The last week was decisive for the USD/CHF. We had very strong fundamental factors that influenced this pair. First of all, the USD was pushed lower by the US Treasury Secretary, who said that the weak dollar is good for trade. Traders had no problems interpreting those words and they started to sell USD without any hesitation. Another bearish blow for this pair came from the SNB. Thomas Jordan, the SNB Governor, warned traders about the possible intervention on the market, which should've been negative information for the CHF. Apparently it was not. At first, we saw some bullish momentum on this pair but it was quickly denied.

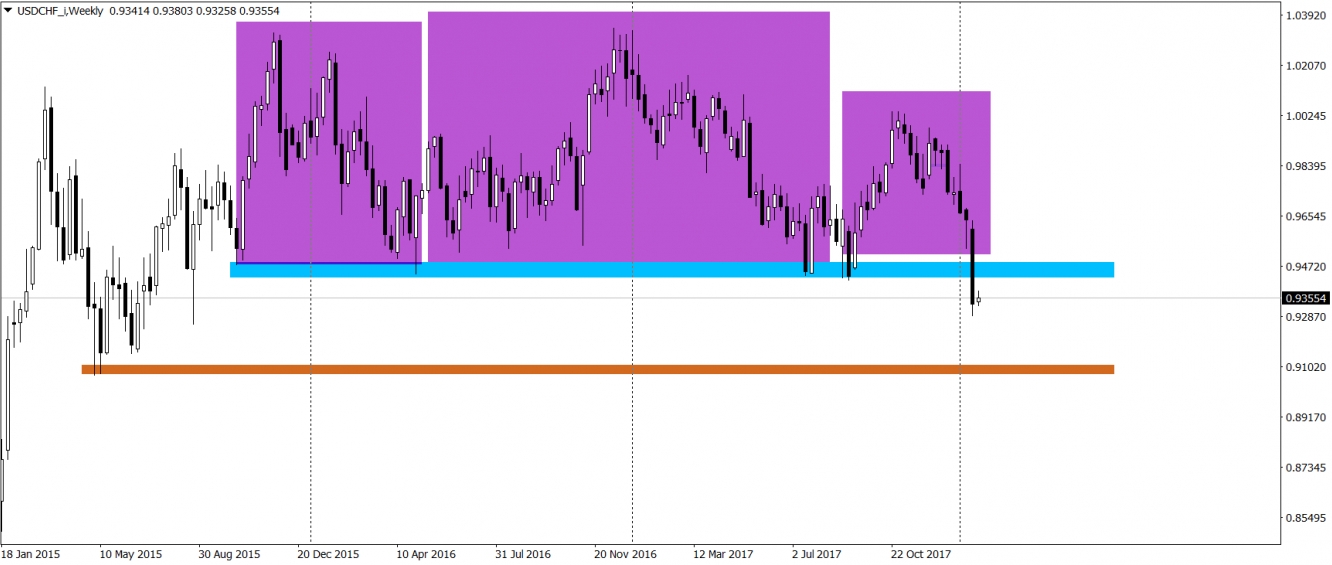

The price went to the lowest levels since the August 2015. All that happened after the massive Head and Shoulders pattern (purple), which was drawn in the past two and a half years. Last week, sellers, managed to break the neckline of this formation (blue area), which in theory triggers a very strong sell signal on this instrument. As for now, a small bullish correction is possible, with a potential target being the neckline. Long-term sentiment stays negative and with the current momentum, we should see the price next to the lows from April 2015 (orange), relatively soon.