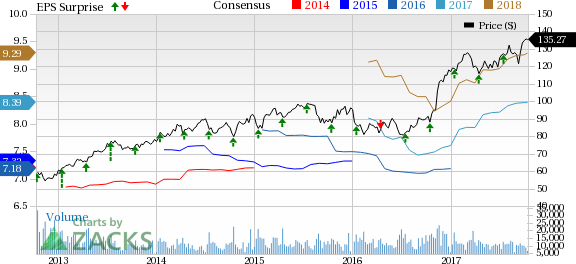

Riding on higher revenues, The PNC Financial Services Group, Inc. (NYSE:PNC) reported a positive earnings surprise of 1.4% in third-quarter 2017. Earnings per share of $2.16 beat the Zacks Consensus Estimate of $2.13. Moreover, the bottom line reflects a 17.4% increase from the prior-year quarter.

Continued growth in loans helped the company earn higher net interest income during the quarter. Also, non-interest income witnessed a year-over-year growth. However, higher expenses hurt results to some extent. Further, rise in provision for credit losses was a headwind.

The company reported net income of $1.13 billion in the reported quarter, reflecting an increase of 11.9% year over year.

Segment wise, on a year-over-year basis, quarterly net income in Corporate & Institutional Banking and Other, including BlackRock, improved 3.1% and 50%, respectively. Also, net income for Retail Banking segment increased 3.6% year over year. However, net income for Asset Management segment decreased 19%.

Revenue Growth Offsets Higher Expenses

Total revenues for the quarter came in at $4.13 billion, rising 8% year over year. The reported figure surpassed the Zacks Consensus Estimate of $4.11 billion.

Net interest income was up 12% year over year to $2.35 billion. Also, net interest margin increased 23 basis points (bps) year over year to 2.91%.

Non-interest income was up 3% year over year to $1.78 billion, driven by higher asset management income, consumer services income, service charges on deposits and other income, partially offset by lower income from residential mortgage and corporate services income.

PNC Financial’s non-interest expenses were $2.46 billion, increasing 3% from the year-ago quarter. The quarter witnessed rise in personnel, equipment and other expenses.

As of Sep 30, 2017, total loans were up 1% sequentially to $221.1 billion, supported by both commercial and consumer lending. Also, total deposits rose 1% to $260.7 billion.

Credit Quality Improves

Non-performing assets declined 13% year over year to $2.07 billion. Moreover, allowance for loan and lease losses decreased 1% year over year to $2.61 billion.

Net charge-offs declined 31% year over year to $106 million. However, provision for credit losses was $130 million, up 49% from $87 million in the prior-year quarter.

Capital Position Weakens

As of Sep 30, 2017, the transitional Basel III common equity Tier 1 capital ratio was 10.3%, down from 10.6% a year ago. Tier 1 risk-based capital ratio and leverage ratio were 11.6% and 9.9%, respectively, compared with 11.9% and 10.1% at the prior-year quarter end.

Share Repurchase

In the third quarter, PNC Financial repurchased 4.2 million common shares for $0.5 billion.

Our Viewpoint

PNC Financial is well positioned to grow based on its diverse revenue mix. Further, an increase in lending activities augurs well for the company. Margin improvement due to rising interest rates should continue to support its top line.

Currently, PNC Financial carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other Wall Street giants, Comerica Inc. (NYSE:CMA) is scheduled to report third-quarter 2017 earnings on Oct 17, while U.S. Bancorp (NYSE:USB) will report on Oct 18. State Street Corporation (NYSE:STT) will report results on Oct 23.

4 Stocks to Watch after the Massive Equifax (NYSE:EFX) Hack

Cybersecurity stocks spiked on recent news of a data breach affecting 143 million Americans. But which stocks are the best buy candidates right now? And what does the future hold for the cybersecurity industry?

Equifax is just the most recent victim. Computer hacking and identity theft are more common than ever. Zacks has just released Cybersecurity! An Investor’s Guide to inform Zacks.com readers about this $170 billion/year space. More importantly, it highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

PNC Financial Services Group, Inc. (The) (PNC): Free Stock Analysis Report

Comerica Incorporated (CMA): Free Stock Analysis Report

U.S. Bancorp (USB): Free Stock Analysis Report

State Street Corporation (STT): Free Stock Analysis Report

Original post