- Traders are betting that the BOC will have to end it’s “conditional pause” with a rate hike after a solid CPI report earlier this week.

- USD/CAD is consolidating in the middle of a longer-term symmetrical triangle pattern near 1.3500.

- There are possible short-term opportunities to trade within the triangle, whereas longer-term traders may prefer to wait for a breakout to signal the next major trend in USD/CAD.

USD/CAD fundamental analysis

Earlier this week, Canada reported its CPI figures for April, and the headline reading was well above expectations at 0.7% m/m (vs. 0.5% eyed). It raised the year-over-year rate of inflation to 4.4%, the first increase in that measure since last June.

As close followers of the loonie know, the Bank of Canada declared a “conditional pause” to its rate hike cycle in January. Much like with the hint of a pause offered by Federal Reserve Chairman Powell earlier this month, traders assumed that the BOC had reached its peak rate for this cycle and that the central bank’s next move would be to cut interest rates.

At least for Canada, those expectations may have been misplaced.

On the back of this week’s CPI figures and the generally better-than-expected economic data out of Canada, we’ve seen a dramatic repricing in the market’s expectations for Canada’s interest rates. In just the past couple of weeks, futures traders have gone from pricing in at least one rate cut by the end of the year to nearly fully discounting another rate hike by the end of the third quarter; more immediately, traders are now pricing in a roughly 30% chance of a rate hike at the next BOC meeting in early June.

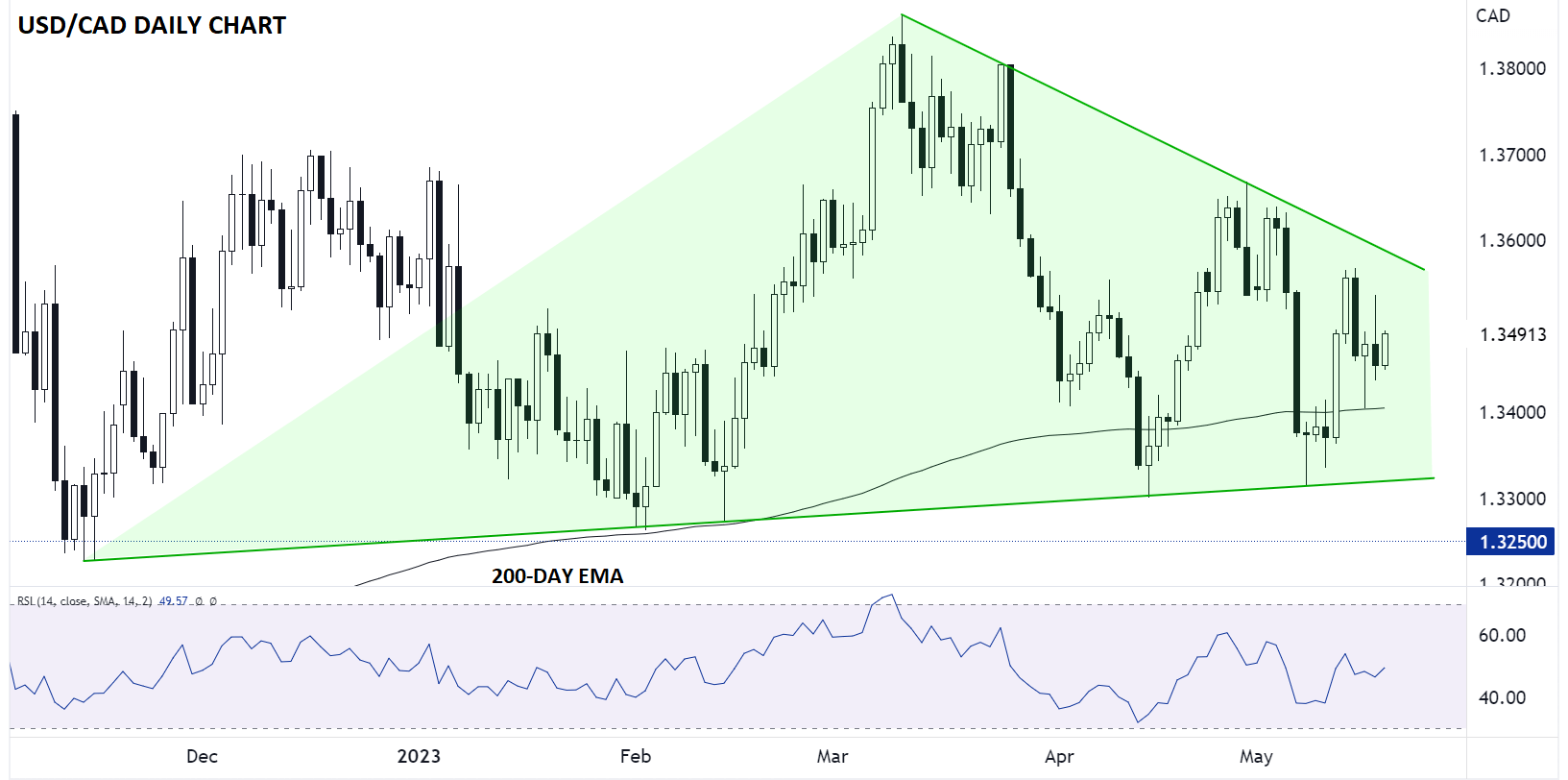

Canadian dollar technical analysis – USD/CAD daily chart

The US dollar is hitting multi-month highs against several of its rivals this morning, including the euro and Japanese yen, but its price action against its Northern neighbor is far more subdued. In essence, traders have been coming to the same conclusion about both North American economies: Aggressive interest rate cuts this year are less likely, and indeed the interest rate hiking cycle may not be done yet.

From a technical perspective, USD/CAD has been putting in higher lows and lower highs since mid-March, creating a symmetrical triangle pattern on the daily chart. For the uninitiated, this pattern is analogous to a person compressing a coiled spring: as the range continues to contract, energy builds up within the spring. When one of the pressure points is eventually removed, the spring will explode in that direction.

Source: Tradingview, StoneX

It’s notoriously difficult to predict the direction of a symmetrical triangle breakout in advance, especially in a market that hasn’t had a clear trend prior to the pattern, so longer-term traders may want to wait for a confirmed breakout to signal the next major trend in the North American pair. More immediately, with USD/CAD trading near the middle of this week’s range around 1.3500, short-term traders could consider quick trades within the symmetrical triangle pattern if rates rally up to resistance in the mid-1.3500s or down to support in the low-1.3300s.