- USD/CAD exits from the consolidation area

- Momentum oscillators indicate bearish correction

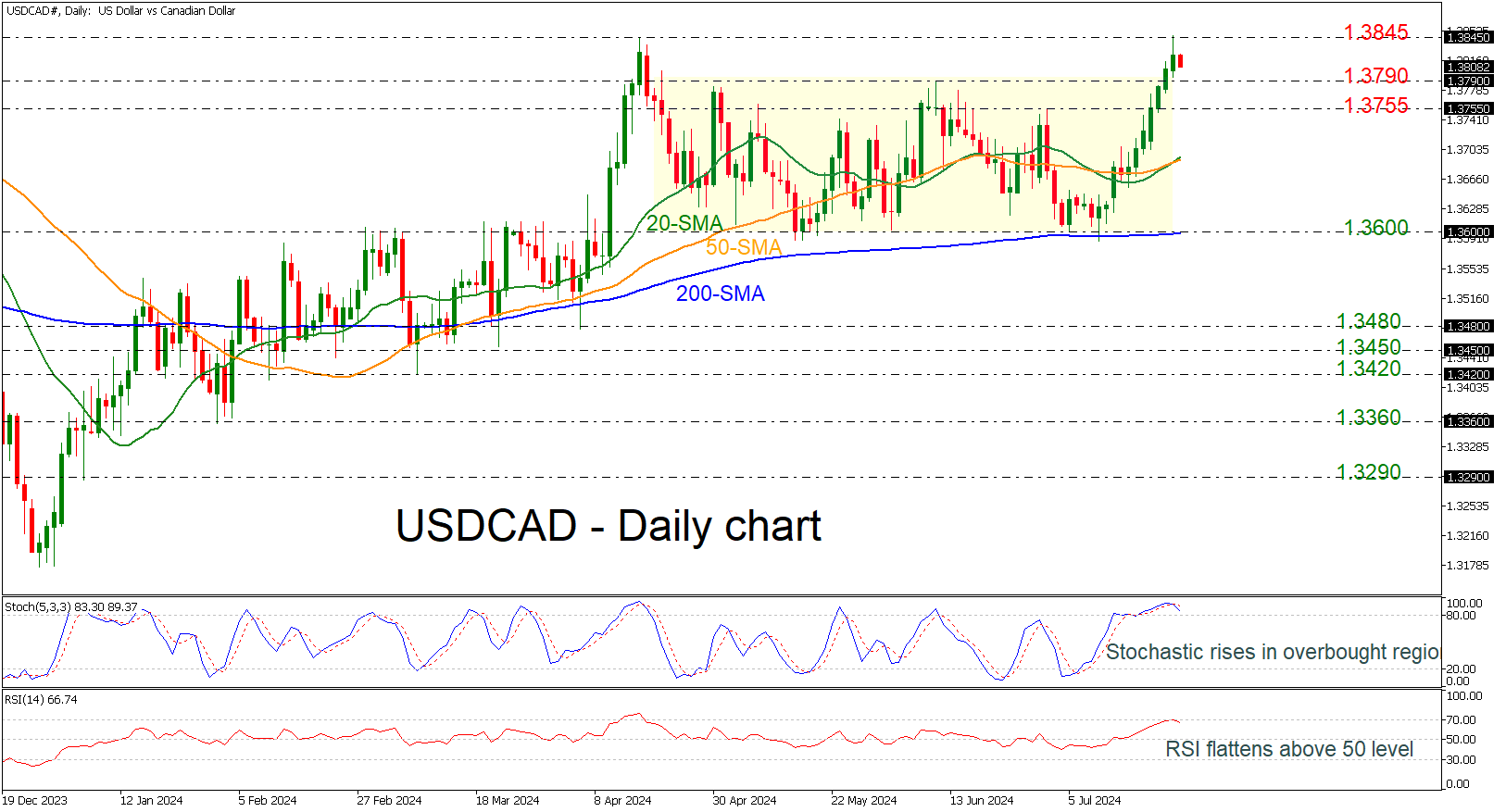

USD/CAD rallied towards the 1.3845 high and completed the seventh consecutive green day on Thursday following the bounce off the 200-day simple moving average (SMA) near 1.3600. The pair climbed above the medium-term trading range, suggesting more gains may be on the cards.

However, the technical oscillators indicate an overstretched market. In the overbought region, the stochastic posted a bearish crossover within its %K and %D lines, while the RSI is pointing downwards beneath the 70 level.

A potential downside retracement could drive traders towards the immediate support of 1.3790, ahead of 1.3755. Below these levels, the bullish crossover within the 20- and 50-day SMAs around 1.3700 may halt steeper decreases.

On the other hand, a successful rise above 1.3845 could meet resistance at 1.3900, taken from the peak in October 2023. Further advances may push the price until 1.3975, achieved in October 2022.

To summarize, USD/CAD posted an impressive bullish move, but the momentum oscillators show that a negative correction may be the next possible scenario.