Rising Oil prices caused by another unrest in the Middle East are helping the Canadian Dollar in gaining the bullish momentum. Actually, on the USD/CAD we do have two different forces which push the price into the same direction. First one is the Oil mentioned above - strengthening the CAD. Second one is the weakness of the USD, which can be seen across the globe, almost on every instrument.

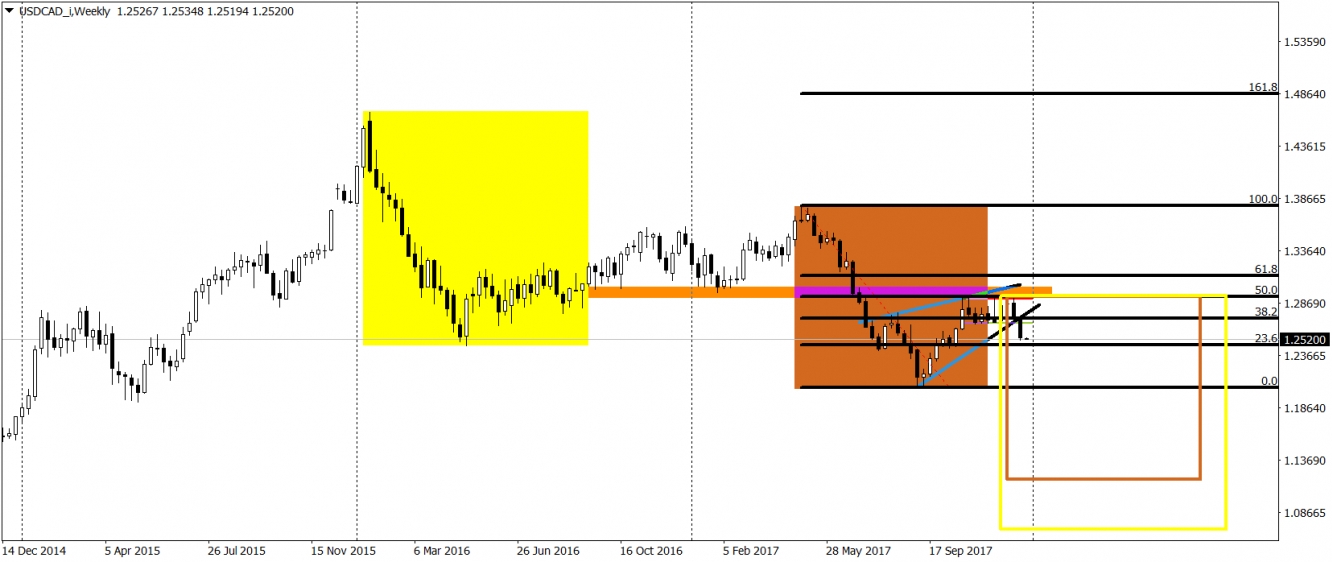

So USD/CAD is fundamentally driven lower from the both sides. Technical analysis is not far behind. The last quarter of the 2017 brought us a bounce from the 50% Fibonacci of the latest downswing. We also broke the lower line of the wedge (blue), which triggered the long-term sell signal.

Let's talk about the potential targets for the current negative sentiment. On the first place we do have lows from the 2017. That is rather obvious and I guess that we all pretty much agree that the price will eventually get there. What is the next, long-term target? Let us look on the main bearish waves from 2016 and 2017. First one (yellow) had around 2200 pips. Second one (orange) was a bit smaller – 1700 pips. Using the impulse equality method, we can assume that the another leg down will be at least as big as the second one, which sets the potential target on the 1.118. If the price would like to go any lower and duplicate the drop from the 2016, the target would be on the 1.07. Anyhow, the sentiment is negative here and sellers have higher chance for the profits in the mid-term.