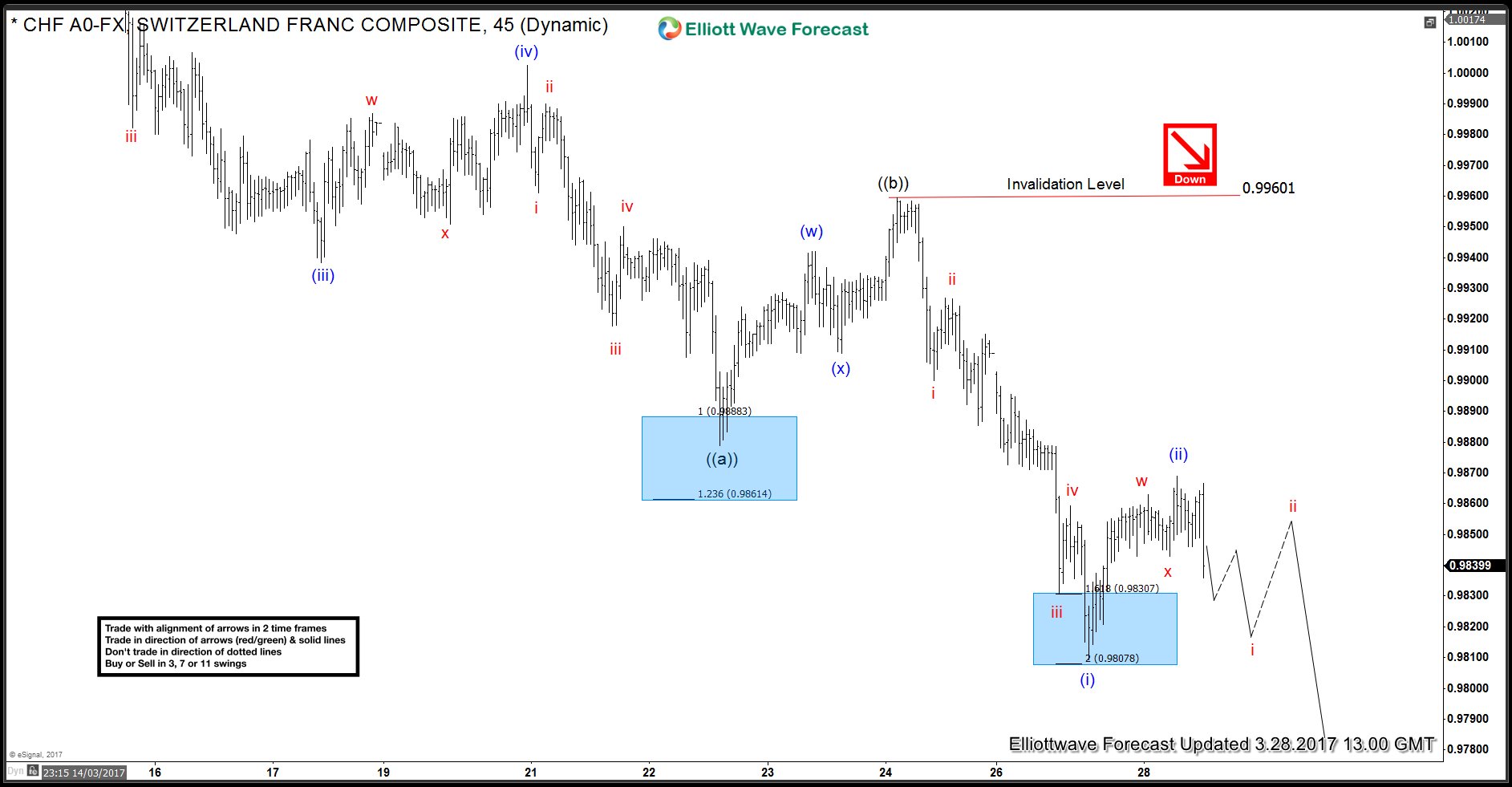

USD/CHF's decline from 3/7 (1.0170) high to 3/22 (0.9879) low could be viewed as a 5-swing move that we have labeled as Elliott wave ((a)). Bounce to 0.9960 was a three move and completed Elliott wave ((b)). Pair has since dropped to a new low below 0.9879 confirming the view that wave ((b)) ended at 0.9960. Decline from 0.9960 – 0.9809 was again in 5 swings and completed wave (i) of ((c)). Pair has already done 3-wave bounce to 0.9868, which could be all of wave (ii) and the pair can now resume the decline in wave (iii). Pair doing small 5 waves from 0.9868 high will add conviction to this view but we would need to see a break below 0.9809 low to confirm wave (ii) ended at 0.9868 and wave (iii) of ((c)) lower is in progress. Until then, another push higher toward the 0.9884 – 0.9901 area can’t be ruled out to complete wave (ii) as a double three w-x-y structure. In either case, as the pair is showing an incomplete bearish sequence down from 3/7 (1.0170) high, we expect the bounces to fail below the 0.9960 high for extension lower and in case of another push, expect the pair to find sellers in the 0.9884 – 0.9901 area. This view remains valid as long as price stays below 0.9960 high. Ideal target for wave ((c)) lower to complete is in the region of 0.9684 – 0.9569 and we can see the pair turning higher from there in 3 waves at least.

USD/CHF 1 Hour Elliott Wave chart – Wave (ii) completed

Pair showing small 5 waves from blue wave (ii) peak will add conviction to this view and a break below 0.9809 will confirm this idea.

USD/CHF 1 Hour Elliott Wave Chart – Wave (ii) in progress

Pair has already done 3 waves up from 0.9809 low and has minimum number of swings in place to call wave (ii) completed. However, while above 0.9809 low, another 3 swings higher and a test of 0.9884 – 0.9901 area can’t be ruled out to complete wave (ii) as a 7 swing structure before decline resumes. In either case, expect rallies to fail below 0.9960 high for extension lower in USD/CHF.