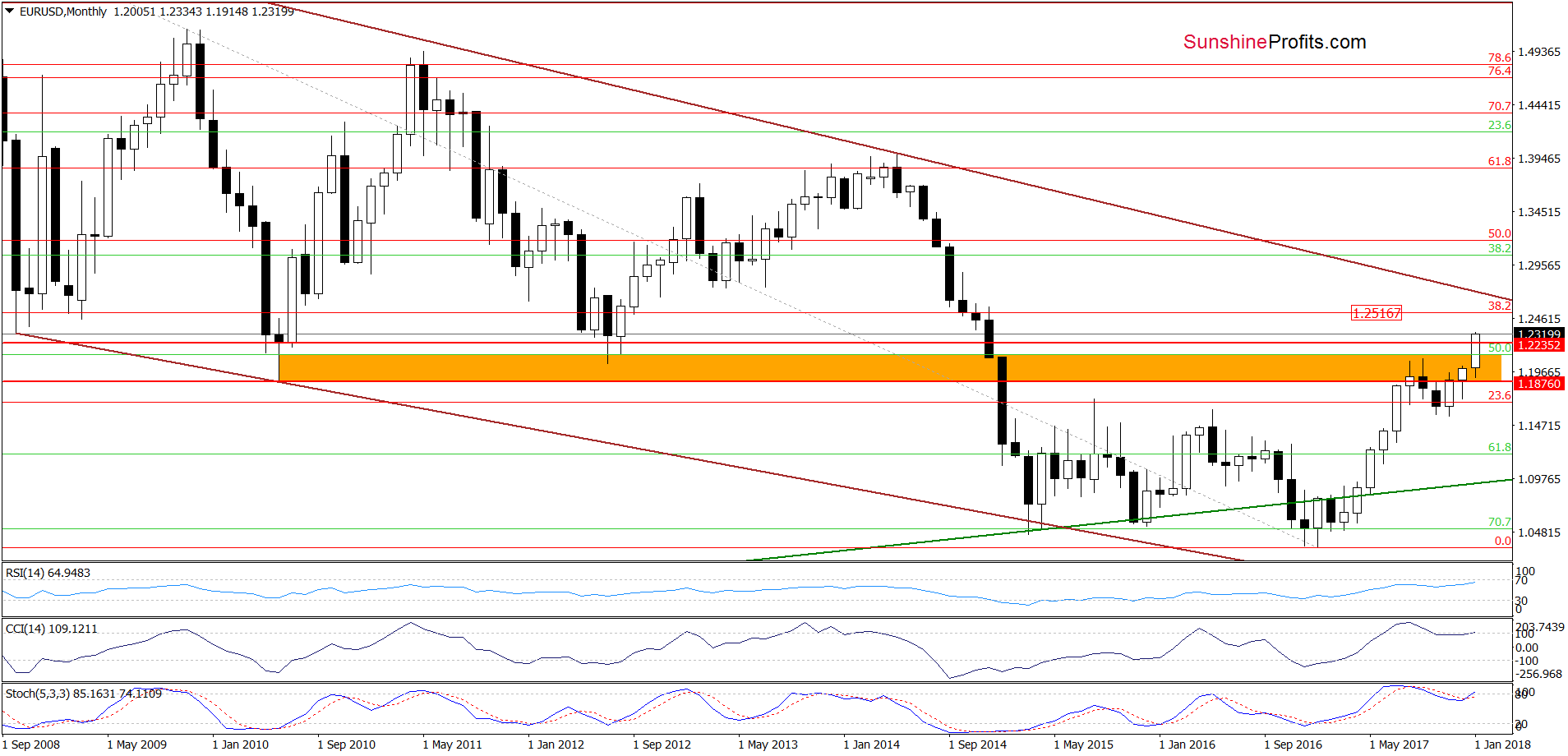

What could happen at the same time with EUR/USD?

We think that such decline in the greenback could push the exchange rate to the 38.2% Fibonacci retracement based on the entire 2008-2017 downward move. Nevertheless, this is just a potential scenario and we will continue to monitor the market very closely in the coming days.

Finishing today’s alert, please note that if the support area around 89 doesn’t stop declines in the USD Index, the next downside target for the bears will be likely the 61.8% Fibonacci retracement (around 88.44) based on the entire 2014-2017 upward move.

