- Potential bearish engulfing candle forming may lead to downside risk for USD/CAD

- Support levels at 1.3869 and 1.3815 in focus, if reversal confirms

- Momentum shifting as RSI breaks down from overbought

Overview

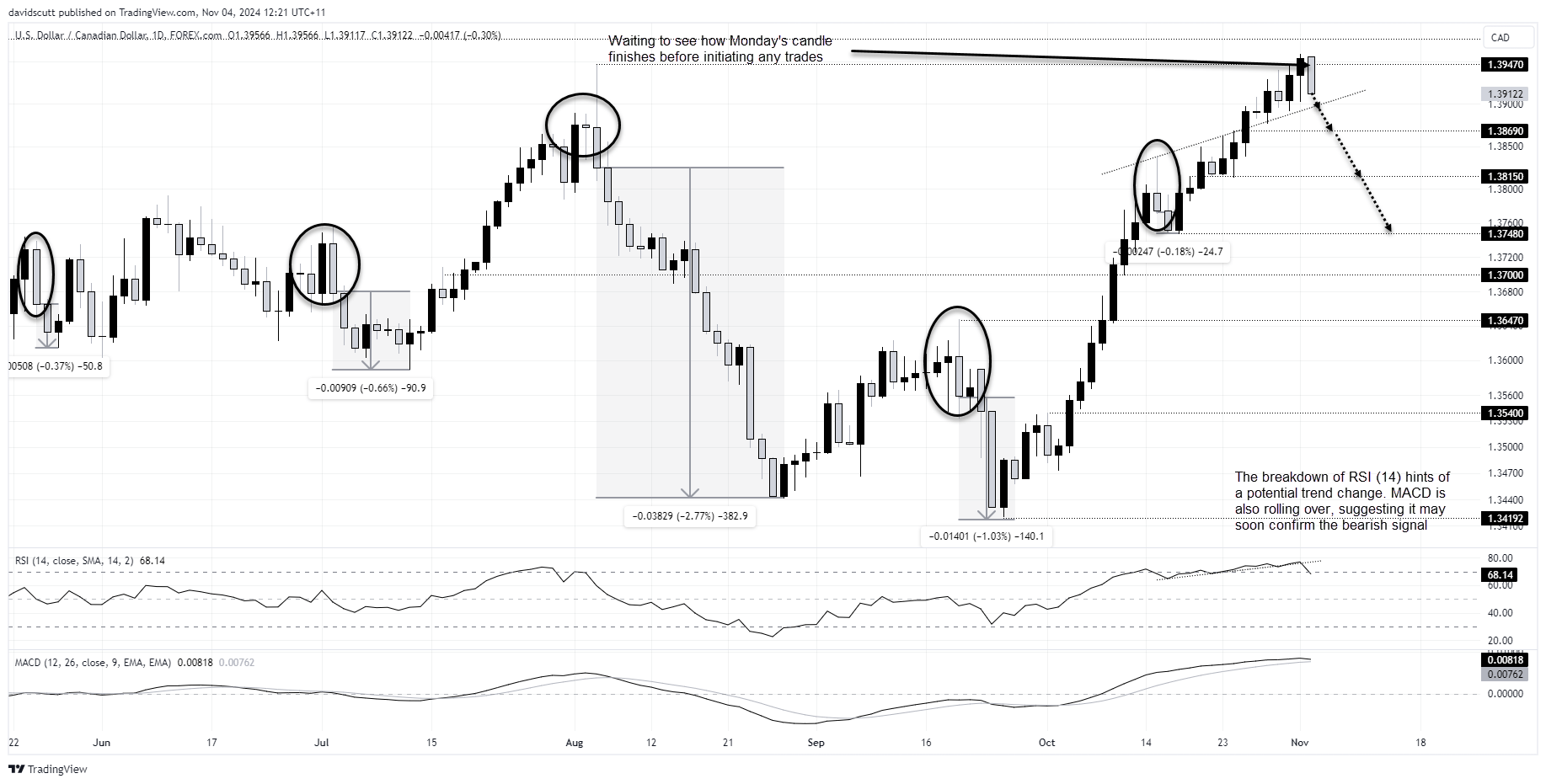

A steep unwind in USD/CAD should have traders on alert for a potential bearish engulfing candle on the daily chart, especially given the recent trend for reversal patterns to stick following a substantial bullish move, as we’ve seen since late September.

On Alert for Bearish Engulfing Pattern

Bearish reversal patterns generated by USD/CAD have enjoyed a decent track record recently, especially when following a pronounced bullish trend. I’ve labeled the chart below, accompanied by the subsequent decline once the initial pattern was delivered. While past performance is not indicative of future performance, often the largest moves occurred after strong rallies.

As Monday’s daily candle has yet to be completed, getting short pre-emptively screens as a low probability setup. But if we do see a bearish engulfing candle print on Monday, it will provide a decent short opportunity heading into US election day, especially if we see the price bounce a touch from these levels.

USD/CAD Short Setup

Source: TradingView

Depending on entry-level, the price would need to break several nearby levels to make the trade stack up from a risk-reward perspective, including the uptrend from October 15 and horizontal support at 1.3869. If they were to fold, 1.3815 is one potential target with 1.3748 and 1.3700 the next after that. A stop above Friday's high would provide protection against reversal.

Bolstering the case for the potential downside, RSI (14) has broken the uptrend it was sitting in after sitting in overbought territory for more than a week, hinting bullish momentum may be starting to turn. While the signal is yet to be confirmed by MACD, that too is looking like it may soon roll over as it moves closer to the signal line.