- USD/CAD marks new higher high after disappointing ISM manufacturing PMI

- A close above 1.3880-1.3900 is needed to postpone profit-taking

- US nonfarm payrolls eagerly awaited at 12:30 GMT

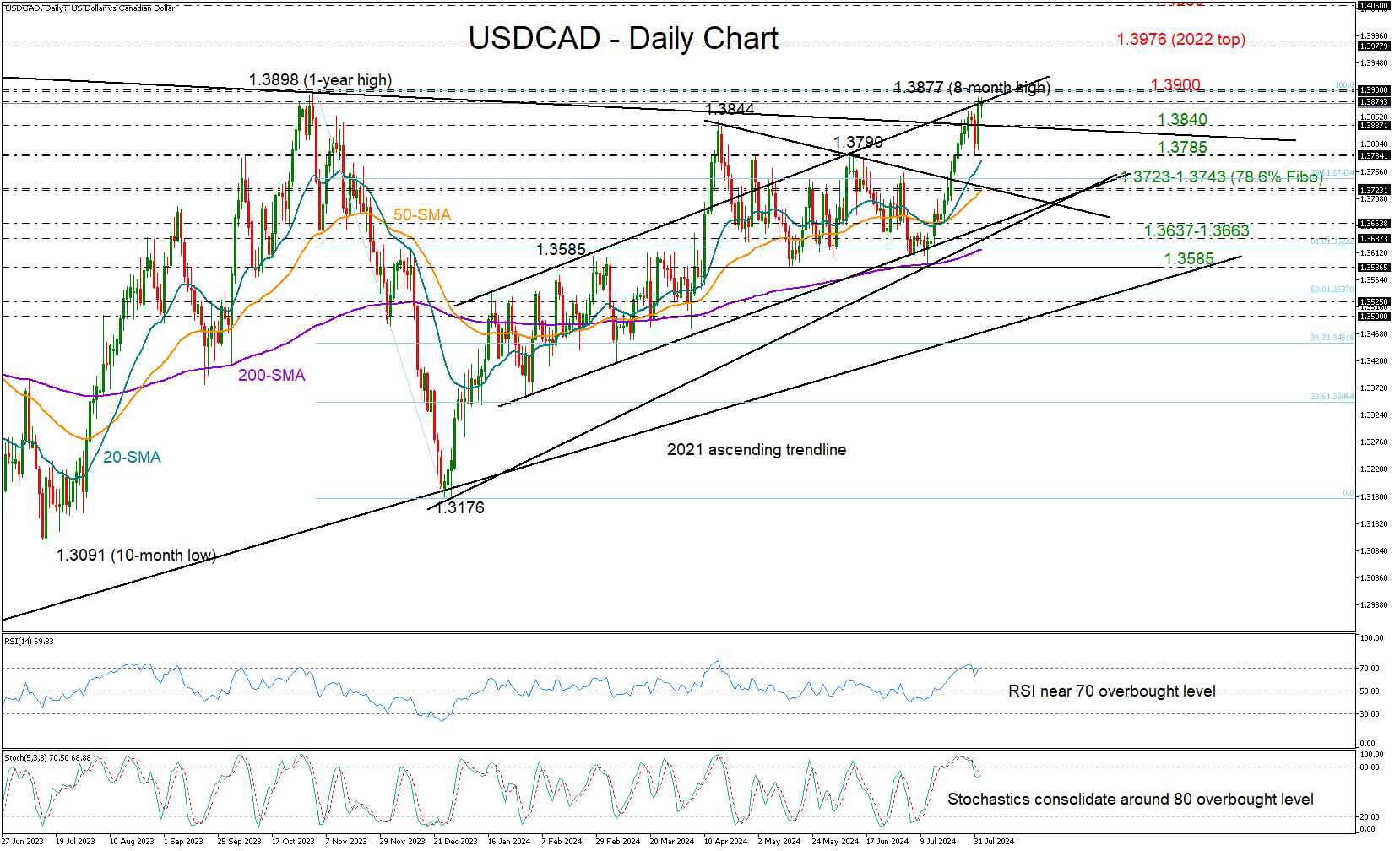

USD/CAD began the month on a positive note, swiftly recovering from its recent setback and reaching an eight-month high of 1.3877, slightly above April’s peak of 1.3844.

The pair has been in a bull run since bottoming twice near May’s floor of 1.3588 and around the 200-day exponential moving average (EMA) on July 11, but the recent comeback was not powerful enough to achieve a close above January’s resistance line yesterday.

Given the weakening momentum in the RSI and the stochastic oscillator, which are close to overbought levels, traders might exercise some caution.

On the downside, the falling line, which connects the 2022 and 2023 highs, might provide some footing near 1.3840 ahead of the 1.3785 handle, where the 20-day EMA is converging.

A move below the latter could dampen sentiment once the bears cross below the 1.3723-1.3743 constraining territory, which includes the 50-day EMA, and the broken resistance line from April’s peak.

Should the bears dominate there, the decline could next stabilize within the 1.3637-1.3663 trendline territory. Note that the 200-day EMA is approaching that region too.

Alternatively, if the bulls successfully close above 1.3880, surpassing the 1

Breaching that wall and rallying beyond the 1.4000 round level, where the 161.8% Fibonacci extension of April’s downfall is placed, the price could next challenge the 1.4050 region taken from May 2020.

Overall, if the price fails to rise above 1.3880-1.3900, traders could begin to think about profit-taking as the USD/CAD chart keeps trading near a constraining zone after a green wave.