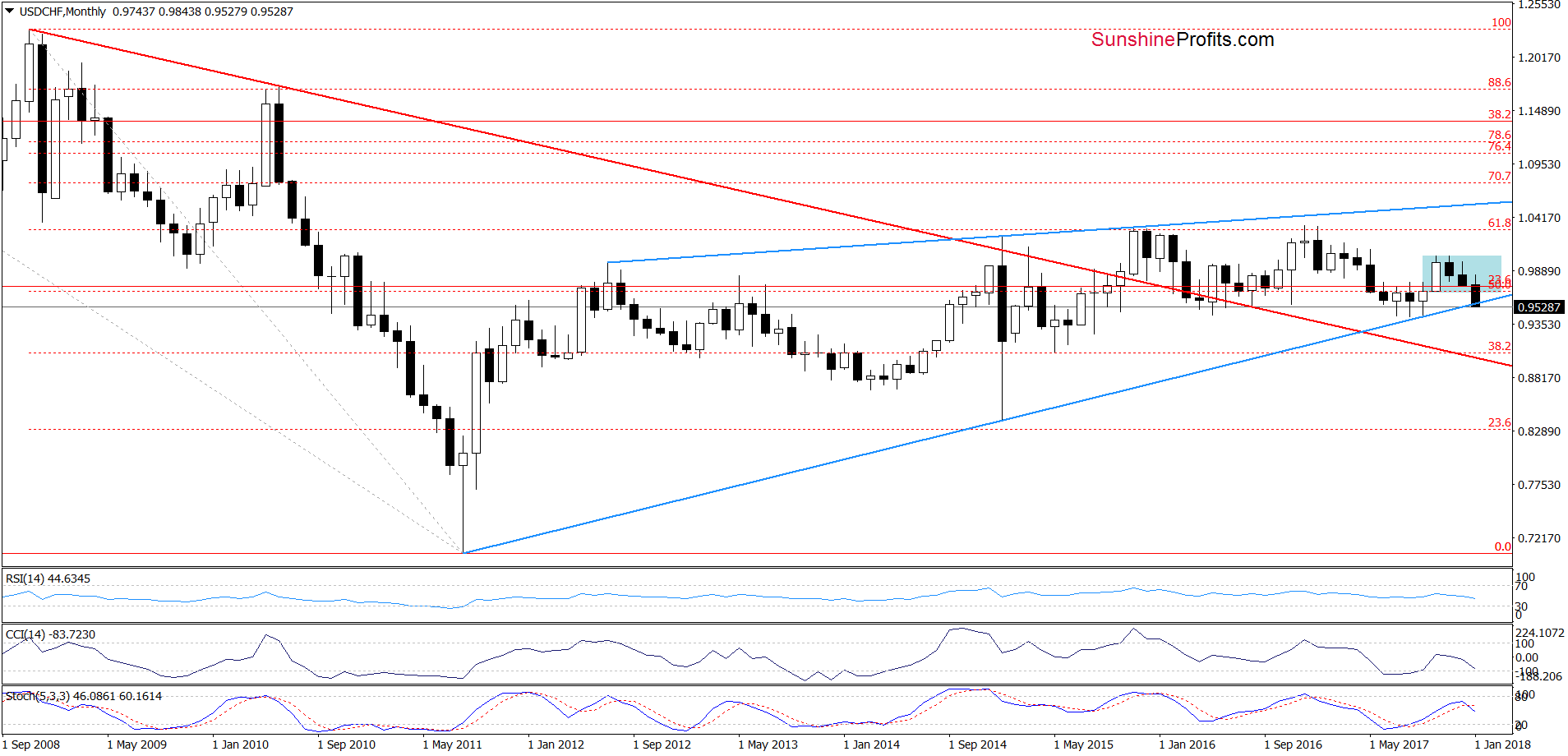

USD/CHF

On the long-term chart, we see that USD/CHF slipped slightly below the long-term blue support line based on the previous important lows, which doesn’t bode well for currency bulls – especially when we factor in the sell signal generated by the Stochastic Oscillator.

