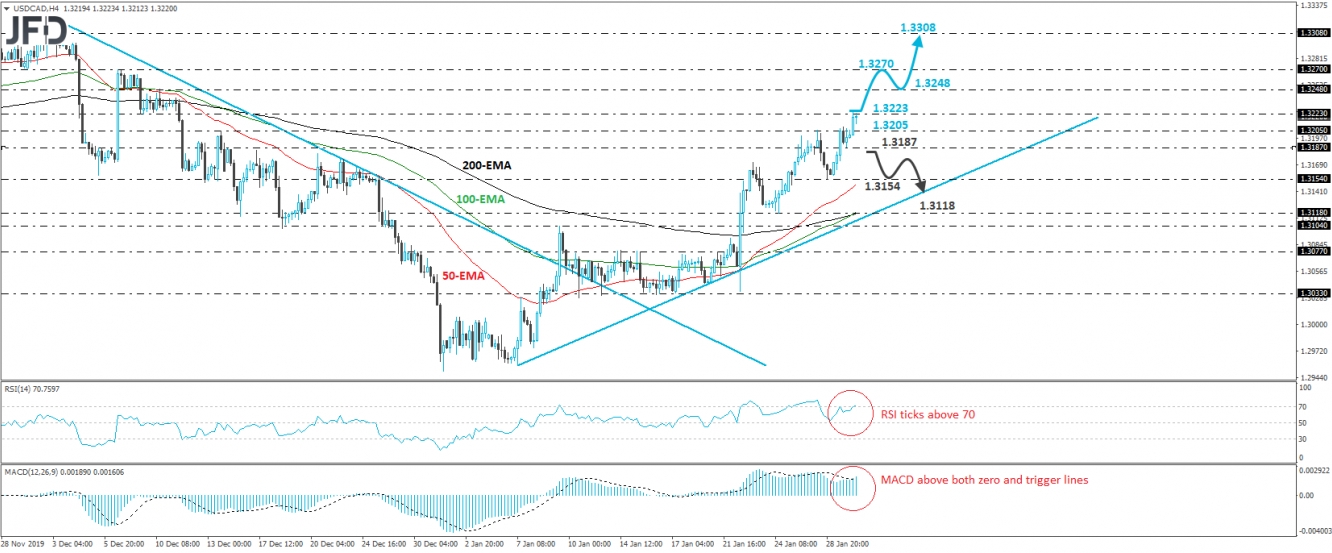

USD/CAD edged higher today, breaking above the key resistance (now turned into support) barrier of 1.3205, marked by Tuesday’s peak, as well as by the high of December 13th. Overall, the pair continues to print higher peaks and higher lows above an upside support line taken from the low of January 7th, while since January 22nd, it’s been trading above all three of our moving averages. In our view, all these signs point to a positive near-term outlook.

The rate is currently testing the 1.3223 zone, defined as a resistance by the inside swing lows of December 9th and 10th. If the bulls are willing to continue to parade and overcome that hurdle, then we may see them aiming for the 1.3248 zone, marked by the high of December 10th, or the 1.3270 obstacle, near the peak of December 6th. If they are not willing to stop there either, a move higher may set the stage for larger extensions, perhaps towards the 1.3308 area.

Taking a look at our short-term oscillators, we see that the RSI turned up and just poked its nose above its 70 line, while the MACD, already positive, has turned up again and crossed above its trigger line. Both indicators suggest accelerating upside speed and enhance the case for this exchange rate to continue sailing north for a while more.

Now, in case the bulls decide to take a small break and the rate falls below 1.3187, this may signal the initiation of a decent correction to the downside. Initially the rate may target the 1.3154 level, which is Tuesday’s low, where another break may allow a test near the aforementioned upside line. Nonetheless, the outlook would still be cautiously positive. In order to start examining whether the bears have gained the upper hand, we prefer to wait for a dip below 1.3104, marked by the inside swing high of January 9th.