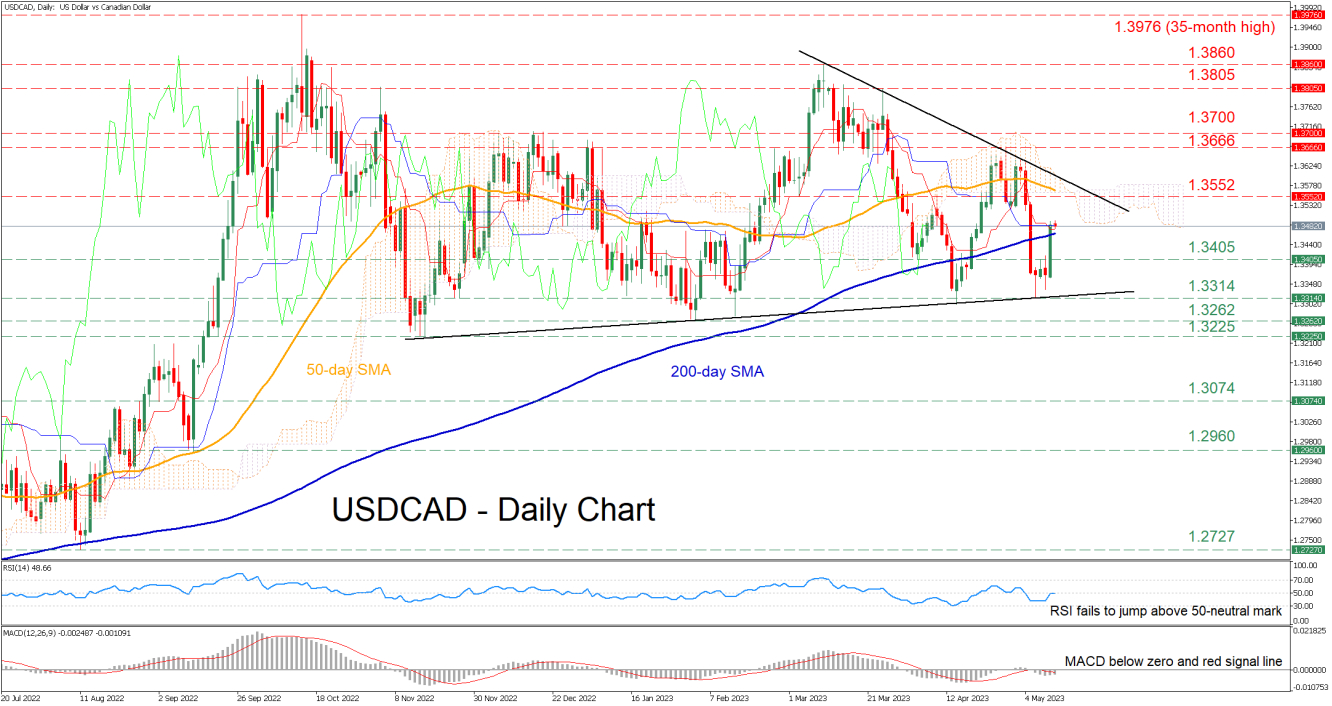

The momentum indicators currently suggest that despite the recent bounce, near-term risks remain tilted to the downside. Specifically, the RSI rebounded but failed to cross above the 50-neutral mark, while the MACD is holding below zero and its red signal line even after gaining significant ground.

Should the recovery resume, initial resistance could be met at the 1.3552 barrier. Breaching that region, the pair could advance towards the April peak of 1.3666 or higher to test the 1.3700 psychological mark that held strong in December 2022. Further advances could then cease at 1.3805.

Alternatively, if the price reverses lower and dips beneath its 200-day SMA, the April support of 1.3405 could act as the first line of defense. Should that floor collapse, the pair could descend towards the May low of 1.3314 before the 2023 bottom of 1.3262 gets tested. Even lower, the November 2022 support of 1.3225 may prove to be a tough one for the bears to overcome.

In brief, even though USDCAD experienced an upwards spike and crossed above its 200-day SMA, the technical indicators have not yet turned to the bullish side. Hence, for the rebound to strengthen the pair needs to surpass the restrictive trendline formed from its recent lower highs.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD/CAD Rebounds Strongly Above 200-Day SMA

ByXM Group

AuthorTrading Point

Published 05/12/2023, 05:01 AM

Updated 05/01/2024, 03:15 AM

USD/CAD Rebounds Strongly Above 200-Day SMA

USDCAD has been generating a structure of lower highs after peaking at the 2023 high of 1.3860 in mid-March. Although the pair managed to bounce off its May low and reclaim the 200-day simple moving average (SMA), the developing bearish flag pattern is indicating that the price could soon experience a bearish breakout.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.