The Canadian dollar had a bumpy ride on Thursday. A better than expected current account deficit was positive for the loonie at the start of the North American trading session, but after some mixed message on trade by the US it was reported that US President Donald Trump will impose tariffs on steel and aluminium imports next week. The imports could be as high as 25 percent for steel and 10 percent for aluminium. The move came against opposition from within the Republican party but there was little anybody could do to prevent Trump from fulfilling one of his campaign promises.

Canadian Foreign Affairs Minister Chrystia Freelander said that if the US imposes the tariffs it would have to retaliate. Canada is the biggest buyer of American steel, with about 50 percent going north of the border which could end up hurting the very industry Trump seeks to protect. Mexico has told through sources that is would have no option but to retaliate with tariffs. The US exports more steel to Mexico than it imports. Looking beyond Canada the move by the US is another shot across the bow to China which ironically has seen steel exports fall in recent years.

The US has pushed a protectionist trade agenda with the steel tariffs the biggest step taken so far. The fate of NAFTA remains uncertain with very little progress during the 7 rounds of talks. The current round in Mexico City will end in March 5 with some potential comments addressing the just announced steel and aluminum tariffs.

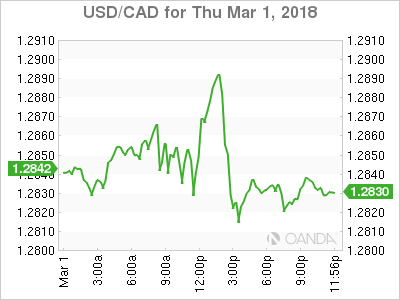

The USD/CAD gained 0.01 percent on Thursday. The currency pair is trading at 1.2829 after a volatile 24 hours that brought the loonie close to the 1.29 price level. Comments from US President Donald Trump on trade triggered a sell off of the Canadian currency. US stocks also retreated as the one two punch of a potential trade war and higher interest rates hit indices. The USD/CAD ended up almost flat as the market awaits more details on the tariffs that could end up with the US issuing exceptions for certain trade partners, which Canada almost surely on that list.

The USD was trading higher during Fed Chair Jerome Powell’s testimony in front of the Senate Banking committee. Tuesday’s comments before Congress were taken as hawkish by the market and while not walking them back today Powell set a more neutral tone pointing out there is no evidence of the US economy is overheating or higher wages. NY Fed President William Dudley said that gradual will still apply to four rate hikes this year. Wages have not grown at the same rate as the economy which is a concern from some voting Fed members as they cite that lack of inflationary pressure as the main reason the central bank should slow down its rate hike path. Previous Chair Janet Yellen preferred to be ahead of the curve as eventually inflation would catch up. Powell appears to agree with Yellen’s assessment with the Fed anticipated to announce a 25 basis point rate hike on March 21.

The loonie has been under pressure touching weekly lows and will close out the week with the release of the Canadian gross domestic product (GDP). Growth has slowed down in the second half of the year and the monthly GDP data point is forecasted to come in at 0.1 percent. Given the softness of Canadian retail sales it could even end up being a contraction which would be negative for the currency, specially as trade remains a sensitive topic.

Market events to watch this week:

Friday, Mar 2

Tentative GBP Prime Minister May Speaks

4:30am GBP Construction PMI

8:30am CAD GDP m/m