They say that the fortune favors the bold, but “they” clearly have never tried making money while trading the forex market. “Nobody ever got broke by taking profits” seems more reasonable as far as sayings go, but the truth is that in the end it’s always the risk to reward that decides whether a given position should be held or not and deviating from it is costly sooner or later. The situations in the EUR/USD and USD/CAD pairs were just very favorable, but they are now only somewhat favorable and exercising the above key rule seems appropriate. This is a profitable execution.

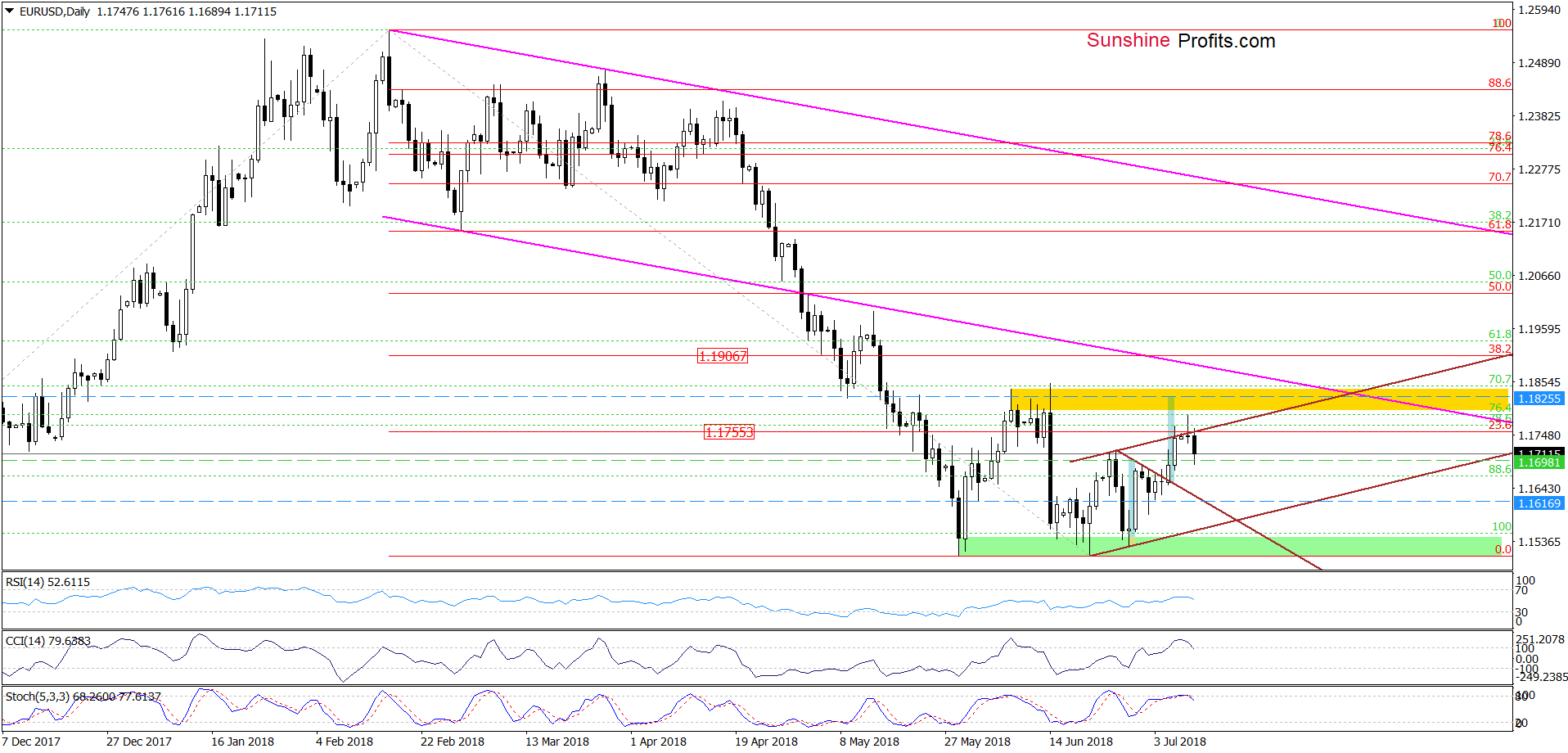

EUR/USD: Currency Bulls, Be Ashamed!

