- USD/CAD changes the outlook to bearish after the fall below 1.360

- Stochastic ticks up but RSI still holds near 30 zone

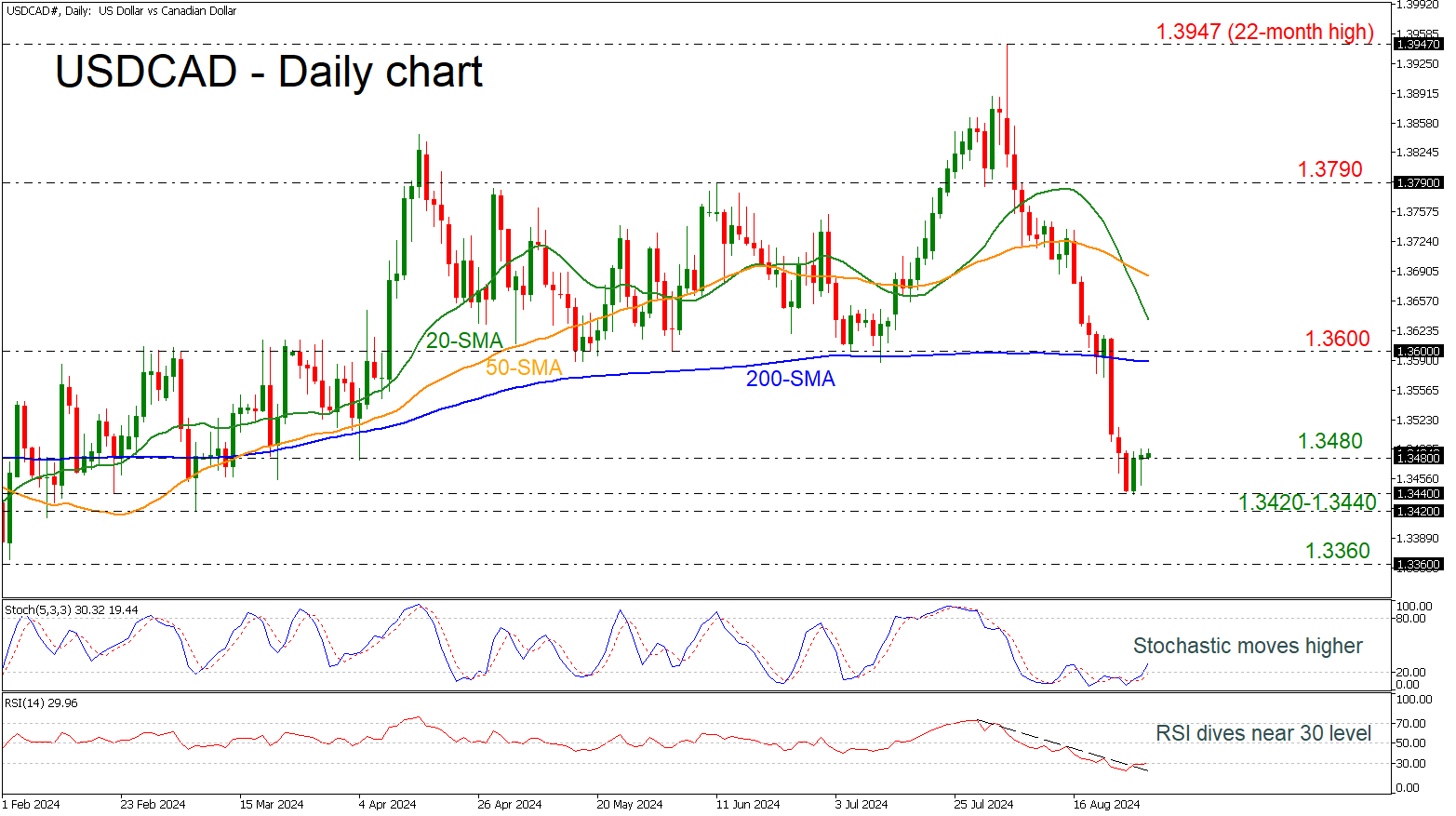

USD/CAD is recouping some losses after the strong selling interest that started from the penetration of the 1.3600 round number and the 200-day simple moving average (SMA). The pair found support near the 1.3440 level, which is an almost six-month low.

Currently, the market is trying to remain above the 1.3480 barricade with the technical oscillators suggesting more buying interest.

The stochastic is pointing upwards following a bullish crossover within its %K and %D lines, while the RSI is flattening near the 30 level after it bottomed in the oversold region.

In case of more bullish movements the next battle would come again with the 1.3600 psychological mark ahead of the 20- and 50-day SMAs at 1.3635 and 1.3685 respectively.

On the other hand, a slide beneath the 1.3420-1.3440 support area could open the way for a new low in the short-term, meeting the 1.3360 barricade, taken from the trough on January 31.

All in all, USD/CAD has decreased around 4% from the 22-month high of 1.3947 and switched the near-term outlook to bearish.