On the other hand, not far from current levels there are July, August and September lows, which could pause further deterioration. Are there any other factors that could stop currency bears? Let’s take a look at the daily chart.

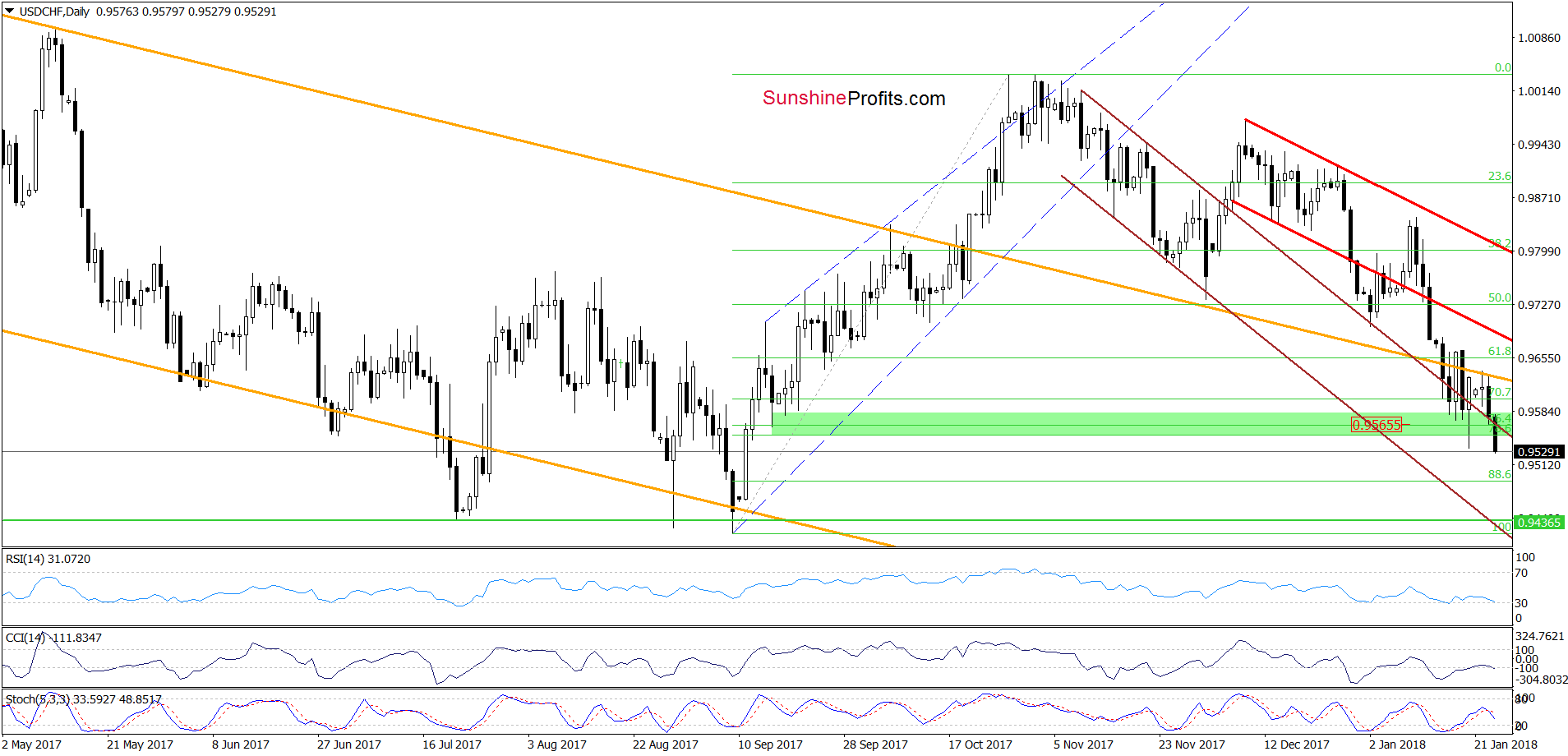

From today’s point of view, we see that although USD/CHF invalidated the breakdown under the upper border of the brown declining trend channel in the previous week, this improvement was only temporary and currency bulls didn’t manage to trigger further improvement.