Yesterday, we wrote the following:

(…)taking into account the current position of the indicators and the proximity to our initial upside target, we believe that closing half of our recent long positions and taking profits off the table is justified from the risk/reward perspective.

From today’s point of view, we see that it was a good idea, because EUR/USD reversed and declined after our alert was posted. Thanks to yesterday’s move, the pair slipped under the upper border of the brown rising trend channel and closed the day below it, which encouraged currency bears to act earlier today.

As a result, the exchange rate extended losses, which together with the current position of the daily indicators (the CCI and the Stochastic Oscillator generated sell signals) suggests that lower values of EUR/USD are just around the corner. Therefore, we believe that closing the other half of our short positions and taking profits off the table (yes, they are still profitable at the moment of writing this alert) is justified from the risk/reward perspective.

Is it right time to open short positions? We are not so sure about this idea, so we’ll wait at the sidelines to see the closing rate for today's session. If the weakness of currencybulls is confirmed, we’ll consider going short.

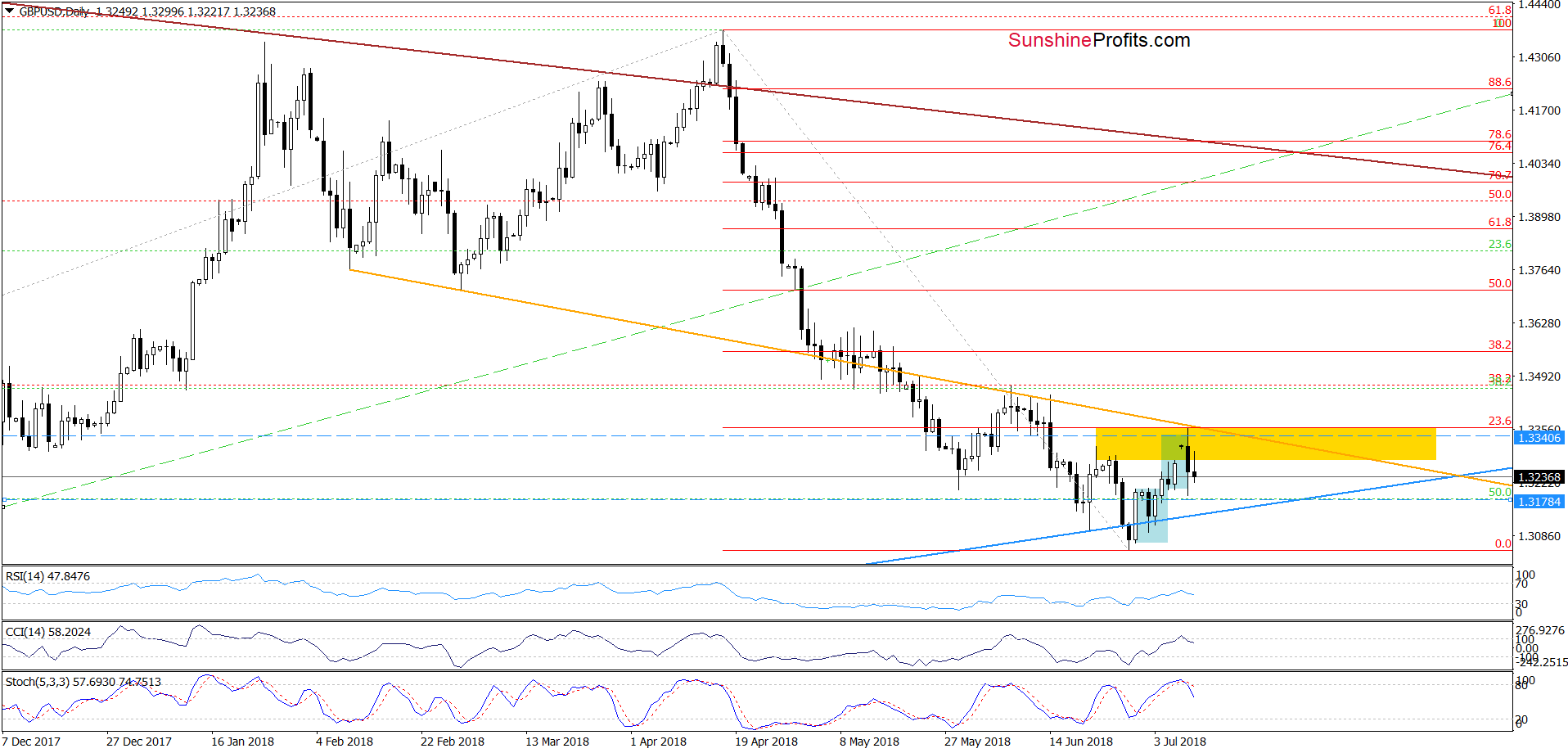

GBP/USD: Profitable Bulls

On Friday, we wrote that if the exchange rate extends gains from current levels, the initial upside target will be around 1.3340, where the size of the upward move will correspond to the height of the aforementioned consolidation.

Yesterday, we added:

(…) the situation developed in tune with our assumptions and GBP/USD moved higher, reaching our initial upside target earlier today.

