BOC Meeting and USD/CAD Key Takeaways

- The Bank of Canada cut interest rates by 50bps to 3.25%, as expected.

- BOC Governor Macklem is delivering an incrementally more hawkish speech, hinting at a potential pause in the rate-cutting cycle depending on how growth and inflation evolve.

- USD/CAD fell back toward key horizontal support near 141.00 in the initial reaction.

BOC Interest Rate Decision

The Bank of Canada cut interest rates by 50bps to 3.25%, as expected. This is the second consecutive 50bps rate cut from the central bank.

BOC Monetary Policy Statement

In its final monetary policy statement of the year, the central bank explained its reasoning for delivering the expected 50bps rate cut and highlighted the potential policy uncertainty around trade and immigration as US President Trump prepares to take office for his second term:

- Donald Trump’s threat to impose 25% tariffs on Canadian exports to the US has “increased uncertainty and clouded the economic outlook

- Lower immigration targets mean GDP growth next year will likely be weaker than forecast in October.

- Inflation impacts will likely be muted as lower immigration reduces both demand and supply.

BOC Governor Macklem’s Press Conference

BOC Governor Macklem is delivering an incrementally more hawkish speech as we go to press. Highlights follow:

- Our policy focus now is to keep inflation close to target.

- Monetary policy no longer needs to be clearly in restrictive territory

- The growth outlook now appears softer than we projected in October

- We will be looking at measures of core inflation to help us assess the trend in CPI inflation.

- The economic outlook is clouded by the possibility of new tariffs on Canadian exports to the United States.

- We want to see growth pick up to absorb the unused capacity in the economy and keep inflation dose to 2%.

- Going forward, we will be evaluating the need for further reductions in the policy rate one decision at a time.

- In other words, with the policy rate now substantially lower, we anticipate a more gradual approach to monetary policy if the economy evolves broadly as expected.

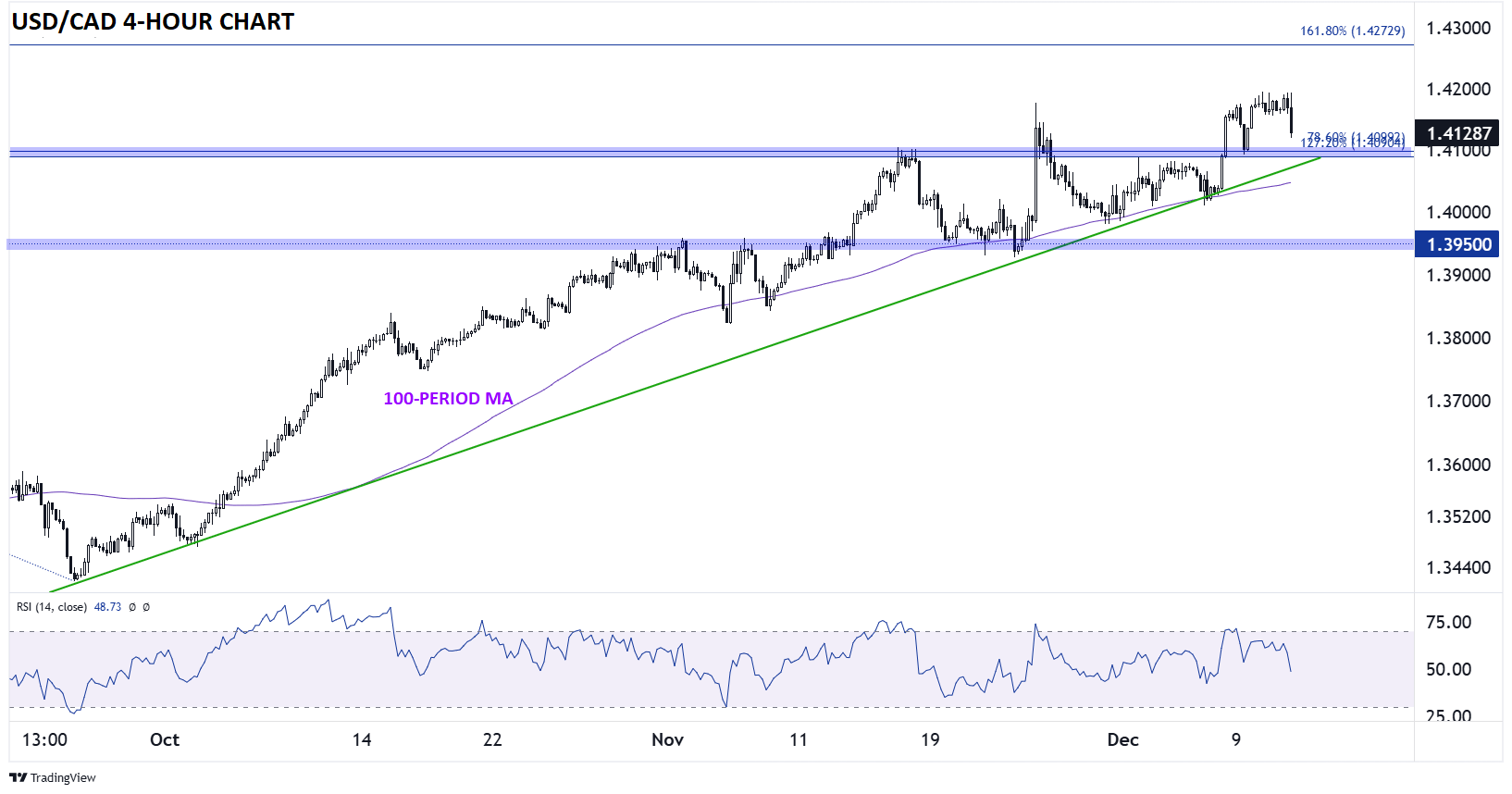

US Dollar Technical Analysis – USD/CAD Daily Chart

Source: TradingView, StoneX

Turning out attention to the Loonie, USD/CAD (the Canadian dollar strengthened) on the more balanced outlook toward further interest rate cuts next year. From a technical perspective, the North American pair’s multi-month uptrend remains broadly intact as long as price remain above key confluent Fibonacci levels and rising trend line support in the 1.4100 area, so readers may want to look for a bounce off that zone if rates fall much further. Only a conclusive break below 1.4100 would erase the near-term bullish bias and open the door for a continuation toward 1.3950.