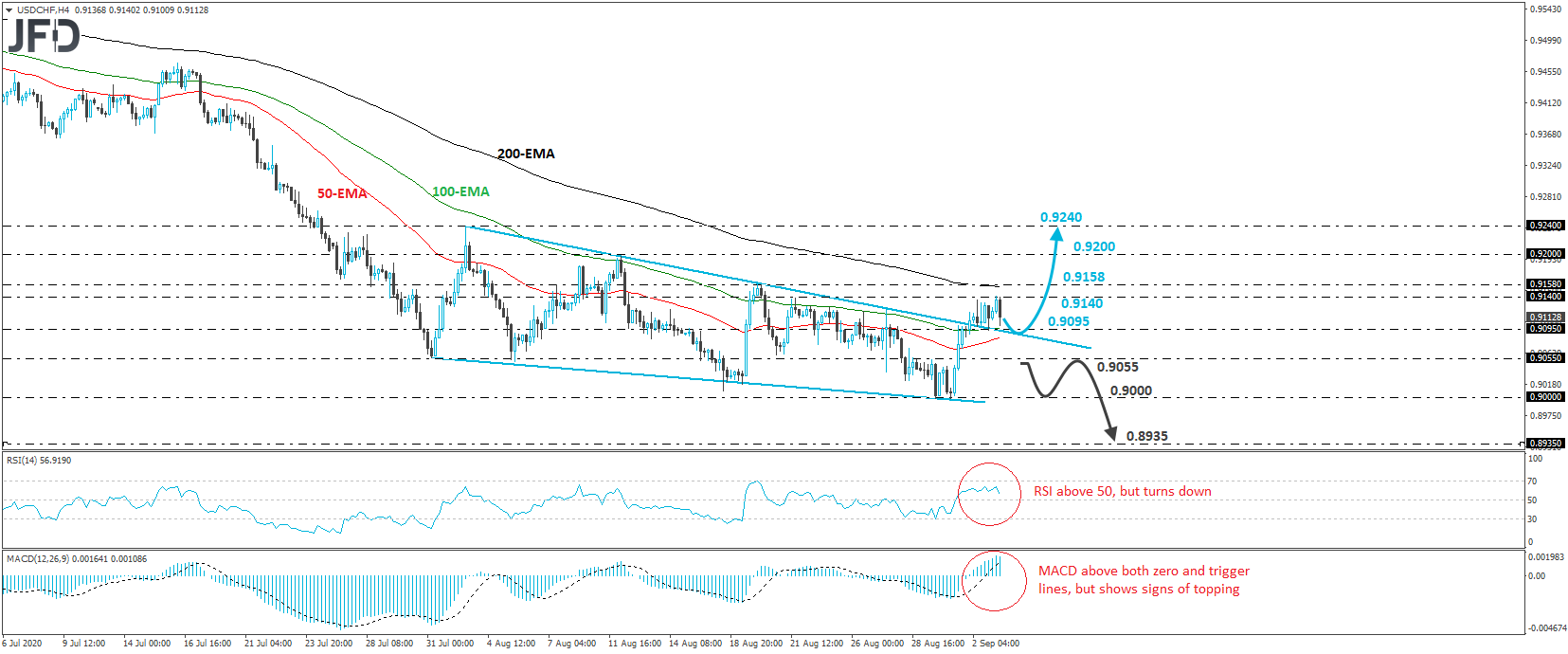

USD/CHF traded lower on Thursday, after it hit resistance near the 0.9140 level during the early European morning. Overall though, since yesterday, the rate has been trading above the upper bound of a falling wedge formation that contained the price action since July 31st, and thus, we would consider the near-term outlook to be positive.

The rate may continue sliding for a while more, perhaps to challenge the upper bound of the wedge as a support this time. The bulls may take charge from near that zone and drive the battle back up towards the 0.9140 level, or the 0.9158 barrier, marked as a resistance by the high of August 20th. A decisive break above the latter level would also take the pair above the 200-EMA on the 4-hour chart and may set the stage for extensions towards the peak of August 12th, near the 1.9200 territory. If that area is not able to stop the bulls either, then a break higher may pave the way towards the 0.9240 obstacle, marked as a resistance by the high of August 3rd.

Taking a look at our short-term oscillators, we see that the RSI, although above 50, has turned down, while the MACD, even though above both its zero and trigger lines, shows signs of topping as well. Both indicators detect slowing upside speed and support the notion for some more declines before the next positive leg, perhaps for a test near the upper end of the wedge.

In order to abandon the bullish case and turn flat, we would like to see a retreat below 0.9055. This would bring the rate back within the wedge and may allow declines towards the psychological zone of 0.9000, which provided support on Monday and Tuesday. Now, in case the 0.9000 barrier does not hold, a move lower would confirm a forthcoming lower low and thereby, turn the outlook to a negative one. This is when the bears may decide to shoot for the 0.8935 zone, which supported the price action back on January 27th, 2015.