So, what’s next?

(…) thanks to today’s upswing the exchange rate also climbed to the resistance area created by the 23.6% Fibonacci retracement and the previously-broken orange line. (…) this resistance was strong enough to successfully stopped currency bulls June, which suggests that similar price action in this zone can’t be ruled out – especially when we factor in the current position of the daily indicators.

Therefore, (…), we think that closing our short positions and taking profits off the table is the most sensible decision for this moment.

Looking at the daily chart, we see that currency bears pushed GBP/USD sharply lower after our yesterday’s commentary (as we had expected), making our wallets happy. Thanks to Monday’s drop, the pair re-tested the previously-broken upper border of the blue consolidation, which can result in a rebound later in the day.

Nevertheless, the CCI and the Stochastic Oscillator generated the sell signals, increasing the probability of another move to the downside in the following days. Therefore, we think that as long as there is no successful breakout above the yellow resistance zone and the orange resistance line a bigger move to the upside is not likely to be seen.

On the other hand, as long as there is no invalidation of the breakout above the upper line of the blue consolidation and a breakdown below the blue support line, short positions are questionable. This means that waiting at the sidelines for another profitable opportunity is the best decision at the moment.

If we see any reasonable arguments for short or long positions we’ll let our readers know as soon as possible so stay tuned.

