- US inflation is showing signs of stalling as it approaches the Fed’s 2% target, while Canadian price pressures are already well within the BOC’s 1-3% target range.

- This makes a more compelling case for interest rate cuts north of the 49th parallel heading into today’s jobs report out of Canada.

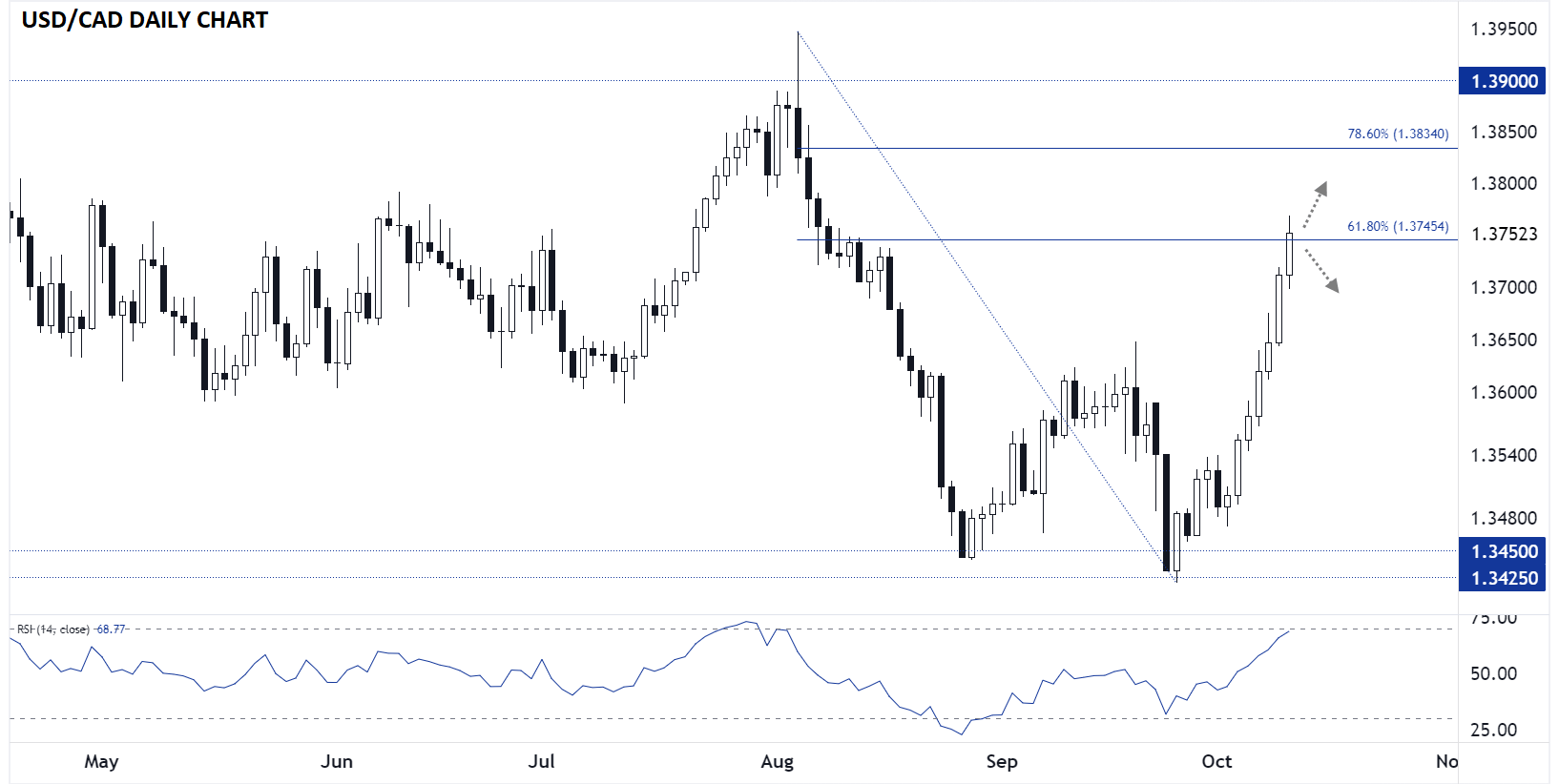

- USD/CAD is testing technical resistance near 1.3750 with an overbought RSI, raising the odds of a pullback ahead of the weekend if data cooperates.

What a difference a week makes.

Midway through last week, USD/CAD was trading near its lowest levels since February amidst the general weakness in the world’s reserve currency.

Now, the pair is working on its seventh consecutive “up” day, helped along by stronger-than-expected NFP and CPI reports out of the US.

In addition to being the most recently released reading, yesterday’s CPI report also underscores a notable divergence on from the two North American countries.

While it did fall on a headline basis, the US CPI report still came in above the Fed’s target at 2.4%, with Core CPI outright rising to 3.3% y/y. In contrast, last month’s Canadian CPI report missed expectations, falling to 2.0% y/y flat, with the more stable “Trimmed Mean” measure falling toward 2.4%.

To put it simply, whereas US inflation is showing signs of stalling as it approaches the Fed’s 2% target, Canadian price pressures are already well within the BOC’s 1-3% target range, making a more compelling case for interest rate cuts north of the 49th parallel.

To wit, markets are pricing in a 35% chance of a 50bps rate cut from the BOC later this month vs. an almost-assured 25bps rate cut from the Fed early next month.

Today morning, traders will see the latest jobs report out of Canada, with traders and economists expecting the country to add nearly 30K jobs and the unemployment rate to tick up to 6.7%.

After a relentless short-term rally in USD/CAD, any solid reading could be enough to drive USD/CAD lower ahead of the weekend, pending US PPI.

USD/CAD Technical Analysis – USD/CAD Daily Chart

Source: TradingView, StoneX

Looking at the daily chart above, USD/CAD’s big rally is testing the 61.8% Fibonacci retracement of the August-September selloff near 1.3750.

Meanwhile, the 14-day RSI indicator is approaching overbought territory, strengthening the case for potential profit-taking heading into the weekend if the fundamental data cooperates.

In that scenario, a retracement back below 1.3700 could be in the cards, while a weak jobs report could set the stage for a continuation toward the 78.6% Fibonacci retracement near 1.3830 next.