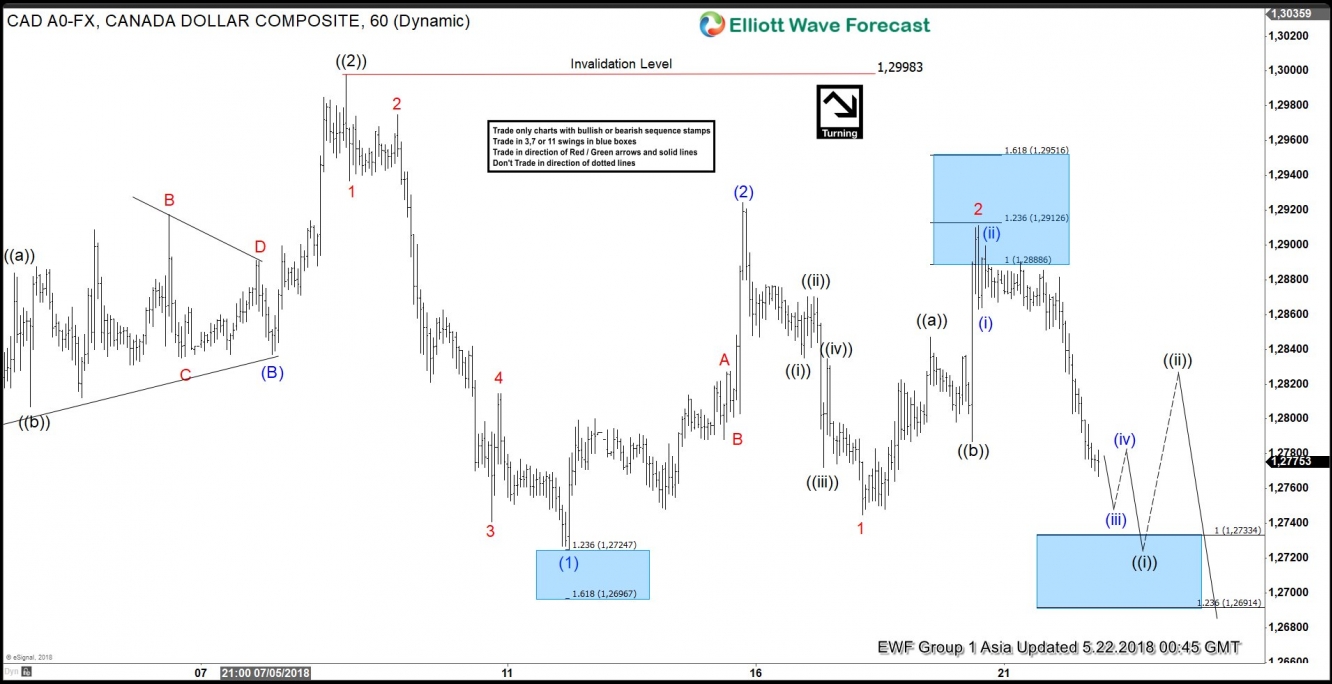

USD/CAD short-term Elliott Wave view suggests that the bounce to 1.2998 on 5/08 high ended primary wave ((2)). Below from there, primary wave ((3)) remains in progress as an Impulse Elliott Wave structure looking for more downside extension. In Impulse wave, the subdivision of wave 1, 3, and 5 is also an impulse structure of a lesser degree. On the other hand, wave 2 & 4 are corrective in nature i.e. double, triple three, Flat etc. In the case of USD/CAD, intermediate wave 1, 3 and 5 are impulse with sub-division of 1, 2, 3, 4 and 5 in Minor degree.

Down from 1.2998 high, the pair ended intermediate wave (1) in 5 waves at 1.2725 low. Then the bounce to 1.2924 high ended intermediate wave (2) as zigzag and the correction against 5/08 high (1.2998). Below from there, Intermediate wave (3) of ((3)) is in progress looking for more downside extension as an impulse. Minor degree wave 1 of (3) ended in 5 waves at 1.2745 low and the bounce to 1.2911 high ended Minor wave 2 of (3) as a zigzag correction. Near-term focus remains towards 1.2733-1.2691, 100%-123.6% Fibonacci extension area of wave 1 and 2, to end the Minute degree wave ((i)) of 3 lower. Afterwards, the pair should bounce in Minute wave ((ii)) to correct the cycle from 1.2911 high before further decline resumes. We don’t like buying the proposed bounces.

USD/CAD 1 Hour Elliott Wave Chart