- Canadian GDP remains flat for a second straight month

- PCE Price Index eases

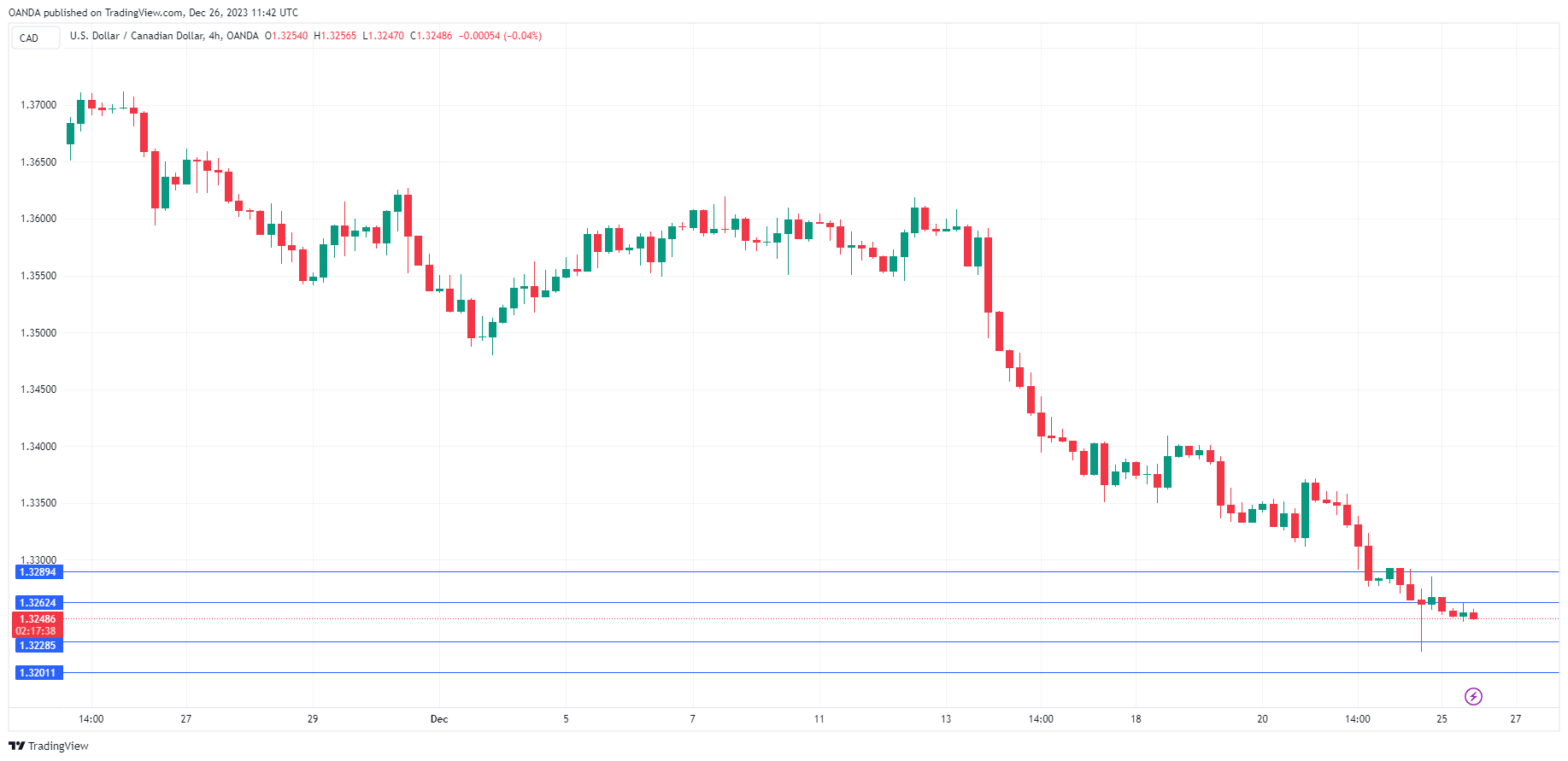

- USD/CAD tested support at 1.3262 earlier

- There is resistance at 1.3262 and 1.3289

The Canadian dollar is showing limited movement on Tuesday. In the European session, USD/CAD is trading at 1.3248, down 0.14%. Canadian banks are closed for a holiday, which means it should remain an uneventful day for the Canadian dollar. As there are no Canadian events this week, US releases could have a magnified impact on the movement of the Canadian dollar.

The Canadian dollar posted a second consecutive winning week, with gains of 0.83%. The Canadian dollar has sparkled in December, climbing 2.2% in both November and December.

Canada’s GDP Stalls Agaon

Canada’s economy remains stagnant as GDP was flat in October for a second straight month. This was below the market consensus of 0.2%. The silver lining was retail sales, which jumped 1.2%, the sharpest pace of growth since January. The preliminary estimate for November stands at 0.1%. GDP in the third quarter came in at -0.3%, and Canada will have to post positive growth in Q4 to avoid a recession, which technically is two consecutive quarters of negative growth.

The US wrapped up last week with the PCE Price Index, the Federal Reserve’s preferred inflation indicator. The headline reading fell to 2.6% y/y in November, down from a downwardly revised 2.9% in October and lower than the market consensus of 2.8%. The core rate eased to 3.2%, down from a downwardly revised 3.4% and lower than the market consensus of 3.3%.

The numbers are an encouraging sign for the Federal Reserve and support the case for rate cuts next year. However, personal spending and income were higher than expected and could temper these expectations. Personal income edged up to 0.4% m/m in November, up from an upwardly revised 0.3% in October and matching the consensus estimate. Personal spending gained 0.2%, up from a downwardly revised 0.1% and shy of the consensus estimate of 0.3%.

Fed Chair Powell has pencilled in three cuts in 2024 but the markets have priced in up to six cuts. Investors have priced in a rate cut in January at 14%, up from 8% a week ago, according to the CME’s FedWatch tool.