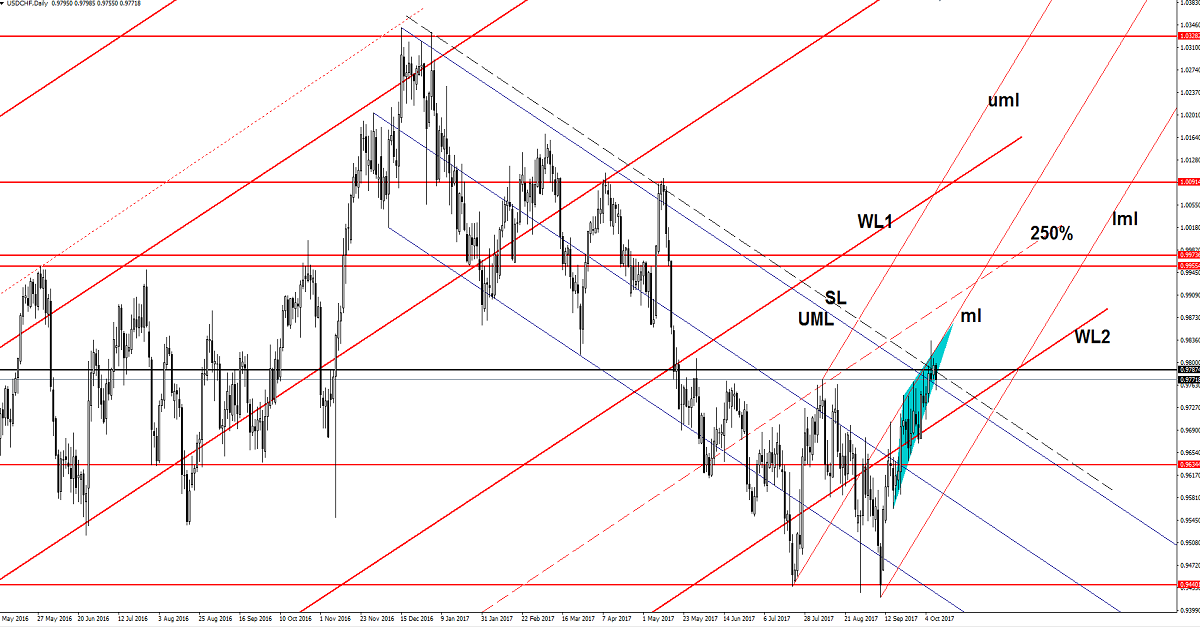

USD/CHF Trading In The Red

The USD/CHF drops like a rock and erases the latest gains. Technically, has shown some exhaustion signs in the last two weeks, but the USD dragged the price higher as the USDX has managed to reach new highs. The dollar loses ground versus its rivals as the USDX failed to stabilize above the 93.81 horizontal resistance.

Price is located above the 0.9760 level and stays above a dynamic support (resistance turned into support), it could come much deeper to retest a major support before will try to climb much higher.

The Swiss Franc rallied also because the Switzerland Unemployment Rate dropped unexpectedly, it was reported at 3.1%, below the 3.2% estimate and below the 3.2% in the former reading period. The economic indicator reached the February 2015 low.

Price dropped sharply and erased the yesterday’s gains and could invalidate the breakout above the outside sliding line (SL) and above the 0.9787 static resistance. We’ll see what will happen in the upcoming days because a USDX increase will force the rate to increase again. I’ve said in the yesterday’s report that only a consolidation above the 0.9787 will confirm a further increase. USD/CHF could come along the upper median line (uml) of the descending pitchfork till will reach the WL2.