As a result, the exchange rate came back under the above-mentioned line and slipped under the green support zone, which opened the way to the lower border of the brown declining trend channel, which currently intersects the support area created by the recent lows.

The pro bearish scenario is also reinforced by the current position of the indicators – the CCI invalidated the buy signal, while the Stochastic Oscillator generated the sell signal, supporting lower values of USD/CHF in the coming days.

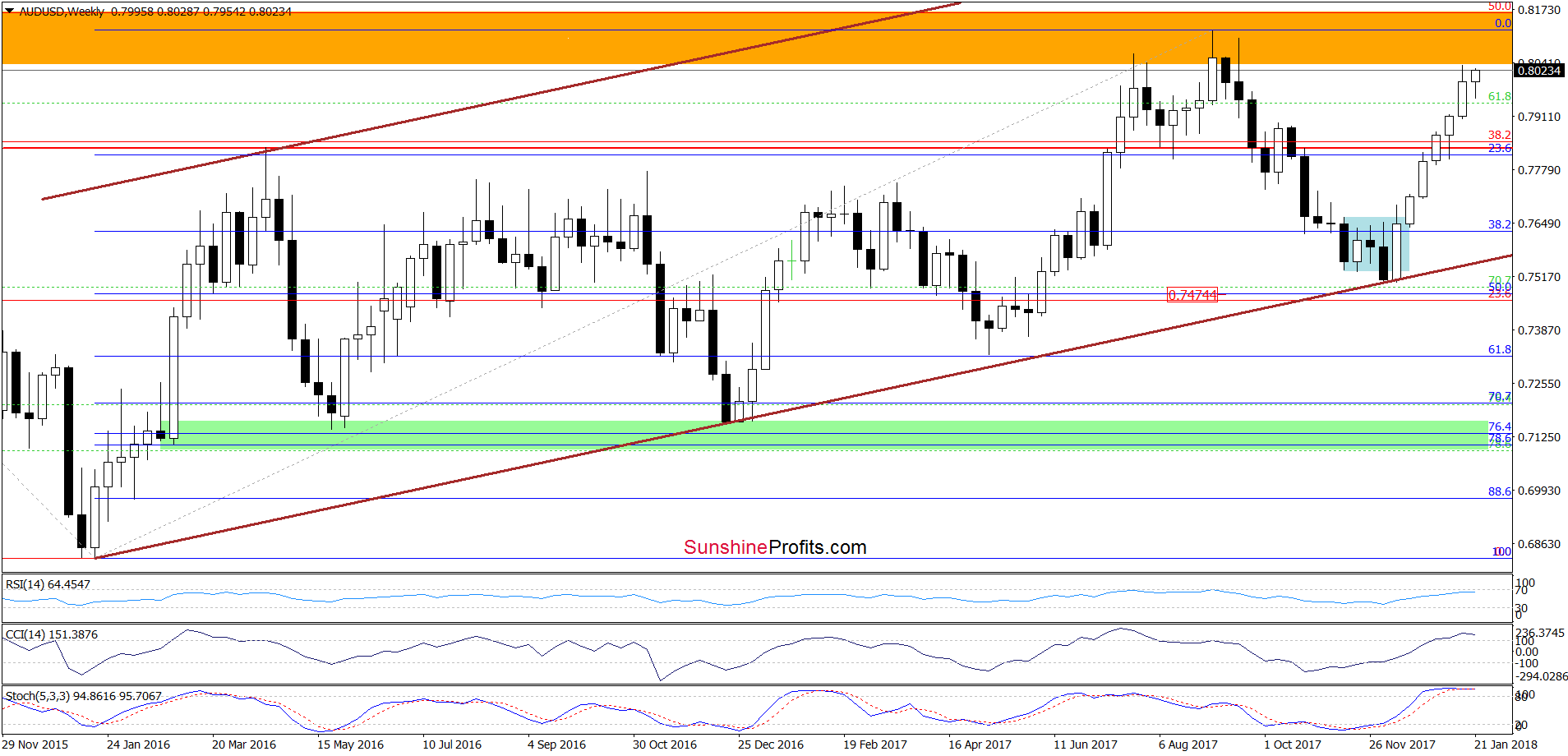

