Canadian dollar takeaways- A combination of strong jobs data, surging oil prices, and hawkish comments from BOC Governor Macklem pushed USD/CAD to test multi-month lows in the 1.3300s.

- Key support levels sit down around 1.3320 and 1.3250.

- Meanwhile, a recovery above the 200-day EMA around 1.3400 could clear the way for a more substantial bounce this week.

Canadian dollar fundamental analysis

As it often does, the first Friday of the month brought dueling jobs reports from the US and Canada…and as it turns out, both North American countries received stellar news about their labor markets.

The US NFP report showed +253K net new jobs (vs. 181K eyed, albeit with negative revisions to previous reports) and wages rising by 0.5% m/m (vs. 0.3%), while Statistics Canada reported +41.4K new jobs in Canada (vs. 21.6K expected).

On balance, the Canadian report was relatively stronger, but more to the point, the strong economic data alleviated some concerns about global economic growth, leading to a broad-based rally in risk assets heading into the weekend. The Canadian dollar was a big beneficiary of that optimism, as was the price of oil, Canada’s most important export. Relatively hawkish comments from BOC Governor Macklem no doubt helped boost the loonie as well.

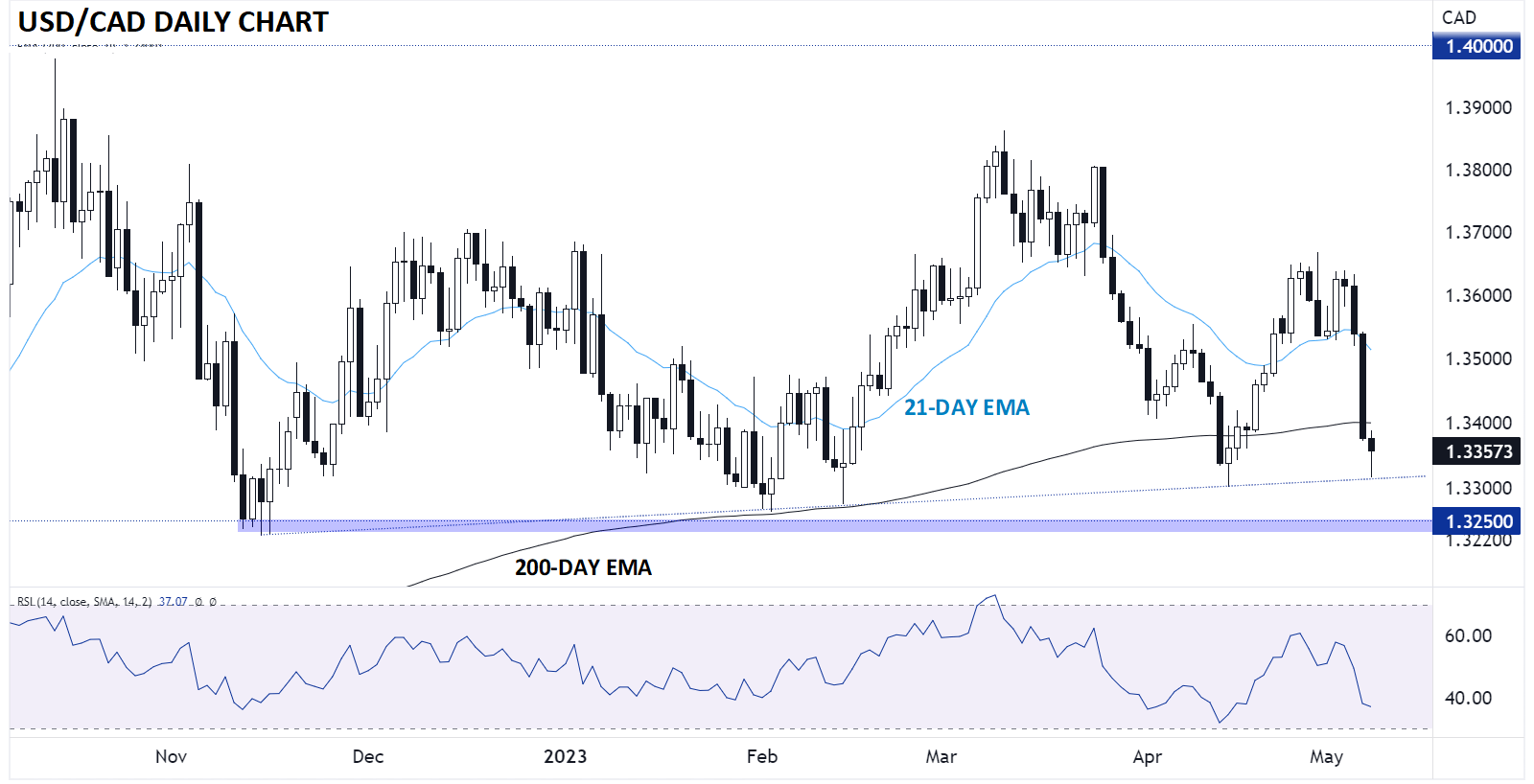

Canadian dollar technical analysis– USD/CAD Daily Chart

Source: StoneX, TradingView

As we start a new trading week, USD/CAD is probing its lowest level in months in the mid-1.3300s. More to the point, the pair is peeking below its 200-day EMA for only the second time since last June, signaling that the longer-term uptrend may be losing momentum.

In terms of the short-term levels for USD/CAD traders to watch, the rising trend line starting in November coincides with today’s low near 1.3320, and if that support level gives way, the 8-month low near 1.3250 would represent the next major support level to watch.

Meanwhile, a bounce back above the 200-day EMA near 1.3400 could embolden short-term bulls for this week, though readers with a longer-term perspective may prefer to see the pair clear the April highs in the mid-1.3600s (perhaps accompanied by falling oil prices) to start looking for bullish swing- or position-style trades.