BOC hold their second policy meeting of the year tomorrow, after having raised for the third time this cycle in January’s meeting. Yet whilst there has been speculation they may raise again in April or May, concerns surrounding NAFTA and Trump’s surprise steel and aluminium tariffs could outweigh any optimism in tomorrow’s meeting.

Markets are currently pricing in a 34% chance of an April hike, and 53% in May. And with an expectation of only 11.9% for a hike tomorrow, the purpose of tomorrow’s meeting to traders is to help decipher clues for tightening on subsequent meetings.

Following January’s meeting, BOC governor Stephen Poloz outlined 3 issues concerning any future hikes:

- How much slack remains in the economy?

- How the evolution of capacity pressures will affect the outlook for inflation?

- How best to account for the uncertainty surrounding the renegotiation of NAFTA in our policy decisions?

Whilst central banks assume to be able to control the first two points (to a degree), the final point is completely out of their hands. So it begs the question as to whether BOC would want to appear too hawkish tomorrow anyway, given the world is yet to hear details over Trump’s tariffs. Of course, it is possible Trump is using his tariffs as a bargaining chip for NAFTA, but it remains a threat none the less which could see tomorrow’s statement littered with risks surrounding NAFTA and trade wars.

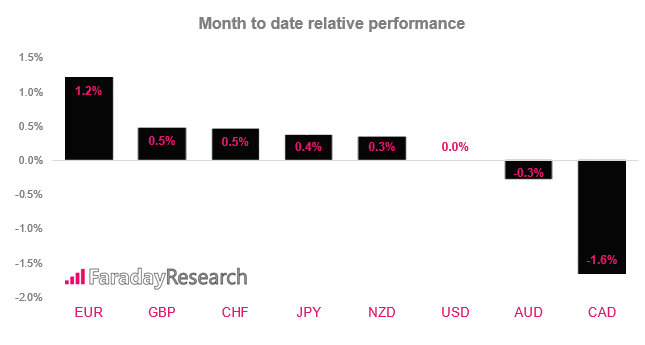

Markets were quick to toss Canadian dollars overboard at the announcement of Trump’s latest tariffs and remains the weakest performer this month. This fresh round of selling has allowed USD/CAD to break to new highs with venom and underscore CAD weakness (as USD has struggled to gain traction elsewhere). And if BOC are to err on the side of NAFTA caution, there’s potential for this move to continue higher.

As we mentioned in Friday’s analysis, we were seeking opportunities for CAD to retrace before assuming a break to new highs. Yet, thanks to Trump’s threat of trade war, USD/CAD didn’t stop to look back as it broke decisively above December’s high of 1.2919.

The bullish daily structure has presented prominent swing lows and its bullish momentum has increased as the trend has developed. With no clear sign of price exhaustion we continue to seek a suitable entry, whilst trying to avoid jumping into an over-extended move. Whilst the trend structure points to new highs, we see two immediate signs that price could become over-extended over the near-term.

RSI is now overbought and today marks its fifth session above the upper Keltner band. Moreover, the low and high of yesterday’s bullish range expansion is above the Keltner band. And whilst the daily close confirmation above December’s high is constructively bullish, we’d prefer volatility to subside a little before considering a long entry.

As broken resistance can become support, a low volatility retracement above 1.2919 may provide such an opportunity. If we are to see a deeper retracement then it doesn’t necessarily negate the bullish trend (as this would require a break beneath the 1.2615 swing low). But as long as momentum doesn’t turn outright bearish from the highs, we’d still keep a close eye on USD/CAD for a suitable long entry when support had been found.