Bank of Canada Surprises With 50 bp Hike

The Bank of Canada delivered a second straight 50-bp hike on Wednesday, which brought the cash rate to 4.25%. The markets had been split on whether the BoC would raise by 50 bp or 25 bp, pricing in 33 bp ahead of the decision. The move didn’t have an effect on the Canadian dollar, which closed the day unchanged.

The BoC decided on the larger rate move due to strong growth, a tight labor market and high inflation. The rate statement noted that inflation is “still too high” but added that core inflation has been falling, which may indicate that inflationary pressures are “losing momentum.”

What’s next for the BoC? The rate statement contained a significant hint that the Bank may be close to winding up the current tightening cycle, stating that the BoC was “considering whether the policy rate needs to rise further”. This was in contrast to the October meeting when the BoC stated it “expects that the policy interest rate will need to rise further.” This appears to be a dovish shift, in that additional rate hikes are longer a given. The BoC meets next in late January, and the Bank’s rate decision could again go down to the wire, only this time it will be a choice between a 25 bp increase and a pause. Policymakers have some time to gauge the effect of high rates on the domestic economy and they will also be keeping a close eye on developments in Europe, China and the US.

Ahead of next week’s CPI report, the US releases PPI and UoM Inflation Expectations on Friday. There are signs that inflation is weakening, and if this is reflected in Friday’s data, the financial markets could get a boost and the US dollar could lose ground, a scenario we’ve become accustomed to seeing whenever inflation underperforms.

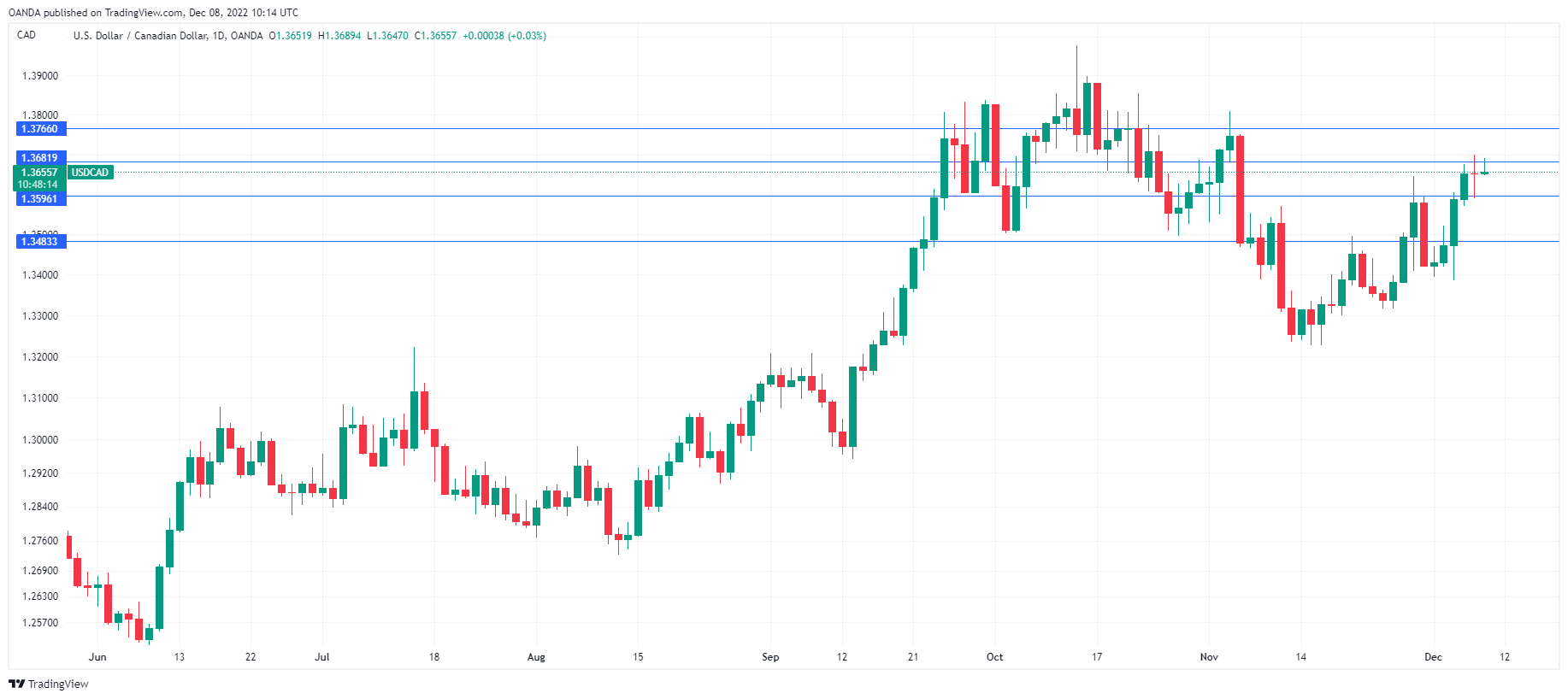

USD/CAD Technical

- There is weak resistance at 1.3681. The next resistance line is 1.3766

- USD/CAD has support at 1.3596 and 1.3484