- USD/CAD is on track to record its ninth consecutive daily gain. One more and it will be the longest since 2017

- The winning streak has seen price move towards known level, presenting an opportunity for fresh trade setups

- Canada’s September inflation report released Tuesday

Overview

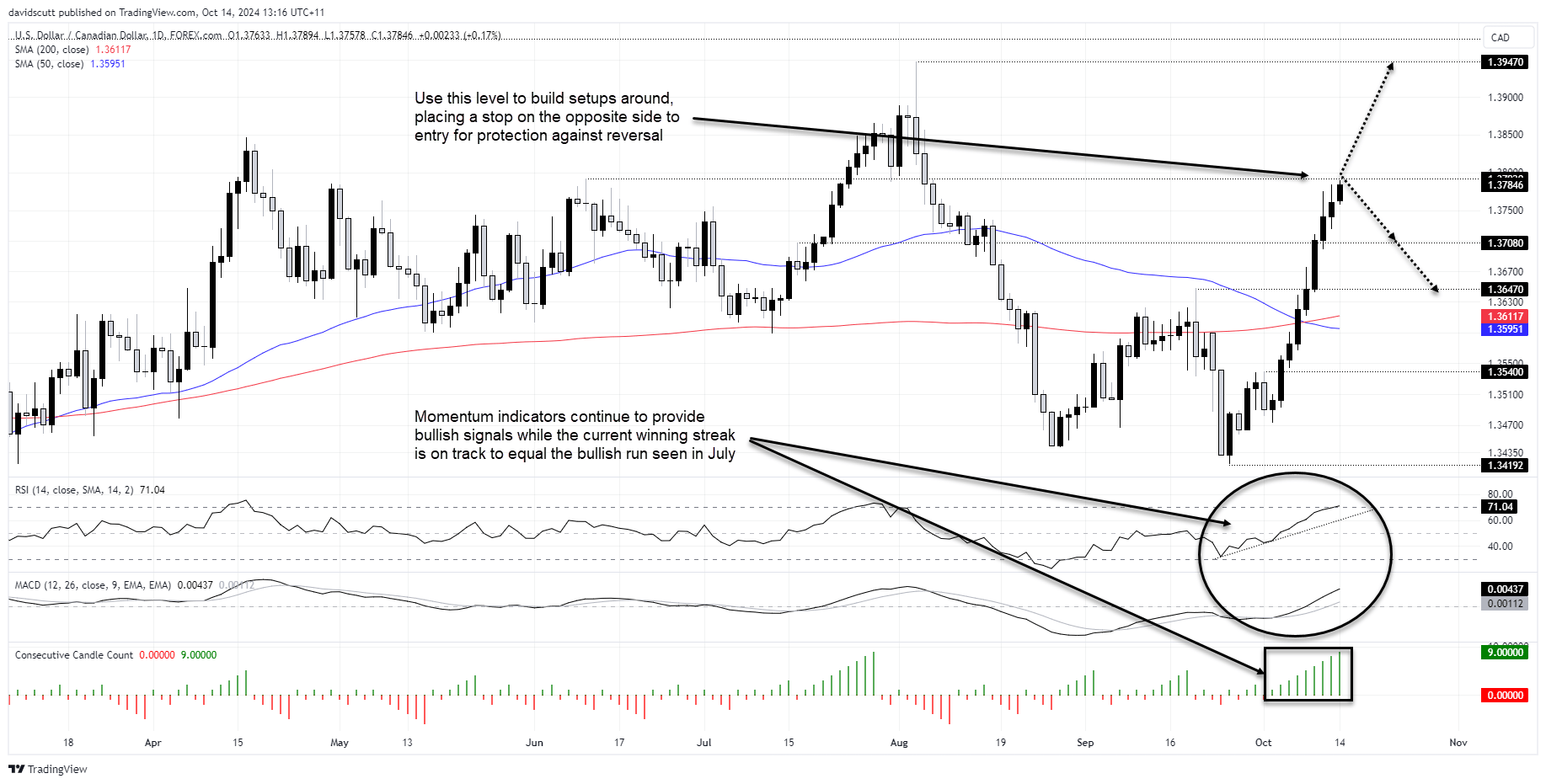

USD/CAD sits just below a known level heading into Tuesday’s Canadian inflation report, providing potential setups for bulls or bears depending on how the price action evolves. Considering the length of the winning streak heading into the event, an upside surprise may deliver the largest market impact.

USD/CAD Trade Ideas

1.3792 has acted as both support and resistance on multiple occasions earlier this year, making it a potential level to build setups around. Sitting less than 10 pips away, how the price interacts with the level before or after the inflation data should inform you on what setup to choose.

With RSI (14) and MACD providing bullish signals on momentum, the path of least resistance appears higher near-term. If we were to see the price break and hold above 1.3792, longs could be initiated with a stop below for protection. Possible targets include 1.3947 or 1.39777, two levels coinciding with former market peaks.

Alternatively, if the price were to be rejected at the level, you could sell with a stop above for protection. Potential targets include 1.3708, 1.3647 or 200-day moving average.

With nine consecutive bullish daily candles, equalling the run seen in July, it’s safe to assume near-term positioning in stretched in favour of US Dollar longs. Another bullish candle on Tuesday would make this the longest winning streak since 2017.

That suggests an upside surprise in the inflation report may deliver the greatest market impact, forcing some short CAD positions to be closed.