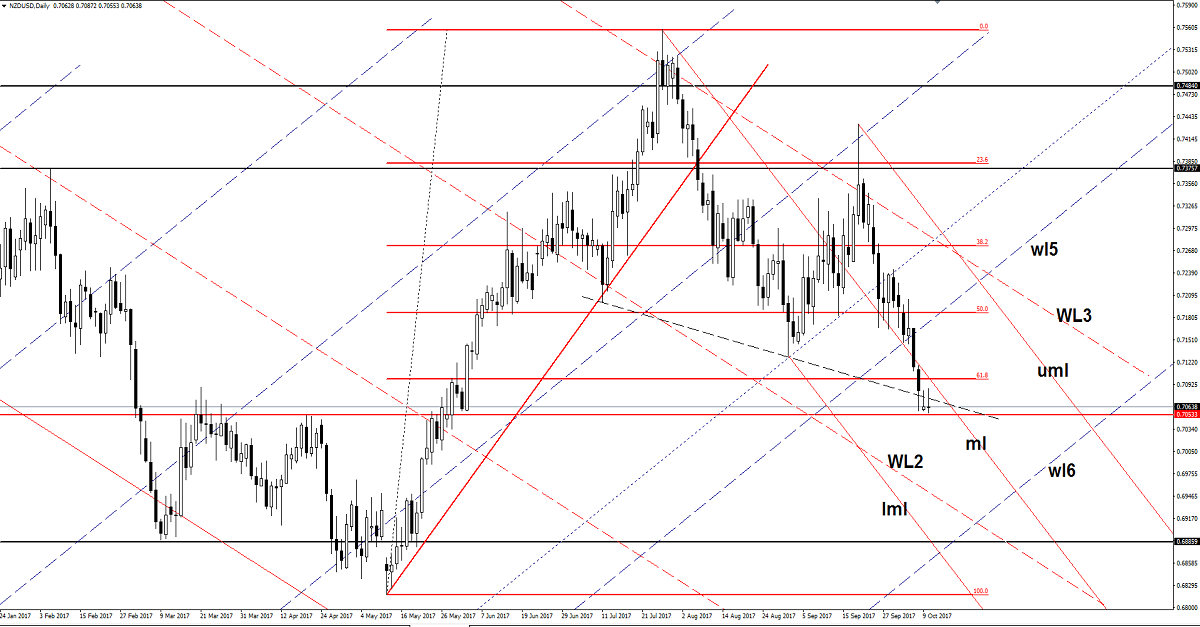

NZD/USD Hovers Above Critical Support

NZD/USD increased today and still tries to close the yesterday’s gap down, but failed to stay near 0.7087 today’s high and now could reach the 0.7053 horizontal support if the USDX will squeeze a little after the morning drop. Price hovers above the 0.7053 support and below the median line (ml) of the minor descending pitchfork. It could come to retest the median line (ml) before will drop much deeper, the perspective is bearish as long as is located below this level.

Only a breakout above the median line (ml) will announce an increase towards the upper median line (uml).

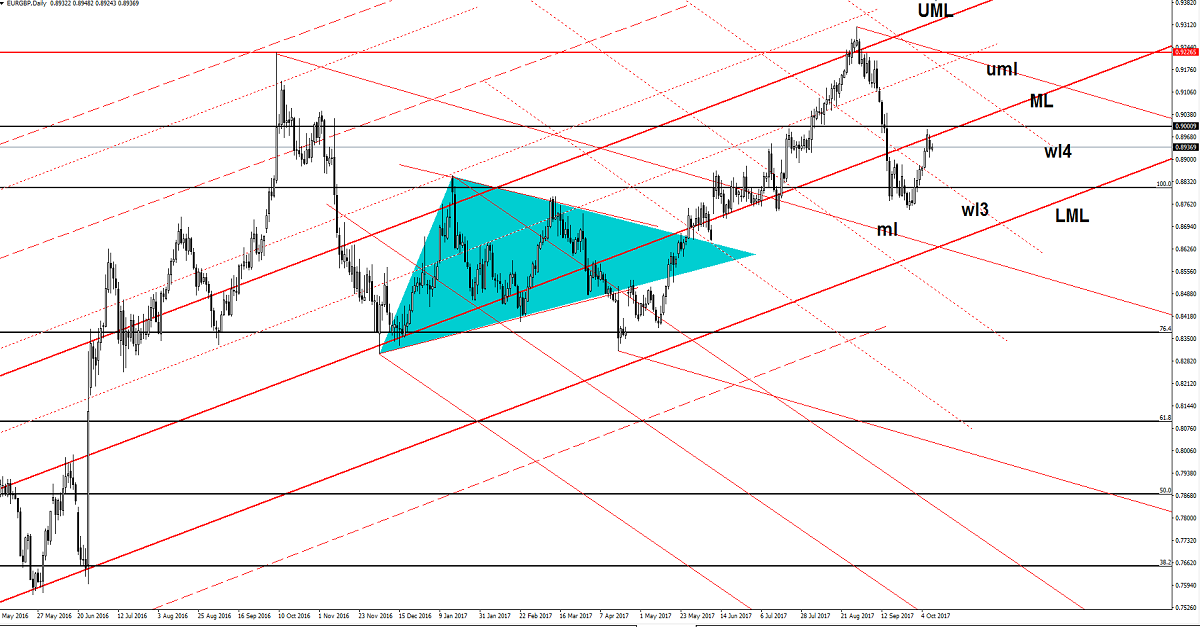

EUR/GBP Downside Uncertain

EUR/GBP posted humble gains today and still could drop in the upcoming days. Is trading in the green and tries to recover after the yesterday’s drop. Technically, it should drop after the retest of the median line (ML) of the ascending pitchfork.

Only a valid breakout above the median line (ML) and above the 0.9000 psychological level will announce a further increase towards the 0.9226 static resistance.

I graduated a Master in Business Administration, I am a Market Analyst / Trader on Financial Markets (forex, commodities, futures, options) for more than 6 years, I use technical and fundamental analysis for my daily activity. Founder and Market Analyst at ovtbusiness.com (Financial Markets Blog) and contributor on investing.com, actionforex.com, countingpips.com, forexalchemy.com, etc.

Risk Disclaimer: Trading, in general, is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can’t afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this website.