Since the 0.9983 high, USD/CHF has printed its worst 10-day run since February. And with extreme positioning of the US dollar and Swiss franc, we think it has the potential to extend losses.

We can see on the daily chart that USD/CHF has been confined to a 280-pip range since May, with a recent turn in momentum testing the range’s lower bound. The pair has struggled to garner bullish attention since its bearish pinbar at the 2018 high, and momentum since 0.9983 has only played into bearish hands.

Last Tuesday saw a break of a retracement line and daily close confirmation of the 0.9867 low, which has since turned into resistance as part of a minor retracement. And although price action has found support above the June low at 0.9788, we’re looking for prices to break lower in line with recent momentum.

A clear break of 0.9788 support brings the 0.9700 and 0.9650 structural levels into focus for interim targets. But, if the breakout results in a new range it leaves a potential 280 pips up for grabs with a target around the April lows.

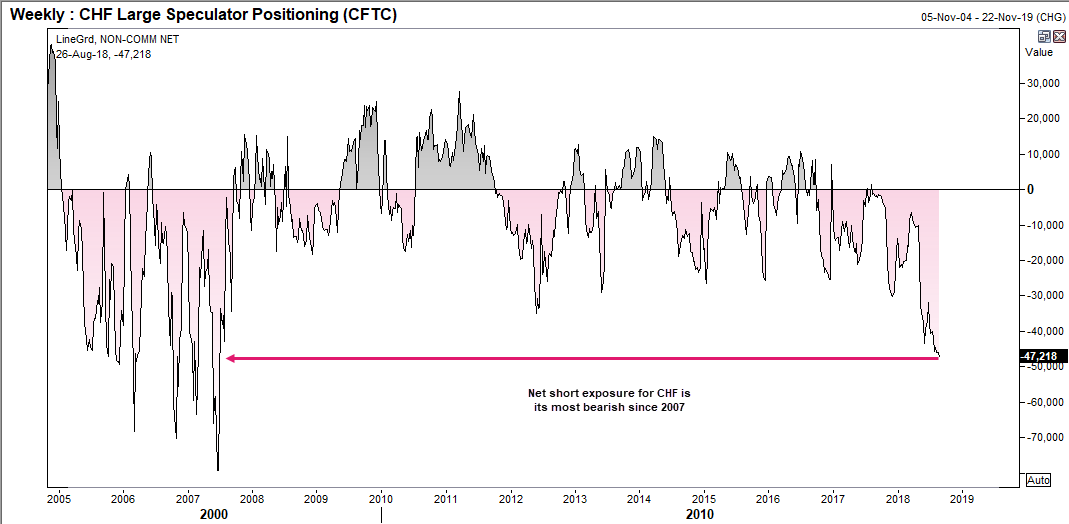

Initially this may seem far-fetched, but considering the extreme readings on large speculative positioning it doesn’t seem impossible either. USD aggregate positioning is at its highest (and most bullish) since Jan 2017 whilst CHF net positioning is at its most bearish since 2007. So, given that USD/CHF continues to trade lower, it runs the risk of short-covering which could send USD/CHF lower still. As always, let price action be your guide.