Stocks are coming down at the start of the European sessions due to geopolitical uncertainties over Ukraine. We see USD moving higher at the same time. Even crude oil has slowed down, which can be bullish for the buck as well.

We see energy in a potential higher degree irregular/flat correction as structure from $87.56 can be in three waves. An overlap with $90.73 would indicate that energy will stay sideways for a flat. Nice support should then be at $87.56. If crude would come south, then USD/CAD can see more upside ahead.

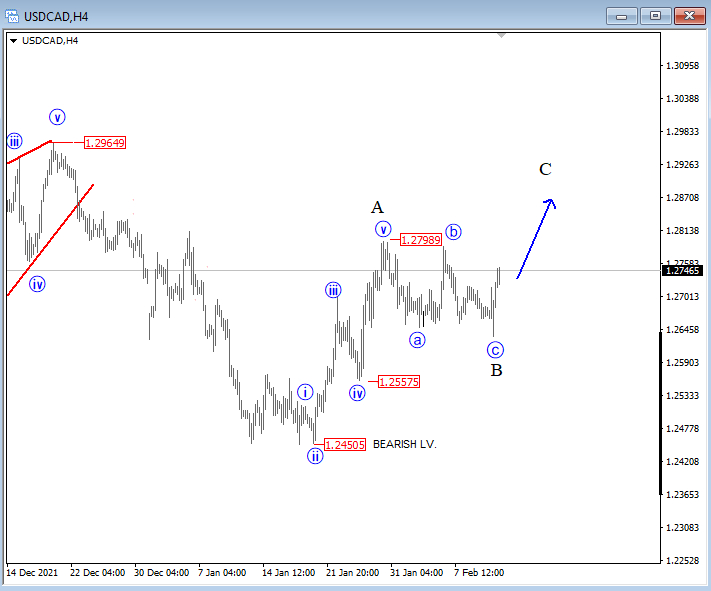

USD/CAD made five waves up from 1.2450 to 1.2800 as shown on the 4-hour chart, followed by a three-wave pullback that we see as wave B, so we think that recovery is incomplete, and that third leg up can be coming towards 1.2850/1.29 area in the short-term.