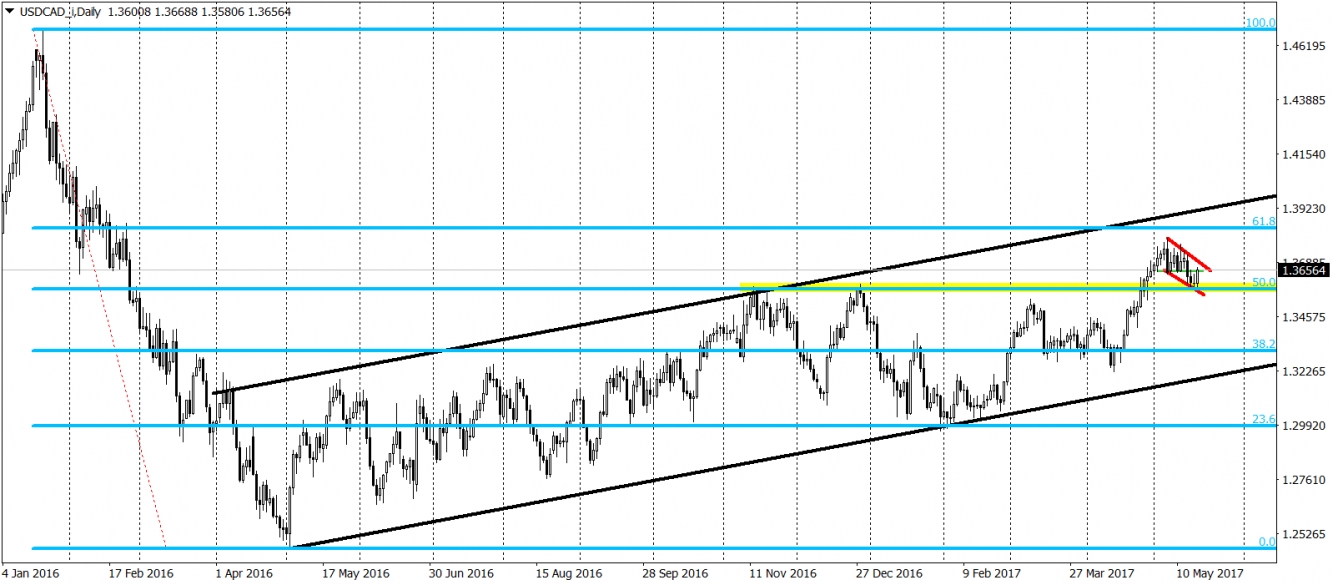

Nice setup is emerging on the USD/CAD. It is not ready yet (if you are patient and waiting for a confirmation) but should be available for trading soon. What we have in mind is a buy signal, which should emerge after the price will break the upper line of the flag. But let us describe this situation in a grater detail below.

Up trend started in May 2016 and since that, the price created a nice channel up formation (black). The price is making higher highs and lows and recently broke a very important resistance on the 1.358 (yellow). It is now being used a support, which additionally helps our bullish view. As we mentioned earlier, our optimism is also driven by the flag (red). This is a trend continuation pattern and there are high chances that we will break its upper line.

Some traders can say that we do not have a channel up formation here but a flag (correction) of a stronger downswing that happened at the first half of the 2016 (which would be negative). Ok, fair enough, even if so, we still do have enough space to reach the upper black line, which still makes it a nice buying opportunity.

So what's next? Patient traders wait for the breakout, others can obviously risk now. Our view can be disrupted by more jawboning from the OPEC, which can lift the Oil prices higher in the same time strengthening commodities currencies like the CAD.