- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

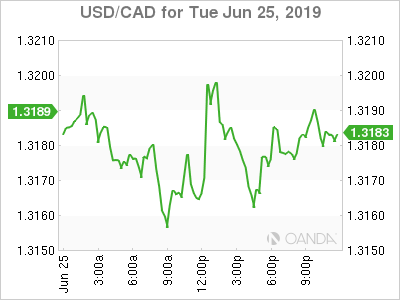

USD/CAD Canadian Dollar Rises On Strong Economic Indicators

The Canadian dollar is higher against the US dollar on Tuesday. It rose slightly 0.11 percent versus the greenback with the price of oil also subdued and the gold rally fuelled by comments from a Trump administration official commenting that there will no broad trade agreement announced at the G20 after the meeting with Trump and Xi.

Canadian wholesales sales surprised to the upside with a monthly gain of 1.7 percent smashing the forecast of 0.2 percent. Economic data has been solid and adds to the narrative of the Bank of Canada (BoC) keeping the benchmark rate at 1.75 percent.

US data reinforced calls for an interest rate cut sooner rather than later. Manufacturing, consumer confidence and new home sales all disappointed on Tuesday morning. The dovish case for the economy put the dollar under pressure early, but in a surprise turn of events, it was the comments from Fed Chair Powell that turned the currency around.

The Fed chief was less dovish than a week earlier and known dove St Louis Fed President James Bullard, who was the lone dissenter voting for a rate cut in June, said a 50 basis point cut was not warranted.

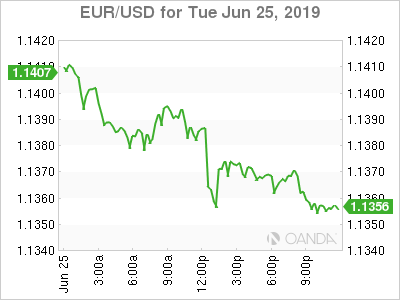

The US dollar is mixed against major pairs on Tuesday. The greenback has depreciated against the NZD, the JPY and the CAD, but has risen against European pairs. The economic calendar for Wednesday is busy for dollar traders with durable goods, wholesale inventories and the weekly crude stock report.

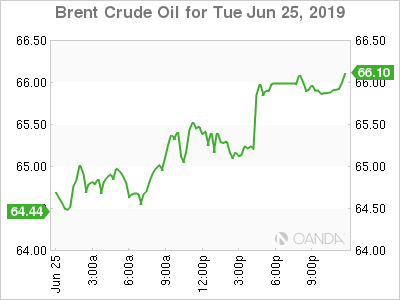

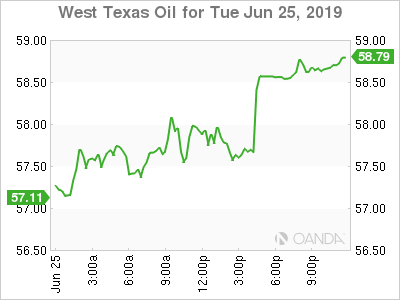

OIL – Crude Mixed Awaiting EIA Weekly Report

Oil prices were mixed on Tuesday with Brent gaining 0.32 percent and West Texas Intermediate falling 0.07 percent. Tension in the Middle East remains high after Iran countered the US sanctions with a threat to close diplomatic relations, but traders were content to take profit as escalation was not on the agenda.

Supply will continue undisturbed unless there is another incident and the upcoming US weekly crude inventory report by the Energy Information Administration (EIA) will provide more insights into the state of global output.

Supply disruptions have added price stability, in particular, the production cut agreement by the OPEC+, but as doubts rise on what the fate of the G20 meetings will have on global growth and energy demand, the deal could not get an extension. It makes sense for major producers, Russia being the most vocal, to delay their decision until they get a sense which way the US-China trade war will unfold.

The API report posted a 7.5 million barrel drawdown and is making a strong case for a larger than expected shortfall in US inventories. The forecasts for the EIA before the API release were for a drawdown of 2.7 million barrels, following a fall of 3.1 million barrels the previous week.

Supply disruptions and lower inventories would push crude prices higher as Middle East tensions remain high, and with trade optimism at a level where at least trade relations could not get worse after a Trump-Xi meeting.

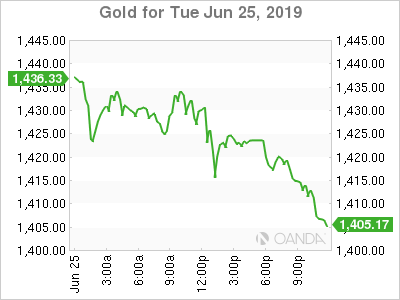

GOLD – Safe Haven Rally Keeps Gold Higher

Gold rose 0.62 percent on Tuesday as the metal is the clear safe haven play in the market. Middle Eastern tensions will continue to remain high as Iran and the US do not seem ready to back down and have in fact escalated their verbal attacks. The G20 is looking to be a disappointment to investors looking for a blockbuster trade deal to be announced and is now probably expected to yield a new round of talks between the US and China to be held later this year.

The gold rally did suffer one setback, as two prominent Fed members, Chair Powell and FOMC voting member and known dove Bullard were less dovish than a week ago. A 50 basis point rate cut is off the table as per Bullard next meeting but the sense that there is no urgency from the Fed was not lost on the market.

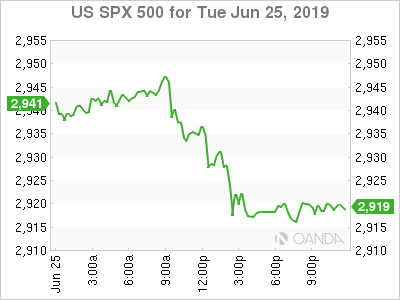

STOCKS – Fed Loses Sense of Urgency in Rate Cut, Equities Lose Momentum

Equities lost momentum on Tuesday as Middle Eastern tensions, trade anxiety and a less dovish Fed did not combined to reassure investors. The Trump administration is trying to downplay expectations of a significant outcome of the upcoming meeting between Presidents Trump and Xi in Japan. The two leaders will meet at a sidebar of their G20 commitments and given the huge distance in their negotiating positions there is now little probability of a major announcement on trade.

The Fed chair and the most prominent dove in the FOMC were less dovish than two weeks ago. Chair Powell stressed the negative impact trade disputes have on economic growth, but he continues to be hawkish on the American economy despite the latest indicators showing some softness. Powell remarked that even the tariffs have not put a lot of pressure, but its important to manage investor sentiment.

Given the G20 meeting is likely not to produce an agreement, but at least the two nations are back on the table, Powell could feel secure in calling current headwinds temporary.

Related Articles

Just recently, S&P Global released its 2026 earnings estimates, which, for lack of a better word, have gone parabolic. Such should not be surprising given the ongoing...

Trump threatens EU tariffs, creates confusion about Mexico and Canada duties Dollar rebounds but gold slides again Nvidia falls in after-hours trading as earnings fail to set...

Gold Consolidates Ahead of Key US Data Releases The gold (XAU/USD) price was relatively unchanged on Wednesday as markets remained cautious ahead of upcoming inflation data and...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.