The Canadian dollar (CAD) has been in focus after a report that U.S. President Trump was pushing for a preliminary North American Free Trade Agreement (NAFTA) deal to announce at a summit in Peru next week. The White House wants leaders from Canada and Mexico to join in unveiling a deal in principle at the summit. However, negotiation over the details would continue. Any agreement in principle would be a political win and little more than a symbolic move. But the prospect of an easing of tensions between the U.S. and Canada boosted the Canadian dollar.

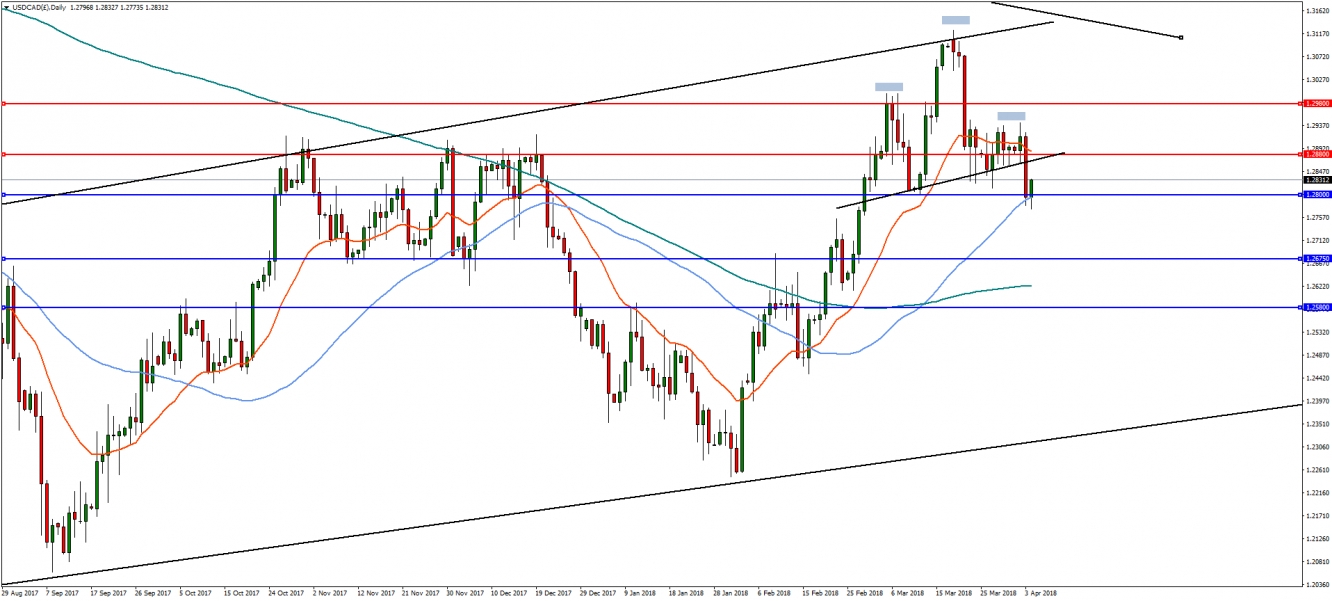

In the daily timeframe, USD/CAD has formed a head and shoulders pattern with a measured target at 1.2580, which is also the 61.8% retracement from the lows in January to the highs in March. Downside support is at 1.2800, followed by the 50% retracement at 1.2675. A reversal above the neckline and horizontal resistance at 1.2880 would negate the pattern, with further upside resistance at 1.2980.

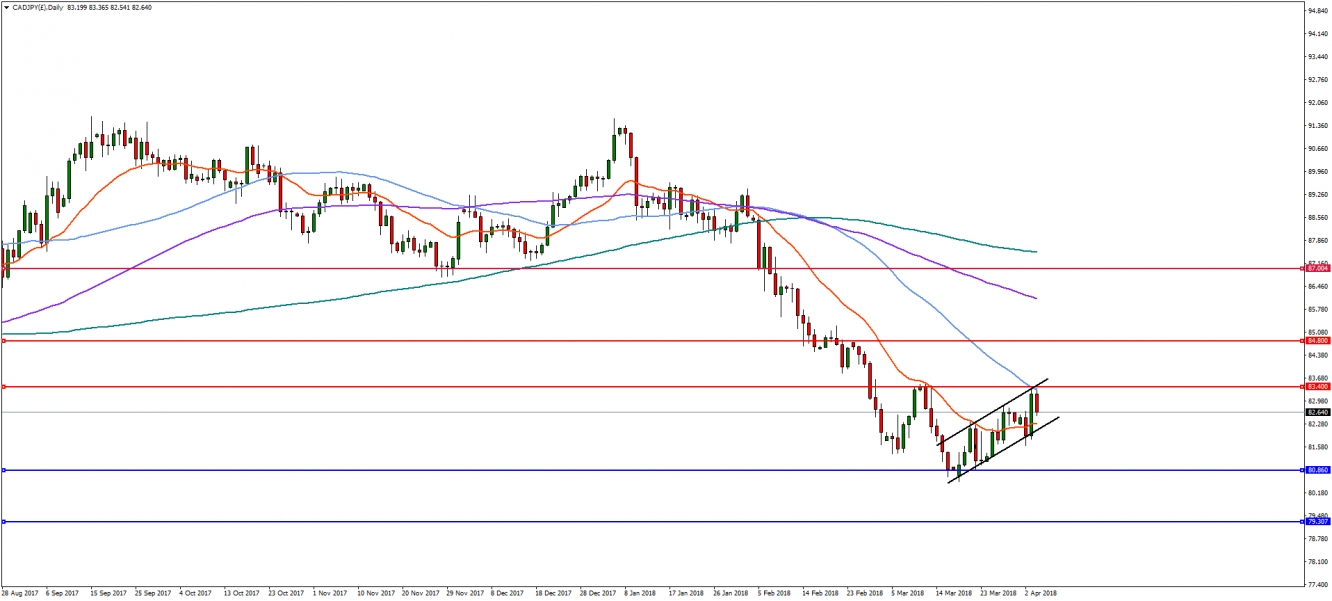

On the daily chart, CAD/JPY has reversed from the April 2017 lows at 80.860 but is running into resistance at the 23.6% Fibonacci level of 83.40. If the pair breaks 83.40, further upside resistance comes in at 84.80. However, a bearish reversal and break of the bear flag could lead to continued downside, with support at 80.86 and then 79.30.