It has been an uneventful week for the Canadian dollar, and the trend has continued on Thursday. Currently, USD/CAD is trading at 1.2958, up 0.11% on the day. On the release front, the U.S unemployment claims is expected to edge up to 223 thousand. The Bank of Canada will release its semi-annual Financial System Review, followed by a press conference with BoC Governor Stephen Poloz. Ontario is holding a provincial election, with the Conservatives expected to form a majority government. On Friday, Canada releases employment change and the unemployment rate. As well, G-7 leaders are meeting in Quebec for their annual summit.

All eyes are on the Ontario provincial election on Thursday. Just hours before poll stations opening, the election remains too close to call. Polls are showing the Conservatives with a slender majority in the popular vote over the left-wing NDP, with the governing Liberals trailing far behind. However, the Conservatives are expected to win most of the electoral districts (ridings), and the latest polls are showing a whopping 87% likelihood that they will form a majority government. The actual results will largely depend on voter turnout and regional dynamics. A Conservative majority will likely boost the Canadian dollar, but a minority government or an NDP win would likely send the loonie sharply lower.

Meetings between G-7 leaders are often a chance to catch up with friends and hold a photo-op, but this year’s summit could be explosive, with plenty of bad will between six of the members and President Trump. The reason? The renewal of the tariff spat, courtesy of the U.S slapping aluminum and steel tariffs on the European Union and Canada. Last week, finance ministers from six members of the G-7 were united in their criticism of US Treasury Secretary Steve Mnuchin over the brewing trade war. Will we see a higher profile, repeat performance at this meeting? Canada and Mexico have already announced retaliatory duties on U.S products. The escalating trade battle is sure to dominate the summit, and if the leaders fail to resolve matters, the result could be a nasty trade war between the U.S and its major trading partners.

USD/CAD Fundamentals

Thursday (June 7)

- 8:30 US Unemployment Claims. Estimate 223K

- Tentative – US IBD/TIPP Economic Optimism. Estimate 54.2

- 10:30 US Natural Gas Storage. Estimate 87B

- 10:30 BoC Financial System Review

- 11:15 BoC Governor Poloz Speaks

- 15:00 US Consumer Credit. Estimate 13.9B

Friday (June 8)

- 8:30 Canadian Employment Change. Estimate 19.1K

- 8:30 Canadian Unemployment Rate. Estimate 5.8%

- Day 1 – G7 Meetings

*All release times are DST

*Key events are in bold

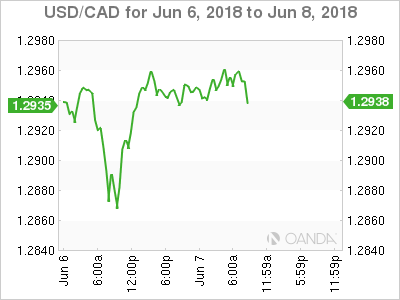

USD/CAD for Wednesday, June 7, 2018

USD/CAD, June 7 at 7:55 DST

Open: 1.2943 High: 1.2963 Low: 1.2936 Close: 1.2958

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2757 | 1.2850 | 1.2943 | 1.3015 | 1.3125 | 1.3224 |

USD/CAD showed little movement in the Asian session and has ticked higher in European trade

- 1.2943 is providing support. This line is fluid and could see further action in the North American session

- 1.3015 is the next resistance line

- Current range: 1.2943 to 1.3015

Further levels in both directions:

- Below: 1.2943, 1.2850, 1.2757 and 1.2614

- Above: 1.3015, 1.3125 and 1.3224

OANDA’s Open Positions Ratio

USD/CAD ratio remains unchanged this week. Currently, long positions have a majority (62%), indicative of USD/CAD continuing to move higher.