The Canadian dollar has rolled off four straight winning sessions. Will the trend continue on Thursday? In the North American session, the pair is trading at 1.3174, down 0.02% on the day. On the release front, Canadian data was strong. Nonfarm payrolls rebounded with a sharp gain of 35.4 thousand. Wholesale Sales posted a gain of 0.3%, beating the forecast of -0.2%. In the U.S., durable goods orders improved to 1.2%, but fell short of the estimate of 1.6%. Core Durable Goods Orders rebounded with a gain of 0.1%, shy of the forecast of 0.3%. Unemployment claims dropped sharply to 216 thousand, a four-week low. However, the Philly Fed Manufacturing Index slipped to -4.1, its first decline since May 2016.

The Federal Reserve has presented a dovish stance in 2019, and this position was underscored in the minutes from the January 2019 policy meeting. Participants reiterated that the Fed will remain cautious, stating that a “patient approach to monetary policy” was appropriate. However, members added that if economic projections improved, the Fed could revise the “patient approach”. The minutes noted that the employment market had strengthened and economic activity was rising, but expected GDP in 2019 to slow down compared to 2018.

Is a breakthrough around the corner in the U.S-China trade talks? The sides are holding a fourth round of talks in Washington this week. Talks are reportedly making substantial progress, as negotiators are preparing memorandums of understanding on key issues such as cyber theft and intellectual property rights. The trade war between the two largest economies in the world has triggered a slowdown in China and weighed on global stock markets. The U.S. has threatened to raise tariffs on March 1 if a deal is not reached, so there is strong pressure to reach a deal before the deadline. If the March 1 deadline is removed, traders can expect risk appetite to jump and the Canadian dollar to respond with strong gains.

USD/CAD Fundamentals

Thursday (February 21)

- 8:30 Canadian ADP Nonfarm Employment Change. Actual 35.4K

- 8:30 Canadian Wholesale Sales. Estimate -0.2%. Actual 0.3%

- 8:30 US Core Durable Goods Orders. Estimate 0.3%. Actual 0.1%

- 8:30 US Durable Goods Orders. Estimate 1.6%. Actual 1.2%

- 8:30 US Philly Fed Manufacturing Index. Estimate 14.1

- 8:30 US Unemployment Claims. Estimate 228K

- 9:45 US Flash Manufacturing PMI. Estimate 54.9

- 9:45 US Flash Services PMI. Estimate 54.4

- 10:00 US CB Leading Index. Estimate 0.1%

- 10:00 US Existing Home Sales. Estimate 5.01M

- 10:30 US Crude Oil Inventories. Estimate 2.9M

Friday (February 22)

- 8:30 Canadian Core Retail Sales. Estimate -0.5%

- 8:30 Canadian Retail Sales. Estimate 0.0%

*All release times are EST

*Key events are in bold

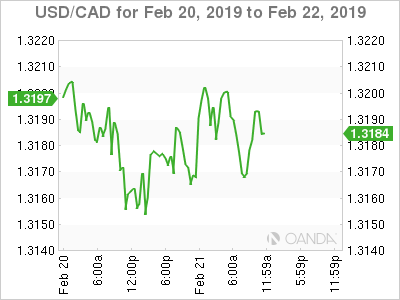

USD/CAD for Thursday, February 21, 2019

USD/CAD, February 20 at 8:15 EST

Open: 1.3177 High: 1.3207 Low: 1.3164 Close: 1.3174

USD/CAD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2969 | 1.3049 | 1.3125 | 1.3200 | 1.3290 | 1.3383 |

USD/CAD posted small gains in the Asian session. In European trade, the pair posted gains but has retracted

- 1.3125 is providing support

- 1.3200 is a weak resistance line. It was tested earlier on Thursday

- Current range: 1.3125 to 1.3200

Further levels in both directions:

- Below: 1.3125, 1.3049 and 1.2969

- Above: 1.3200, 1.3290, 1.3383 and 1.3445