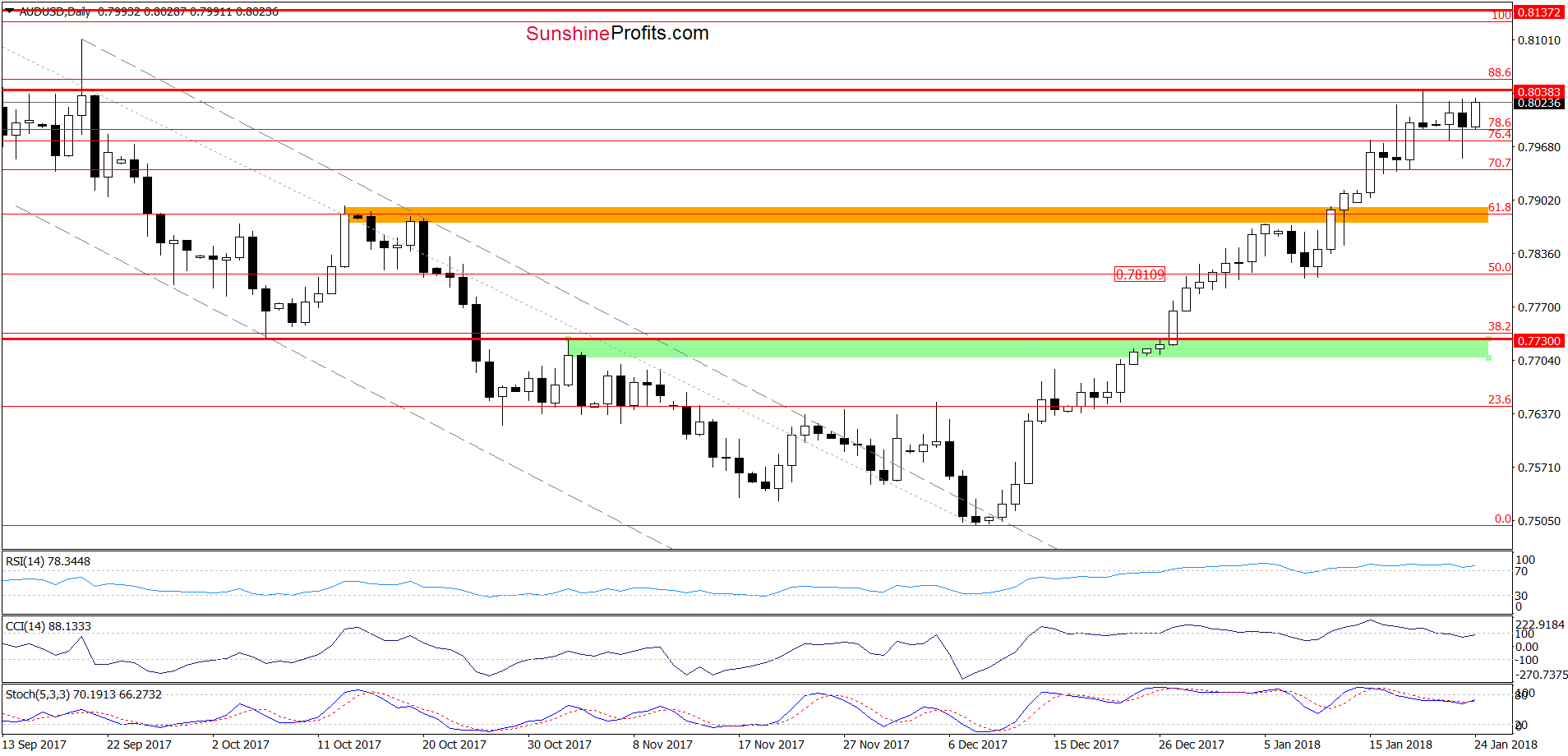

AUD/USD

Yesterday, AUD/USD pulled back, which resulted in a comeback to slightly below the zone created by the 76.4% and 78.6% Fibonacci retracements. Despite this downswing, the pair moved higher earlier today, which suggests that we may see a test of the recent highs in the coming days. Nevertheless, please keep in mind that the orange resistance zone marked on the weekly chart has stopped bulls twice in the past, therefore, if history repeats itself, we’ll likely see another reversal in this area.