- USDCAD constrained within a range as US & Canadian jobs data awaited at 12:30 GMT

- Bulls need a rally above 1.3775; bears could take control below 1.3578

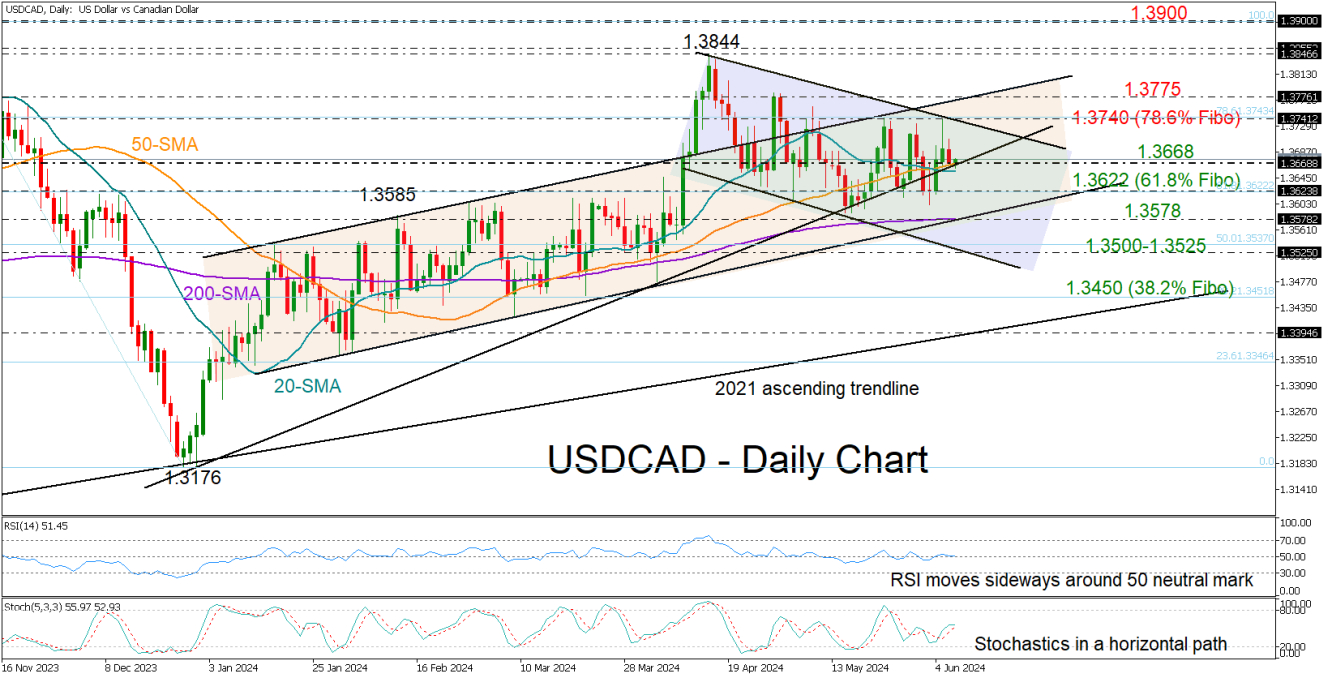

USDCAD has been swinging sideways over the past two weeks between 1.3740 and 1.3600, unable to reverse the short-term downtrend from April’s peak of 1.3844.

The technical signals are currently uncertain, lacking a clear indication as the RSI continues to hover near its neutral mark of 50 and the stochastic oscillator maintains a flat trajectory.

Perhaps a close above the 50-day simple moving average (SMA) at 1.3668 could help the price climb towards the upper band of the range at 1.3740 and probably touch the key resistance line at 1.3775. Note that the 78.6% Fibonacci retracement of the November-December 2023 downleg is within this neighborhood. Further up, the pair could confront the top of 1.3844 and aim for the 1.3900 psychological mark, a break of which would open the door for the 2022 peak of 1.3976.

In the event that downside pressures resurface, initial support could develop around the 61.8% Fibonacci of 1.3622. A move lower and beneath 1.3600 could immediately stall near the 200-day SMA and the crucial support trendline at 1.3578. If the bears claim the latter too, the decline could stretch towards the falling line at 1.3525. Additional losses from there could aggressively squeeze the price towards the 38.2% Fibonacci of 1.3450.

To sum up, the short-term outlook for USDCAD remains neutral. The market could be influenced if it moves sustainably above 1.3775 or below 1.3578.