NOTE: A Major ECB meeting is happening tomorrow so be cautious. A leak of the announcement today sparked some massive volatility, so may see more of that tomorrow. We also have a record amount of Euro shorts, so a short squeeze could be on deck.

USDCAD – Explodes Higher on Surprise Rate Cut (1hr chart)

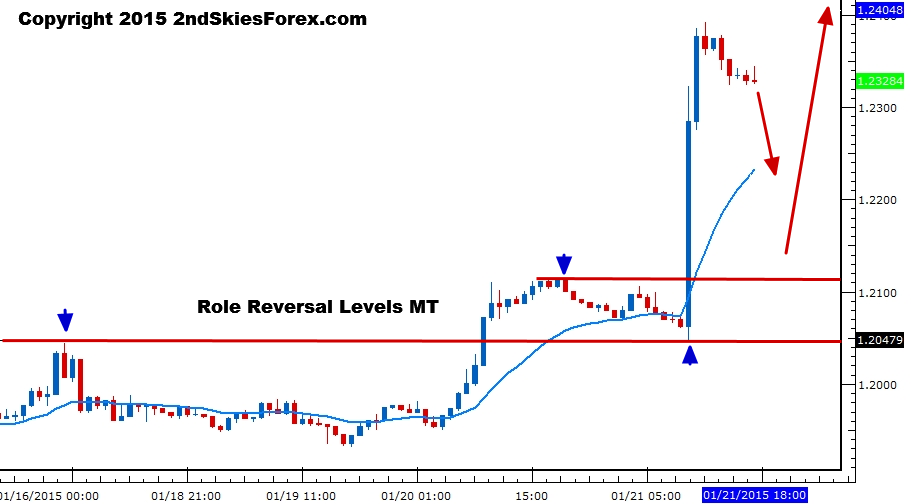

While most traders expected the BOC to hike rates this year, they cut from 1.00 to .75%. This pushed the USDCAD up +300 pips in just a couple hours.

For now the market is in a weak corrective pullback, so we are looking to get long. A deep pullback towards the prior intra-day resistance at 1.2115 seems unlikely within the next 24hrs, but naturally I’d be open to buy there. Intra-day charts suggest 1.2272 may hold a weak test, so that could be an alternate place to get long on corrective price action leading into it.

Upside targets are 1.2390 and 1.2670 which is the role reversal level from 2004/2005.

Also in today’s trade setups commentary, we cover the EURUSD, NZDUSD, GOLD & DAX. Click here to become a member.