- Yesterday’s reversal ended a 9-day winning streak for USD/CAD, something we’ve only seen seven distinct times in the past 30 years.

- After past such streaks have ended, USD/CAD has seen an average 1-month (21-day) return of -1.8% and an average 1-quarter (63-day) return of -5.5% (albeit across a small sample size)

- To the downside, a near-term retracement toward 1.3700 or previous-resistance-turned-support at 1.3625 could be in play

Yesterday, USD/CAD closed the day lower than where it started the day.

While unremarkable on its face, the drop ended a 9-day winning streak for the North American pair, something we’ve only seen seven distinct times in the past 30 years.

The pair’s big intraday reversal emerged despite the release of a cooler-than-expected inflation report out of Canada, ostensibly a bearish development for the Loonie and a bullish one for USD/CAD as it increases the probability that the Bank of Canada cuts interest rates next week. Ultimately, traders used the release as an excuse to “buy the rumor, sell the news” after the big 300+ pip rally over the last two weeks.

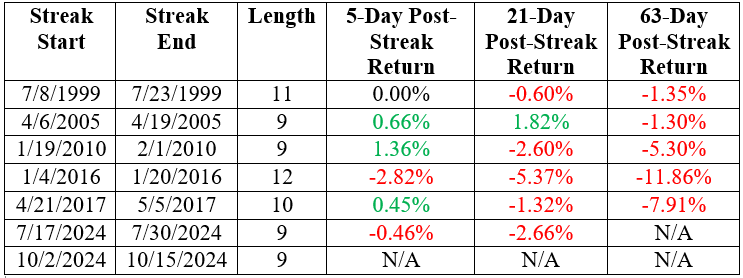

Any time something unusual happens in markets, it helps to look back at past occurrences to better understand the range of outcomes and potential tendencies moving forward. As I noted above, there have been just six distinct 9+ day winning streaks in USD/CAD over the past 30 years:

As the table above shows, the near-term (1-week) returns following the end of big USD/CAD winning streaks have been mixed, with the pair rising three times, falling twice, and trading flat on one occasion. That said, the slightly longer-term returns have been poor, with an average 1-month (21-day) return of -1.8% and an average 1-quarter (63-day) return of -5.5%.

Of course, this study features an exceedingly small sample size with just a handful of prior occurrences (and my compliance department will inevitably implore me to emphasize that past performance is not necessarily indicative of future results), but based on the historical track record at least, USD/CAD bulls may want to exercise patience as we head into the holiday season.

Canadian Dollar Technical Analysis – USD/CAD Daily Chart

Source: TradingView, StoneX

From a more traditional technical analysis perspective, USD/CAD formed a “Shooting Star” candlestick formation yesterday; For the uninitiated, this pattern shows an intraday shift from buying to selling pressure and is often seen at near-term tops in the market.

With yesterday’s reversal taking place at a logical resistance level (the 78.6% Fibonacci retracement of the August-September drop), with the 14-day RSI in overbought territory, the case for a drop is more compelling. To the downside, a near-term retracement toward 1.3700 or previous-resistance-turned-support at 1.3625 could be in play. Only a break above yesterday’s high near 1.3835 would erase the near-term bearish bias.