The USD has found some strength during the selloff in stocks, resulting in a move higher from the lows at 1.22483 to 1.25663. It has retraced lower to 1.24900 today and looks to have formed a bear flag shown here in red. This could target 1.24500 if it breaks down and this area is strong support in itself. The bear flag is across the 1.25000 level and has nearby support on the 4-Hour chart at the 200-period MA at 1.24803, and support at 1.24772. Below these levels are the 100 and the 50-period moving averages around 1.24200, with the 1.24000 area not far below. A further move down can target the 1.23000 and the falling blue trend line below.

The break above the blue trend line occurred at 1.23400 and the 50-period MA, causing a strong bullish move. Should support be found and the uptrend resumed, resistance overhead comes in at 1.25545 and 1.25884.

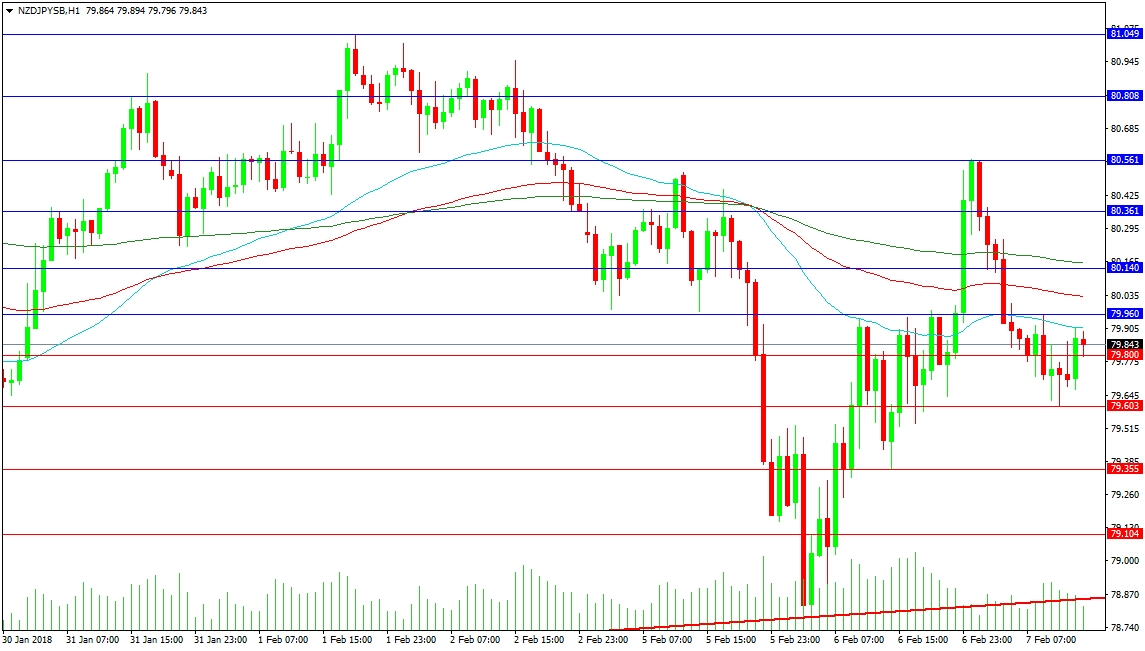

The NZD/JPY pair is trading in a pocket between 79.603 and 79.960, having been as high as 80.561 overnight. The moving averages are holding the price down, for now, extending resistance to 80.161. A clearance above this level can see price break up to the high from yesterday, with resistance above found at 80.808 and 81.049, which is the high for this month.

A bearish move would see support at 79.355, with a loss of this level targeting 79.104 and the 79.000 level. This would put the pair in danger of creating a lower low and attacking the red trend line at 78.850. With a break below this trend line, the way is open to 78.500 and potentially 78.000, unless support can step in to stem the move.