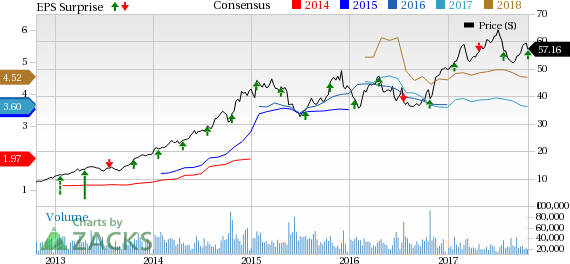

Southwest Airlines Co. (NYSE:LUV) reported better-than-expected earnings but lower-than-expected revenues in the third quarter of 2017. The carrier’s earnings per share (excluding 4 cents from non-recurring items) of 88 cents beat the Zacks Consensus Estimate of 87 cents. The bottom line however, declined 5.4% on a year-over-year basis.

Operating revenues of $5,271million lagged the Zacks Consensus Estimate of $5,296.6 million. The top line however, improved 2.6% year over year. Passenger revenues accounted for the bulk (90%) of the same.

Operating Statistics

Airline traffic, measured in revenue passenger miles, nudged up 2.5% year over year to 33.13 billion in the quarter under review. Capacity or available seat miles (ASMs) expanded 3.1% to 39.05 billion. Load factor (percentage of seats filled by passengers) came in at 84.8%, down 50 basis points on a year over year basis, as capacity expansion was more than traffic growth. Passenger revenue per available seat mile (PRASM: a key measure of unit revenue) slid 1.4% to 12.15 cents. In the reported quarter, revenue per available seat mile (RASM) was 13.50 cents, down 0.5% year over year.

Operating Expenses & Income

In the third quarter, operating income came in at $834 million compared with $695 million in the prior-year quarter. Excluding special items, the operating income stood at $871 million, down 10.4%. Total adjusted operating expenses (excluding profit sharing, fuel and oil expense plus special items) increased 6.5% year over year. Fuel price per gallon (inclusive of fuel tax: economic) declined 4% year over year to $2. Consolidated unit cost or cost per available seat mile (CASM) — excluding fuel, oil and special items — rose 3.9% year over year to 8.58 cents.

Liquidity

The company had cash and cash equivalents of $1,460 million at the end of third quarter compared with $1,680 million at the end of 2016. As of Sep 30, 2017, the company had a long-term debt (less current maturities) of $2,763 million compared with $2,821 million at the end of 2016. While the carrier generated a cash flow of $358million in third-quarter 2017, it returned $375million to its shareholders through a combination of dividends and share repurchases.

Guidance

The company expects RASM growth of up to 1.5% year over year in the fourth quarter of 2017 on the back of a rebound in passenger booking trends in Houston and Floridaand a robust air travel demand. Unit costs (excluding fuel and oil expenses, special items and profit-sharing expenses) in the fourth quarter are expected to be flat up to 1.5%. This is inclusive of a shift in advertising expenses from third to fourth quarter as well as incremental costs associated with technology investments.

The company still expects 2018 available seat mile to be less than 5.7%, while anticipating an increase of 3-4% in the first half of 2018.

Zacks Rank & Stocks to Consider

Southwest Airlines carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the airline space are Deutsche Lufthansa (DE:LHAG) AG (OTC:DLAKY) , International Consolidated Airlines Group (LON:ICAG) SA (OTC:ICAGY) and Bristow Group Inc (NYSE:BRS) . While Deutsche Lufthansa and International Consolidated Airlines sport a Zacks Rank #1 (Strong Buy), Bristow Group carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Deutsche Lufthansa, International Consolidated Airlines and Bristow Group have gained more than 46%, 14% and 22% respectively, over the last three months.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Southwest Airlines Company (LUV): Free Stock Analysis Report

Bristow Group Inc (BRS): Free Stock Analysis Report

Deutsche Lufthansa AG (DLAKY): Free Stock Analysis Report

International Consolidated Airlines Group SA (ICAGY): Free Stock Analysis Report

Original post

Zacks Investment Research