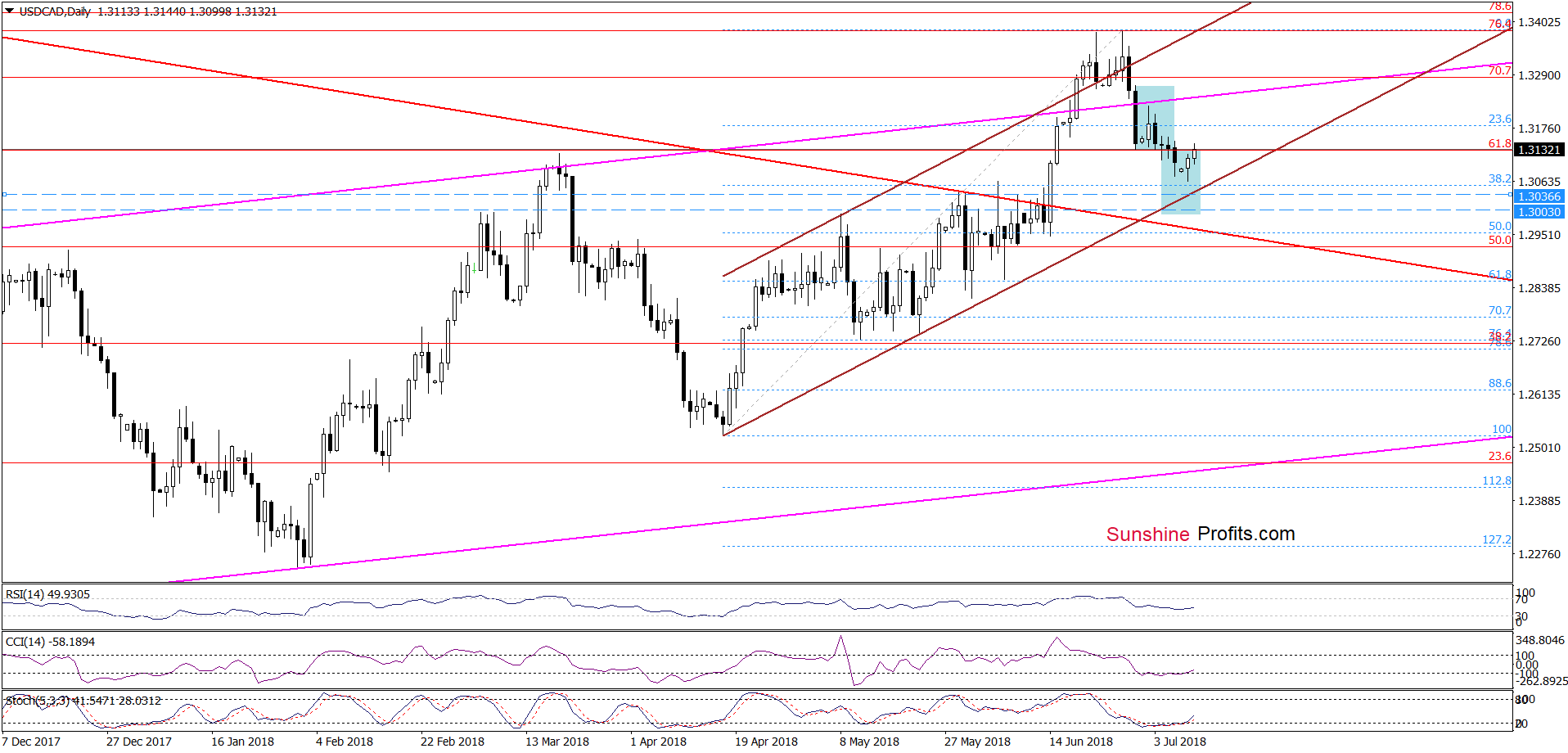

USD/CAD: Time For Gains

In the case of this currency pair, we also decided to take some of the earlier profits yesterday:

(…) USD/CAD is quite close to our initial downside target, which means that closing half of our profitable short positions seems the best decision at the moment.

Nevertheless, in order not to close the road to a potentially higher profit, we leave half of the short positions with the downside target at 1.3003.

As you see on the daily chart, the proximity to our initial downside target (the lower border of the brown rising trend channel) encouraged currency bulls to fight for higher levels. Thanks to their determination USD/CAD came back to the lower border of the blue consolidation, which could be nothing more than a verification of the earlier breakdown.

However, taking into account the buy signals generated by the CCI and the Stochastic Oscillator, we think that risking existing profits (half of the short positions that we opened on June 29, 2018) is a bad idea. Therefore, in our opinion, closing the other half of profitable short positions is justified from the risk/reward perspective.

What’s next for USD/CAD?

If we see an invalidation of the breakdown under the lower line of the blue consolidation, the exchange rate will likely extend gains and test the previously-broken upper border of the pink rising trend channel.

On the other hand, currency bulls’ failure in this area could result in another reversal and a test of the lower border of the brown rising trend channel.

Connecting the dots, depending on the strength of the bulls’ fight, we’ll consider opening next positions. So, let's stay in touch.