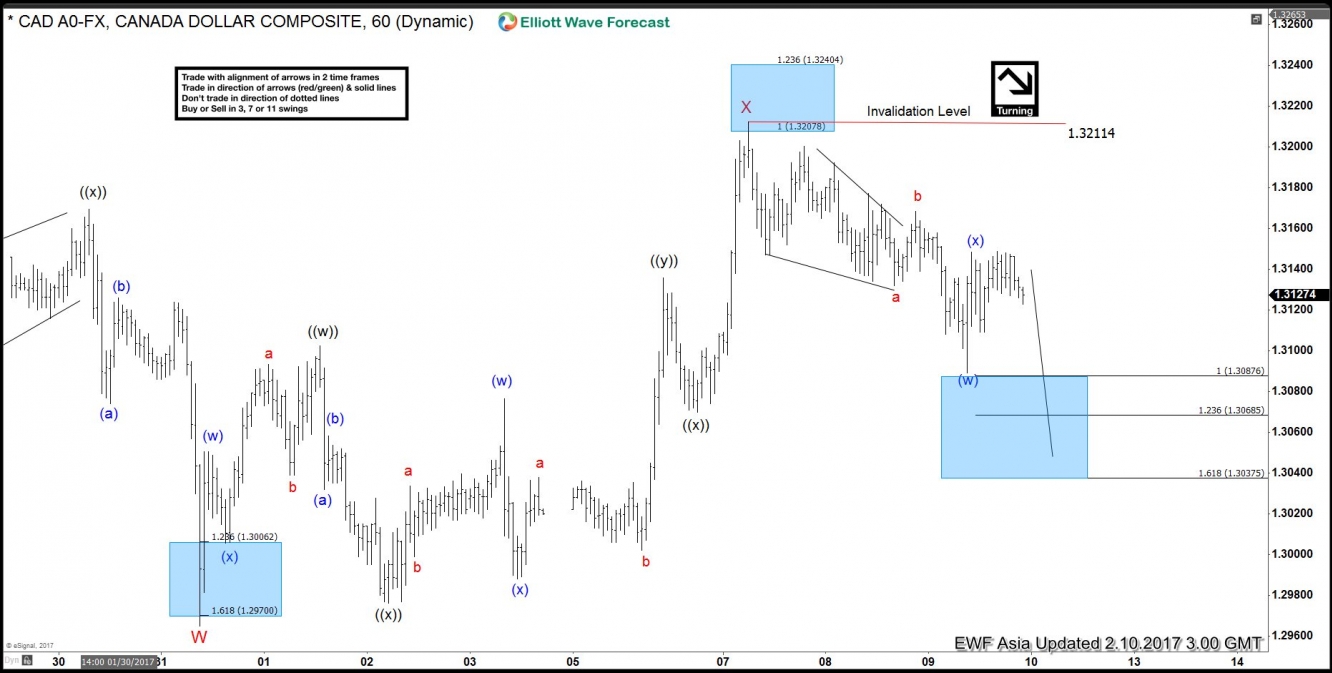

Preferred Elliott wave view in USD/CAD suggests that the pair is showing a 5 swing bearish sequence from 12/28 high, favoring more downside. Short term, decline to 1.2965 ended Minor wave W and Minor wave X bounce is proposed complete as a triple three structure where Minute wave ((w)) ended at 1.3102, and Minute wave ((x)) ended at 1.2976. Minute wave ((y)) ended at 1.3135, Minute second wave ((x)) ended at 1.307, and Minute wave ((z)) of X ended at 1.3212. The rally to 1.3212 ended cycle from 1/31 low (1.2965) and pair has since turned lower.

The decline from 1.3212 high is unfolding as a double three Elliott wave structure where wave (w) ended at 1.3089 and wave (x) is proposed complete at 1.3148. A break below (w) at 1.3089 is need to add validity that wave (x) is already over at 1.3148. Until then, a double correction in wave (x) towards 1.317 – 1.318 area can’t be ruled out.

Near term, while bounces stay below 1.3211, and more importantly below 1.3388, expect pair to resume lower. We don’t like buying the pair and provided that pivot at 1/20 high (1.3388) stays intact, we expect pair to resume lower or at least pullback in larger degree to correct the cycle from 1/31 low (1.2965). If pair breaks below 1.3089, then the next target lower is 1.30 – 1.3027 area.

USD/CAD 1 Hour chart