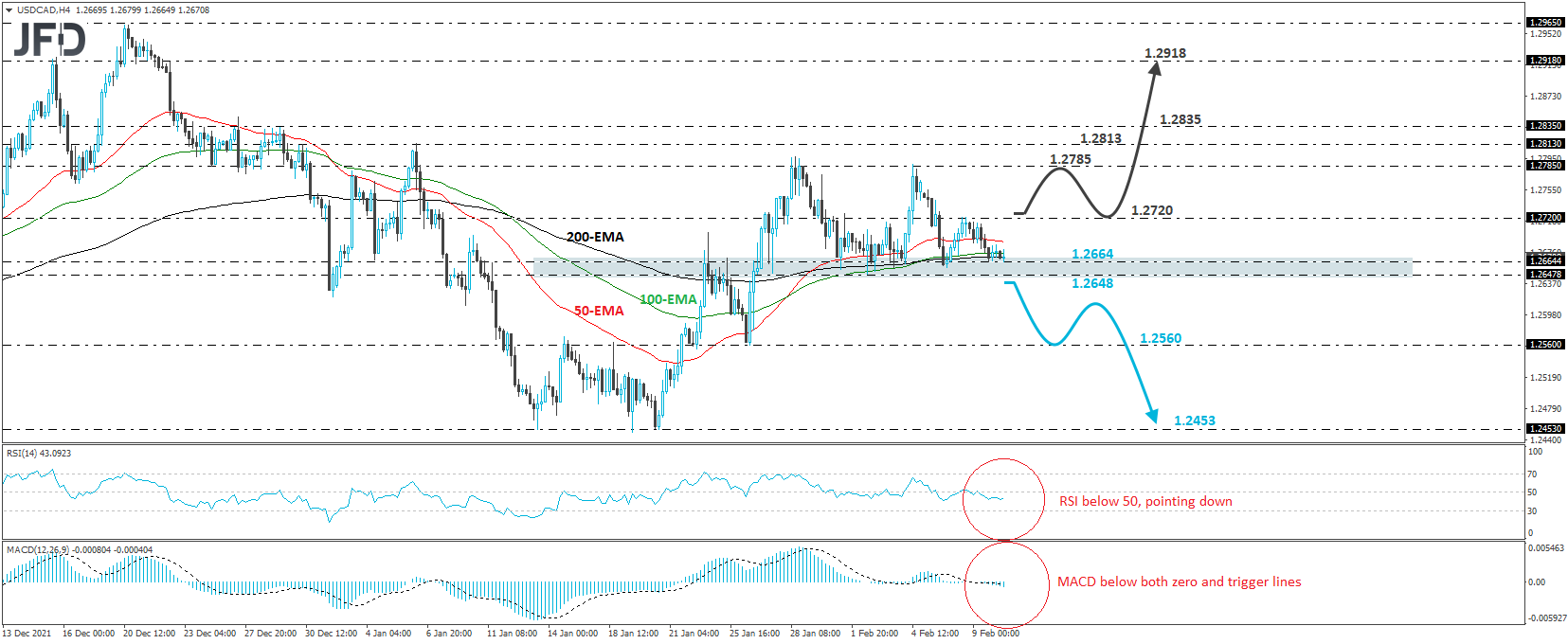

USD/CAD traded lower yesterday, hit support at 1.2665, and then traded in a consolidative manner slightly above it. Although the pair shows signs of a possible negative reversal, we prefer to wait for a break below 1.2648, the low of Feb. 2, before we get confident on that front.

Such a break will confirm a forthcoming lower low on both the 4-hour and daily charts and may see scope for declines towards the low on Jan. 26, at 1.2560. If the bears are unwilling to stop there, then a lower break could carry more bearish implications, perhaps setting the stage for extensions towards the 1.2453 zone, which provided support between Jan. 13 and 20.

Looking at our short-term oscillators, we see that the RSI lies below 50 and points down, while the MACD runs below both its zero and trigger lines. Both indicators detect downside speed and support the notion for further declines in this exchange rate.

We will abandon the bearish case if we see a clear rebound back above the 1.2720 zone, marked by the peak of Feb. 8. This will confirm a short-term higher high on the 4-hour chart and may initially pave the way towards the peak of Feb. 4, at 1.2785.

Slightly higher, we have the 1.2813 or 1.2835 zones, marked by the highs of Jan. 6 and Dec. 29, respectively, and if the bulls are not willing to stop there either, then we could see them climbing all the way to the 1.2918 territory, marked by an intraday swing high formed on Dec. 22.