- USD/CAD surges as oil prices decline and US Dollar rises.

- Market anticipates less rate cuts in 2025 due to Trump’s return, impacting interest rate differentials.

- Potential US tariffs add headwinds for the Canadian Dollar.

USD/CAD has been on a tear since the back end of September, rising some 550 pips over the past 6 weeks. The move coincided with a stronger US Dollar and weaker Oil prices.

Oil Continues to Weigh on the Canadian Dollar

The Canadian Dollars struggles since the back end of September have coincided with a weaker Oil price. Oil prices have faced significant headwinds over the past few months as expectations around demand continue to be downgraded. Just yesterday OPEC announced its fourth consecutive downgrade to its demand forecasts, with China cited as the primary reason.

Interest Rate Differentials Coming Into Play?

The US Election is out of the way and with Donald Trump scheduled to return to the White House on January 20, 2025 markets are already pricing in less rate cuts in 2025. This has left the possibility of interest rate differential coming into play.

As things stand, markets are pricing in around 77 bps of cuts by the Fed and around 91 bps from the Bank of Canada. This leaves the Canadian Dollar in a vulnerable position as Trump is yet to take office. If President Elect Trump moves forward with tariffs and inflationary risks do rear their head, the rate differential could widen adding further headwinds for the Canadian Dollar.

On Tuesday, Neel Kashkari, the President of the Minneapolis Fed, said the central bank is still confident in fighting temporary inflation, but it’s too soon to say they’ve completely won. He also mentioned that the Fed won’t predict how Trump’s policies will affect the economy until they have more details about those policies.

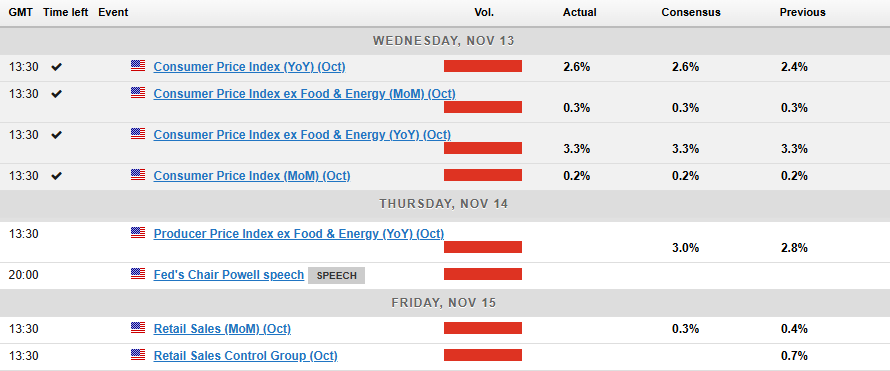

The calendar is quiet this week from Canada but today we just had US Inflation data which came out in line with forecasts. The impact was rather muted but it did firm up rate cut expectations for the Fed at the December meeting.

Technical Analysis

USD/CAD has been consolidating for the last two trading weeks in a 100 pip range between the 1.3850 and 1.3950 handles.

Historically USD/CAD tends to follow up periods of consolidation with significant swing moves in either direction. This means that USD/CAD could be poised for a significant breakout in the days ahead.

The 1.4000 handle remains elusive at this point and given that US Inflation barely moved the needle, the case for a retracement before a push toward the 1.4000 handle looks appealing. However, any pullback may be seen as an opportunity for would be bulls to get involved.

Immediate support rests at 1.3900 before the 1.3854 and 1.3793 come into focus.

Conversely, a break above recent highs at 1.3956 could finally open up a break of the psychological 1.4000 barrier with resistance resting around the 1.42500 handle.

USD/CAD Daily Chart, November 13, 2024

Source: TradingView

Support

- 1.3900

- 1.3854

- 1.3793

Resistance

- 1.3958

- 1.4000

- 1.4250

Most Read: Brent Oil Prices Steady Despite OPEC Demand Forecast Cut. Where to Next?