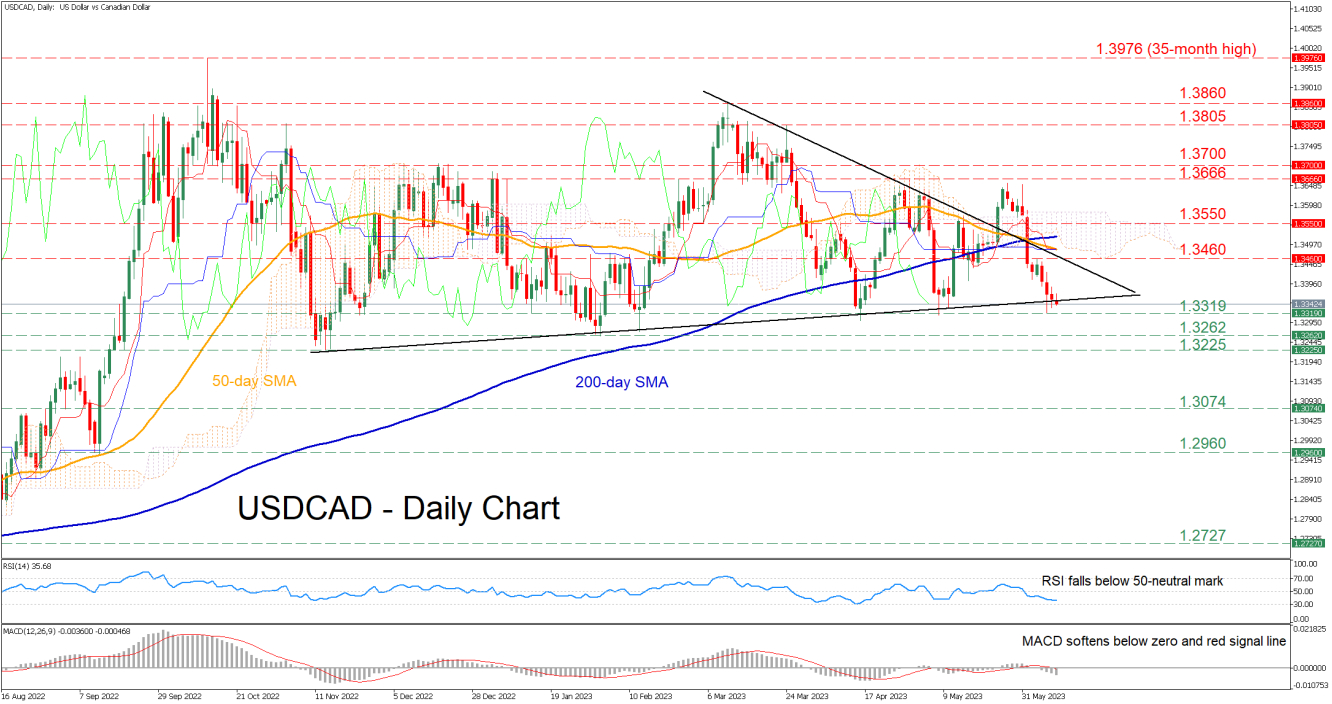

The momentum indicators currently suggest that near-term risks remain tilted to the downside. Specifically, the RSI descends below the 50-neutral mark, while the MACD is softening below both zero and its red signal line.

Should the decline resume, initial support could be met at the June bottom of 1.3319. Piercing that wall, the pair could retreat towards the 2023 low of 1.3262. Further declines could then come to a halt at the November 2022 support of 1.3225.

On the flipside, if the price bounces off the base of the symmetrical triangle, the bulls might aim for the recent resistance of 1.3460. A break above that zone could trigger an advance towards the 1.3550 resistance. Even higher, the April peak of 1.3666 could prove to be a tough one for the price to overcome.

In brief, USDCAD attempted to break its symmetrical triangle to the downside for the first time in the past two months, but the latter continues to hold its ground. Should the price manage to close below this barrier, the recent downtrend is likely to accelerate.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.