Canada Inflation Primer

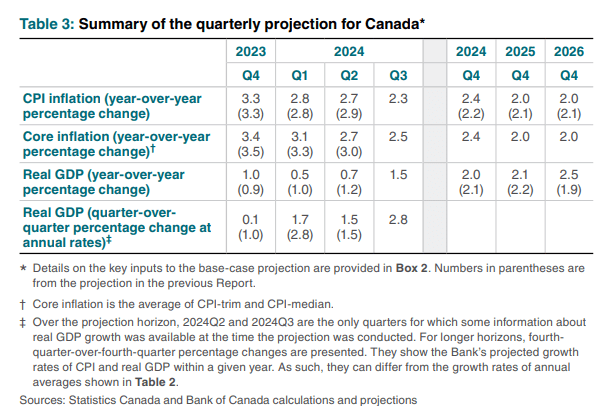

Heading into the inflation report, markets are looking for the trimmed mean and median inflation figures to hold at 2.4% and 2.3% respectively, above the 2% midpoint of the Bank of Canada’s (BoC) 1-3% target band but below the 2.5% pace the BoC forecast for core inflation in the September quarter. The trimmed and median readings are combined to produce the BoC’s core inflation measure.

Source: BoC

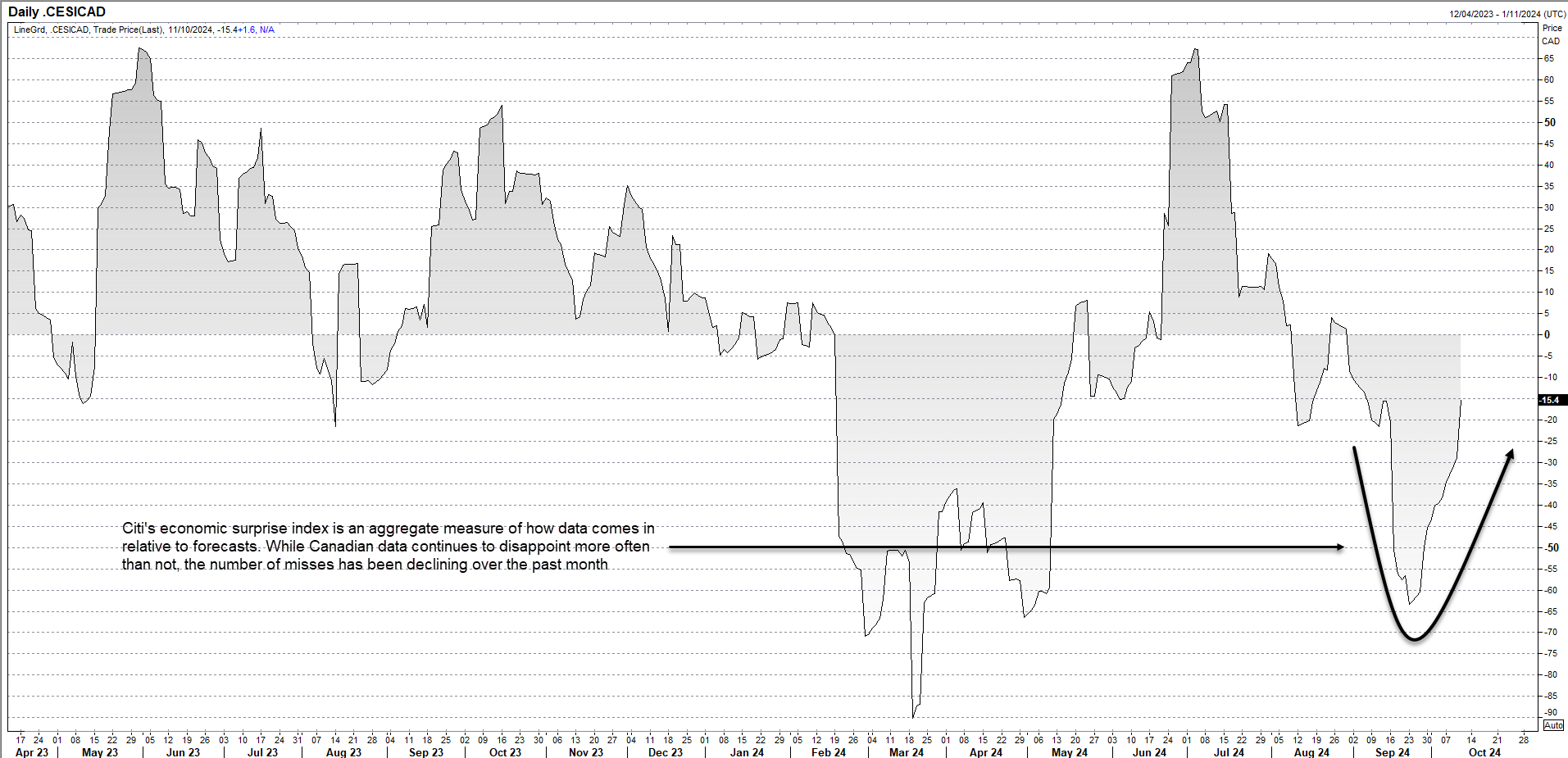

Outside of inflation, the Canadian economy is showing early signs of turning the corner with the number of negative economic data surprises lessening noticeably over the past month, according to Citi’s index.

That was seen on Friday when the Canadian unemployment rate fell unexpectedly in September, printing at 6.5% relative to forecasts for a further increase to 6.7%. At 46,700, the net change in employment nearly doubled expectations with 112,000 full-time roles filled during the month.

Source: Refinitiv

The Bank of Canada’s next monetary policy decision arrives on October 23. Tuesday’s inflation report may play a large role in determining whether it chooses to cut by 25 or 50 basis points at the meeting, adding to the 75 basis points worth of cuts already delivered.